FX News Today

- Stock markets pared losses after stronger than expected Services and Composite PMIs out of China.

- This helped to counterbalance a disappointing US manufacturing PMI yesterday which had signalled contraction and rekindled concerns about the fallout from ongoing geopolitical trade tensions.

- US August ISM manufacturing PMI dropped 2.1 points to 49.1 from 51.2 July.

- US construction spending edged-up 0.1% in July after falling 0.7% in June.

- US Markit manufacturing PMI slipped to 50.3 in August from 50.4 in July.

- Brexit: PM Johnson pushes for new elections after MPs voted against “no-deal”.

- GBP moved to session highs of 1.2104 as the UK government lost its majority, with a Conservative member defecting to the Liberal Democrats.

- China softened its tone on protesters yesterday and CSI 300 and Shanghai Comp are posting gains of 0.2% and 0.3% respectively.

- US futures are moving higher, as are GER30 and UK100 futures, with investors scaling back “no-deal” Brexit odds.

- The WTI future is trading at USD 54.20 per barrel.

Charts of the Day

Technician’s Corner

A risk-back-on sentiment has weighed on the Yen and underpinned the Australian Dollar.

- JPY: The USDJPY spiked above 106.10 area after the strong Chinese PMIs, rebounding from 105.73 low yesterday following the sub-50 manufacturing ISM. Last Wednesday’s 105.65 low is the next support level.

- AUD: AUDJPY cross consequently heading into the London interbank open with gains of over 0.5%.The AUDUSD rallied to a nine-day peak at 0.6783. The Aussie, being a liquid currency proxy on China, attracted demand following above-forecast Caixin China services and composite PMI survey readings, which was just the tonic in nervous markets, providing an offset to the yesterday’s worrisome reading in US ISM and PMI data.

- GBP: The Pound rotated nearly 1.5% higher against the Dollar in recouping to levels above 1.2100. The UK currency yesterday hit a low of 1.1958, which aside from the post-Brexit referendum flash-crash lows of 2016 (which were likely a product of technical issues), is the lowest level since 1984.

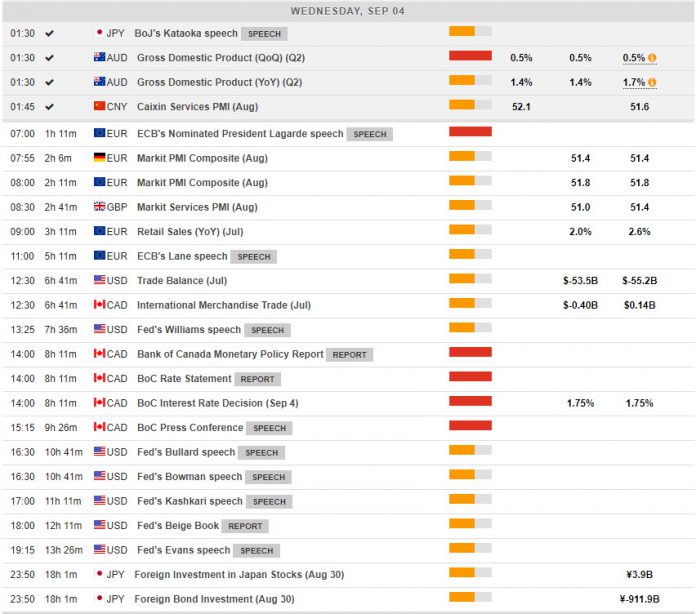

Main Macro Events Today

- ECB’s Nominated Lagarde attends a hearing at the European Parliament and will thus get her first chance to outline her priorities for the ECB.

- Trade Balance (CAD, GMT 12:30) – Canada could run to a C$0.3 bln trade deficit in July, from the C$0.1 bln trade surplus in June which contrasted with projections for a return to a mild shortfall.

- Interest Rate Decision and Statement (CAD, GMT 14:00) – Last time, BoC reaffirmed its commitment to steady policy, as an economy returning to potential growth contrasts with an outlook “clouded by persistent trade tensions.”. The expectations remain for no change of the policy outlook from the BoC through year-end, with the next move expected to be a modest rate hike in late 2020.

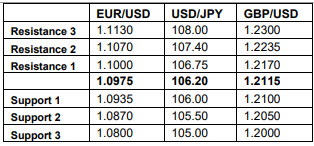

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.