FX News Today

- Treasury yields steadied during the Asian session, with bonds erasing overnight gains and the 10-year yield now up 0.3 bp at 2.092%. JGB yields also backed up from lows and are down -0.1 bp at -0.129%, after returning from holiday, while yields declined in Australia and New Zealand after the minutes of the last RBA meeting showed the bank remains ready to adjust policy if needed.

- Stock markets meanwhile struggled in very light volumes as markets hold back ahead of key US data and earnings reports this week.

- On trade talks US Treasury Secretary Mnuchin said he and Trade-Representative Lighthizer may travel to Beijing if talks by phone this week are productive.

- The WTI future is trading below $60 per barrel and US futures are posting marginal gains.

- In Europe, the GER30 future is currently slightly higher as are US futures, while UK100 futures are in the red, amid ongoing Brexit jitters as Boris Johnson, poised to succeed as PM next week, puts no-deal options firmly back on the table.

- Last week’s round of Brexit negotiations was reportedly one of the most difficult encounters of the last 3 years.

- Meanwhile JP Morgan, Bank of America, Goldman Sachs and Taiwan Semiconductor are among the companies reporting results this week.

Charts of the Day

Technician’s Corner

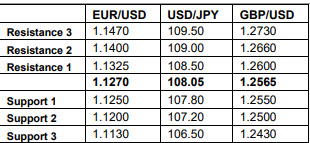

- EURUSD has been held between its 20-day Moving Average of 1.1295 and its 50-day Moving Average at 1.1242 since Friday. A 25 basis point Fed rate cut at the end of the month has been priced into EURUSD, and focus now may shift to the ECB, where further stimulus could be in the cards at its next meeting on July 25, keeping EURUSD capped for the time being.

- USDJPY broke earlier today its 20-day Moving Average at 107.95, after printing an 8-session high from 107.80 during the overnight Asian session. The mixed risk backdrop has limited the pairing’s gains since last week, as Wall Street trades on either side of flat, and Treasury yields remain pressured. The July 5 low of 107.76 remains a floor for the asset, while next Resistance stands at 108.20 and 108.50.

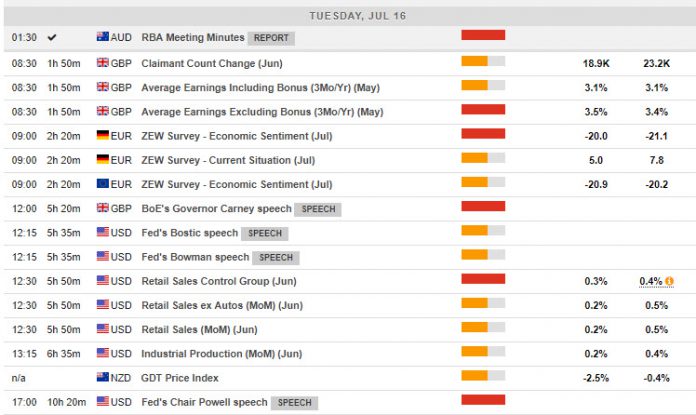

Main Macro Events Today

- Average Earnings (GBP, GMT 08:30) – Average Earnings excluding bonus for May expected to slightly increase at 3.2% from 3.1% last month.

- ZEW Economic Sentiment (EUR, GMT 09:00) – Economic Sentiment for July is expected to be released at -19.0 compared to -21.1 last month.

- Retail Sales and Core (USD, GMT 12:30) – 0.2% June retail sales gains are expected for both with and without autos, following 0.5% May gains for both measures. Unit vehicle sales ticked down to a 17.3 mln pace in June from an upwardly-revised 17.4 mln clip in May, and gasoline prices should provide a drag on retail activity given an estimated -3.5% figure for the CPI for gasoline. Real consumer spending is expected to grow at a 3.9% rate in Q2, following the 0.9% Q1 clip.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.