FX News Today

- A confluence of factors whipped the markets around Thursday heading into the Jackson Hole Symposium and Chair Powell’s comments Friday at 10 ET.

- Hawkish remarks from George (she dissented against the July easing) and Harker (who votes in 2020) weighed on Treasuries and erased early gains from Wall Street.

- Minutes from both Fed and ECB meetings were not quite the all out dovish signal that some had been hoping for and comments from Fed members yesterday also showed a degree of caution with regard to further easing measures.

- The curve in the US steepened again after inverting briefly overnight, the curve flattened and inverted further in Japan.

- Stock markets across Asia moved mostly higher although gains remained contained by caution.

- New Zealand’s central bank governor said he could afford to wait before declining on additional easing measures.

- Onshore Yuan set at its weakest for 11 years.

- Japanese core consumer inflation at a 2-year low in July.

- Meanwhile lingering geopolitical trade tensions and political jitters in Hong Kong, Italy and the UK add to an uncertain backdrop. US futures are also cautiously moving higher.

- The WTI future is trading at USD 55.37 per barrel.

Charts of the Day

Technician’s Corner

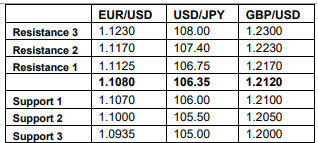

- EURUSD returned to 3-week lows of 1.1064 today, after rallying to session highs of 1.1099 following the sub-50 US manufacturing PMI. Negative European yields appear to be taking their toll on the currency, keeping the Dollar in demand in place for relatively high yielding US Treasuries. This has likely been a major factor keeping EURUSD under pressure, especially ahead of likely ECB easing in September, and perceptions that the Fed will not be as aggressive in easing as previously thought. Key EURUSD level is the 27-month low of 1.1027 seen on August 1.

- USDJPY rallied to 106.64 highs. The risk-sensitive pairing can be expected to consolidate into today’s much anticipated speech from Fed chair Powell, from Jackson Hole.

- GBPUSD: Sterling had its best single day rally since March 13 against the Dollar. Cable’s high was 1.2273, which is the loftiest level seen since late July. The gains were sparked by comments made by German’s Merkel, who indicated that a solution to the Irish border backstop conundrum is doable by the October-31 Brexit deadline. UK Prime Minister Boris Johnson followed this up by saying at his joint press conference with France’s Macron that he was encouraged by his talks in Berlin yesterday, and that a deal, he thinks, can be done ahead of October 31. Macron, said, however, that while he has always respected the UK’s decision to leave the EU, the European project has to be protected, to which the Irish backstop remains an important part of ensuring this. Merkel’s remarks were little more than rhetorical platitudes, though enough to trigger a short squeeze in a heavy shorted currency.

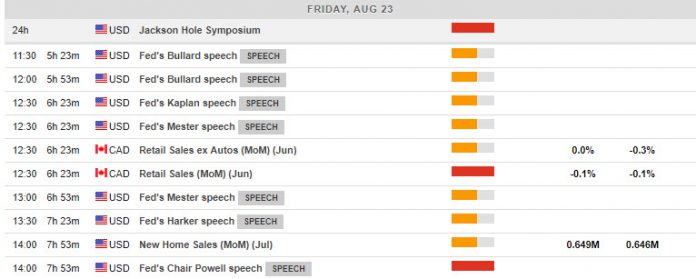

Main Macro Events Today

- Jackson Hole Symposium – Day 2

- Retail Sales ex Autos (CAD, GMT 12:30) – Retail sales are expected to have decreased in Canada, with consensus forecasts suggesting a -0.5% m/m decline should be registered in June and an unchanged ex-autos component at 0.3%. In May, Retail sales were disappointing, falling 0.1% for total sales and declining 0.3% for the ex-autos component. The decline in sales was driven by a 2.0% tumble in food and beverage stores. The report casts some doubt on the resiliency of the consumer sector to the ongoing parade of worrisome geopolitical and trade developments.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.