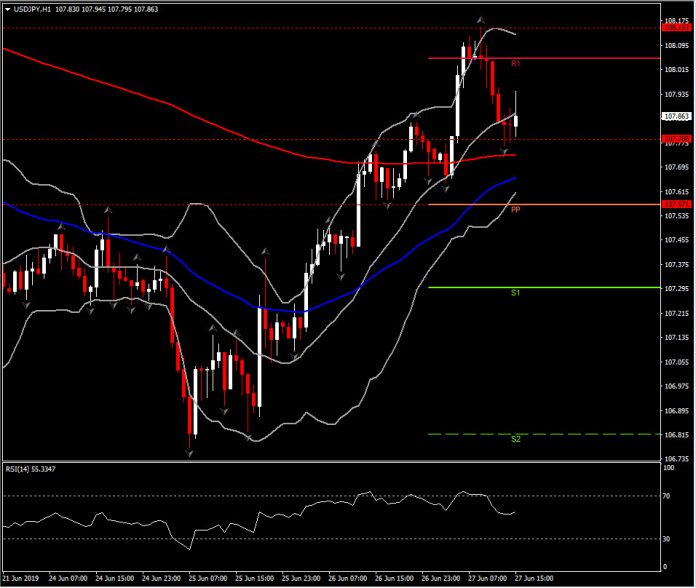

The Dollar revealed little reaction to the mix of data, where Q1 GDP revisions were steady at 3.1%, as core PCE ticked up to 1.2% from 1.0% previous. Weekly jobless claims were a touch higher than forecast, at 227k. EURUSD idles at 1.13, while USDJPY nudged a few points higher, near 107.90. Equity futures remain narrowly mixed, with yields little changed.

US Q1 GDP growth was left unrevised at the 3.1% clip in the second look and 3.2% in the Advance report. And it compares to 2.2% in Q4. Consumption was bumped down to a 0.9% clip from 1.3% previously. Business fixed investment boosted to 3.0% versus 1.0%. Government spending was also revised up to 2.8% from 2.5%. Inventories contributed $26.0 bln, down from the prior $28.7 bln contribution. Net exports contributed $50.7 bln, down from $52.1 bln. The chain price index was nudged up to 0.9% versus 0.8%, with the core rate now at 1.2% versus 1.0%.

The inflation data may be the focus for the report, which otherwise is too old to have much market impact, especially as the focus is on the G20 and the Trump-Xi meeting on Saturday.

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.