FX News Today

- Global bond sell off continued during Asian session.

- There is still cautious optimism on the trade front after Treasury Secretary Steven Mnuchin signalled “lots of progress on talks” recently, although that didn’t prevent China bourses from heading south.

- And while Bond markets have priced out some of their excessive easing expectations, investors are now increasing the odds for fiscal stimulus in Europe and further government measures in China, especially after disappointing PPI data overnight.

- Stock markets traded mixed during the Asian session and European futures are heading south in tandem with US futures, amid concerns that stimulus measures alone won’t be able to prevent a further slowdown against the background of trade tensions and Brexit risks.

- Parliament in London is suspended now until the middle of October, but MPs hope that they have done enough to prevent a no-deal scenario, with yet another Brexit extension.

- The WTI lifted to $58.14 per barrel as markets prepare for an extension of output cuts, ahead of a meeting of OPEC and its allies.

- UK data releases will also remain in focus today, after unexpectedly perky GDP numbers for July helped to ease recession fears. Today the focus is on labour market data and wage growth, which tends to feature heavily in BoE decisions.

Charts of the Day

Technician’s Corner

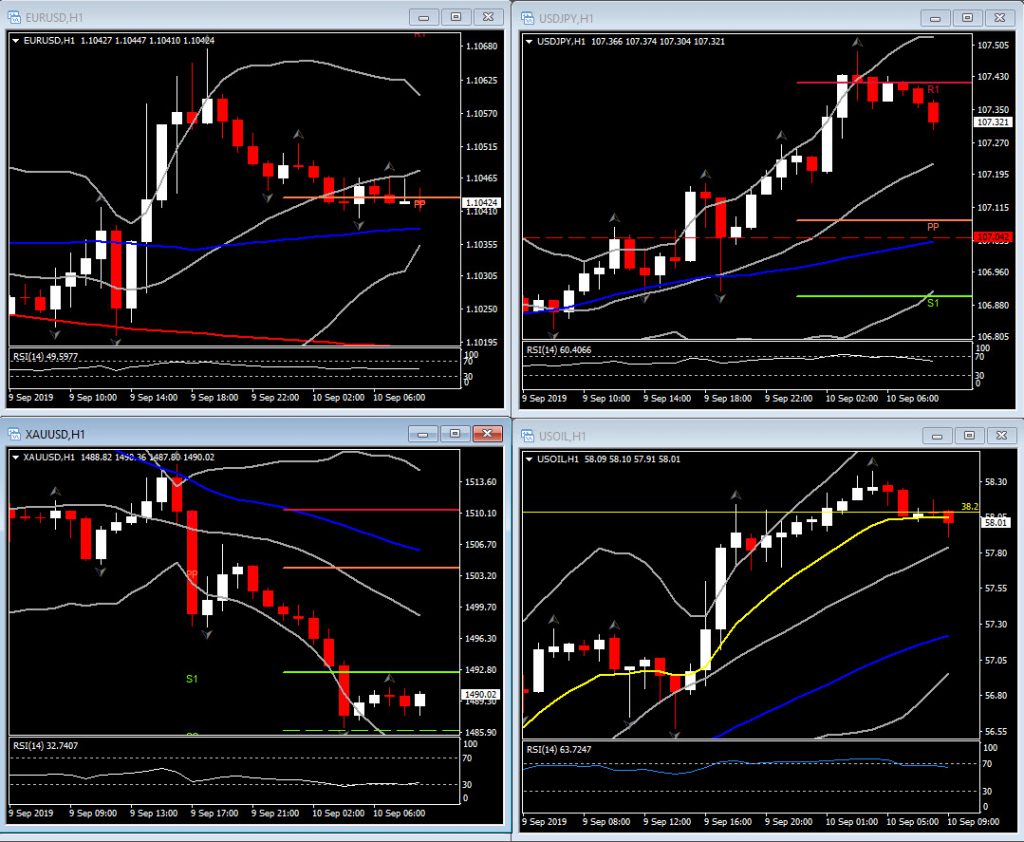

- EURUSD has rallied modestly through the NY session, opening at 1.1028 lows, then peaking at 1.2068 highs after the London close. Markets are looking forward to this week’s ECB meeting, where some sort of easing measures are expected, including a 10 basis point cut in the deposit rate to -0.50%, though beyond that, it remains unclear what else the Bank is willing to do. There may be room for market disappointment however, which would likely see the Euro rally, if only briefly. Until Thursday then, EURUSD may remain in a range, with ups and downs.

- USDJPY climbed to 107.49 highs, coming from lows of 106.93. The pair saw sellers step in above the 50-day MA, which stands at 107.14, effectively halting further gains. Risk-on conditions should limit any downside reversal, with support now coming at the overnight low of 106.76-106.90.

Main Macro Events Today

- UK labour market data (GBP, GMT 08:30) – Average Earnings including bonus is a key short-term indicator of the level of pay and can also be viewed as a measure of cost-push inflation. Consensus forecasts suggest that earnings in August should move at the same pace as earnings in July, at 3.7%. At the same time, the unemployment rate is expected unchanged at 3.9% for July.

- JOLTS Job Openings (USD, GMT 14:00) – JOLTS define Job Openings as all positions that have not been filled on the last business day of the month.

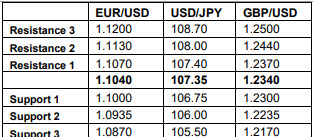

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.