XAUUSD, Daily

A reversal in risk sentiment was in the air yesterday with positive spin from Beijing on the trade talks this month and a raft of positive data points from the US. Today the backdrop remains one of a cautious risk-back-on sentiment, with investors finding tonic from the US and China’s path to another round of face-to-face trade negotiations. However, there are, of course, good reasons to be sceptical with regard to the prospects for a breakthrough on the US-China trade front, given the multiplicity of past disappointments and with Beijing seemingly of a mindset, unencumbered by an election cycle, to use its tactical advantage of patience through to the US presidential election in November 2020.

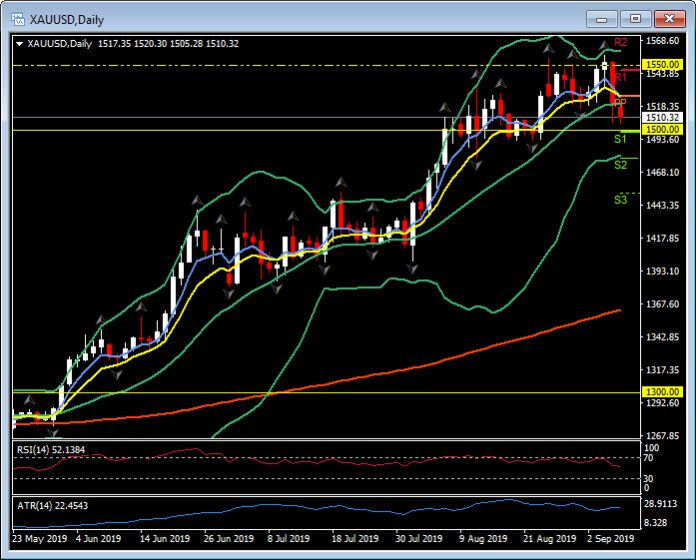

Risk aversion assets took a knock and USD stopped its slide, USDJPY breached 107.00 for the first time since August 6 (22 trading days) and Gold lost over 2.14% from early trades over $1550 to close under $1520. This was the biggest single-day drop since November 11, 2016 and closed below the 20-day moving average for the first time since July 31. The strongly bearish candle engulfed the price action of the nine previous days and puts gold on track for only its second consecutive week of losses since mid-April. The summer rally has cooled and may be over. $1500 now becomes a major psychological support level just as it proved a 12 day resistance level on the rally to $1550.

Technically, the 20-day moving average ($1520) was breached yesterday, S1 sits at $1500, S2 and the lower Bollinger band are at $1478.40 and S3 is at $1450.00. The Daily pivot remains at $1525, R1 at $1546.00 and R2, above the recent $1550 high, at $1572. The moves for the rest of today and into the close this week will depend heavily on the NFP data later today. In the longer term as we wrote earlier in the year and again in our September Monthly Outlook “The central bank shift to questioning and cutting interest rates should, in the longer term, continue to provide some support for the Gold price.”

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.