FX News Today

- Sentiment stabilises as markets have returned from yesterday’s holiday.

- Asian stock markets moved mostly higher, as there are lingering hopes of progress ahead of high level US-Sino trade talks next month.

- Japan’s Jibun Bank Flash Manufacturing Purchasing Managers’ Index slipped to just 48.9. Together with the sharp decline in the German manufacturing PMI this will add to concerns over the outlook for the global economy.

- ECB President Draghi yesterday signalled the readiness to act again.

- Lagarde warned that trade tensions are the biggest threat to the global economy.

- China’s central bank Governor Yi Gang said in a press briefing “China is not in a rush to roll out massive rate cuts or QE like some other central banks”.

- GER30 and UK100 futures are posting slight gains, in tandem with US futures after a cautious move higher in Asia.

- Brexit developments also remain in focus as the Supreme Court in London is set to announce its verdict on the suspension of parliament today.

Charts of the day

Technician’s Corner

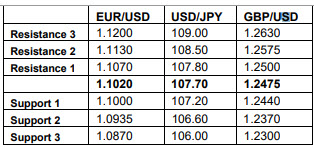

- EURUSD bottomed at 8-session lows of 1.0966 into US session, down from 1.1025 highs. Weak European PMIs took the pairing to session lows, though since then, short covering has been noted, seeing a bounce to 1.0996 highs. There has been talk of a large 1.1000 option expiry on Thursday, which may see EURUSD center on that level until then. Sell-the-rally remains in place however, as the EU economy sputters, and as the Dollar continues to benefit from strong interest rate differentials.

- GBPUSD: Cable carved out a fresh 6-day low at 1.2414, extending the correction from the 2-month peak seen on Friday at 1.2582. Markets will continue to demand a hefty Brexit discount. Markets are also waiting on the judgement of the UK’s Supreme Court, up today, on Boris Johnson’s controversial move to shut down Parliament for a 5-week period, with the government having appealed a ruling by Scotland’s highest court that the move was illegal. There is a chance that, it will agree with the recent court rulings seen in England and Northern Ireland that the matter was “non-justiciable” — being political rather than a legal matter.

- USOIL prices are down by over 8% from week-ago levels, but remain up by 6.7% from month-ago levels, and are up 27.2% on the year-to-date. News that some of Saudi’s production and distribution facilities will be back up and running as soon as next week weighed on crude prices. This comes with the US announcing that it is bolstering its military presence in Saudi Arabia for defensive and deterrence purposes.

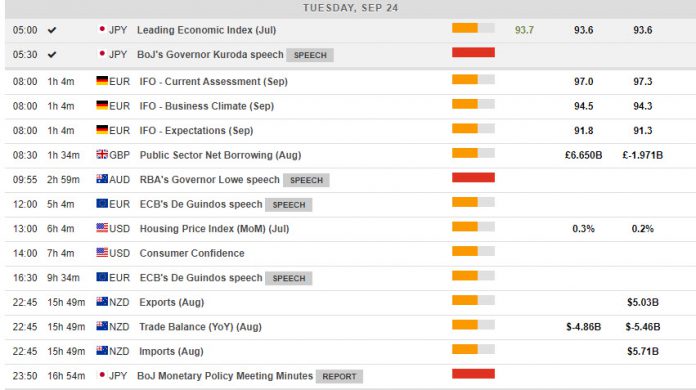

Main Macro Events Today

- German IFO (EUR, GMT 08:00) – German IFO business confidence fell further in August and more than anticipated, with the headline number now at the lowest level since Nov 2012. In September, the overall business climate reading is seen slightly higher at 95.1 from 94.3. So far the sector breakdown of the IFO still shows that optimists outnumber pessimists in both services and construction, but with the trade reading now also in negative territory and services confidence especially falling sharply in August, the balance of risks is clearly tilted to the downside.

- CB Consumer Confidence (USD, GMT 14:00) – The Consumer Confidence is expected to ease to 134.0 in September from 135.1 in August and an 8-month high of 135.8 in July. A drop-back is expected in the current conditions reading to 173.0 from a 19-year high of 177.2 in August. The jobs strength diffusion index is poised for a drop-back from a remarkably lofty 19-year high in August of 39.4. Overall, confidence measures remain historically high.

- BoJ Minutes (JPY, GMT 23:50) – The BoJ Minutes are expected to shed some light regarding whether Japanese policymakers are willing to consider rate cuts in the coming months.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.