FX News Today

- Markets remained choppy Wednesday amid heightened fears over the bearish signals from the drop in rates.

- Better than expected China trade numbers, which showed a rebound in exports helped to underpin sentiment after a slightly higher than anticipated Yuan fixing.

- Fears about the impact of the escalating trade conflict eased somewhat, also helped by news that Japan will allow some exports of semiconductor manufacturing material to South Korea, which suggests easing tensions between the two countries.

- Wall Street losses were pared and the NASDAQ recovered into the green. US futures are up 0.4-0.7%.

- Investors remain jumpy and markets volatile, however, while the inversion of the yield curve looks worrying and highlights the rise in recession fears.

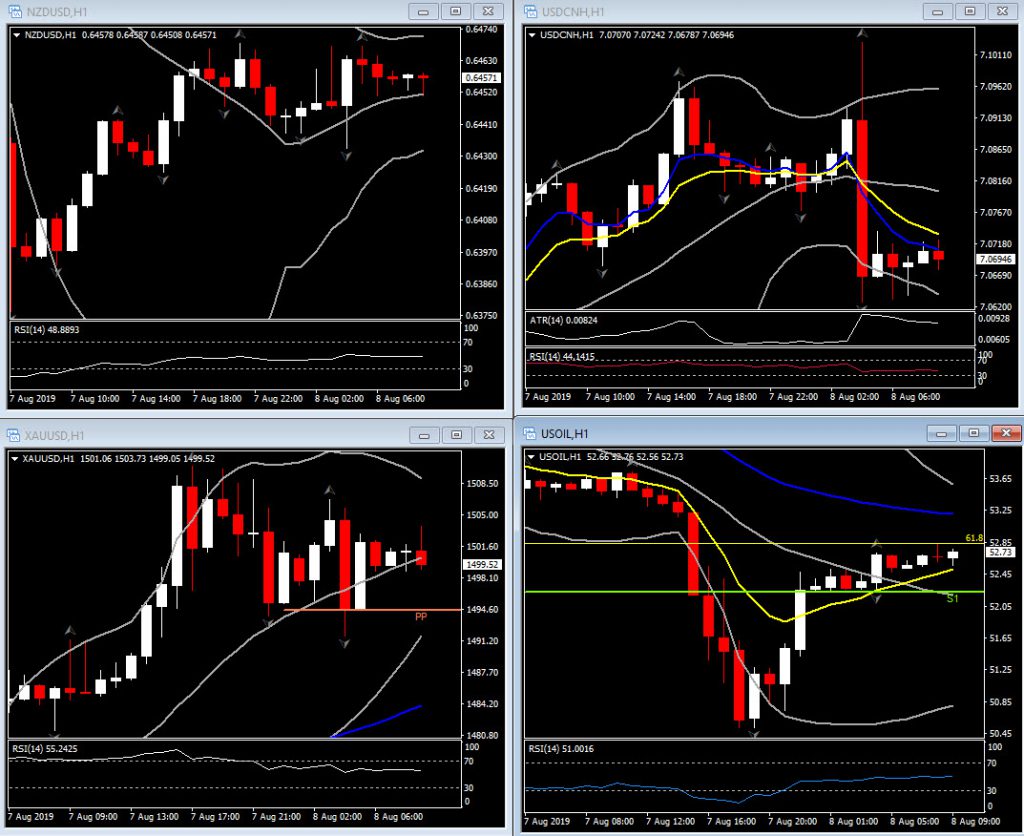

- Oil remains sharply weaker on growth fears and widening supply-demand dynamics. It is currently trading at $52.70.

- The official fixing of the onshore Yuan today was at a new 10-year plus low against the Dollar.

- RBNZ Governor Orr also repeated that negative rates are a possibility, which comes a day after the central bank caught widespread attention by implementing its first 50 bp easing since the immediate aftermath of 9/11.

Charts of the Day

Technician’s Corner

Technician’s Corner

- YEN: The Yen has traded softer, concurrently with a tentative rebound in stock markets, which was seen on Wall Street into the close yesterday, and followed up with gains across Asia-Pacific bourses. USDJPY settled in the lower 106.00s, above the 7-month low seen yesterday at 105.49. AUDJPY, EURJPY and other Yen crosses also posted moderate gains as the Japanese currency saw some of its safe haven premium unwind. Better than expected China trade numbers and Japan and South Korea’s news helped buoy investor spirits, and while the official fixing of the onshore Yuan today was at a new 10-year plus low against the Dollar of 7.0039 (up from 6.9996 yesterday), a little firmer than markets had been anticipating.

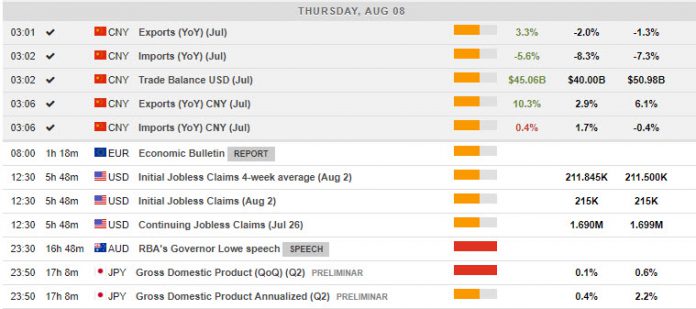

Main Macro Events Today

- Jobless Claims (USD, GMT 12:20) – Initial jobless claims for the week of August 3 are estimated to fall to 214k, after rising to 215k in the week of July 27. Claims should average a cycle-low 212k in July, as seen last September, versus 222k in June and 217k in May. Claims drifted higher into June from tight levels through May, with a spike higher with the advent of the auto retooling season, but with an ensuing drop into mid-July with seasonal factor payback.

- Gross Domestic Product (JPY, GMT 23:50) – Growth in Japan is expected to have decreased by 0.5% in the second quarter from the 0.6% in the first quarter, reflecting weaker exports due to cooling global demand and trade tensions.

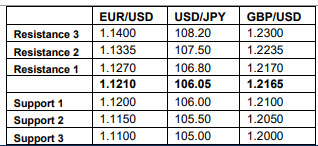

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.