FX News Today

- RBNZ on hold with dovish twist. As widely expected New Zealand’s central bank kept policy on hold with the key rate unchanged at 1%. The statement said, however, that there was more scope for monetary and fiscal stimulus, while saying it was “pleased to see” the the NZD’s depreciation

- Sentiment started to settle overnight, amid signs of further conciliatory moves that keep hopes of progress on the trade front alive. Asian markets are up from lows and U.S. futures are moving higher, after yesterday’s sell off on Wall Street.

- DAX and FTSE 100 futures are in the red, however, as Boris Johnson returns from New York to deal with the fallout from yesterday’s Supreme Court ruling that said the suspension of parliament was unlawful. MPs are set to return to Westminister today and another Brexit extension with new elections in the U.K. in November or December seem increasingly likely.

- The prolonged uncertainty on the Brexit front meanwhile is adding to geopolitical trade tensions and leaving its mark on economic developments on both sides of the channel. The risk of a recession in Europe is looking very real.

Charts of the day

Technician’s Corner

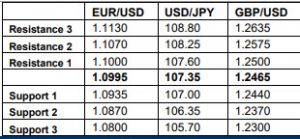

- EURUSD spent the morning session between 1.0994 and 1.1015, later climbing to 1.1020 highs in afternoon dealings. The highs came following reports that House Democrats are considering a special committee in order to attempt to impeach president Trump, which weighed on the Dollar overall. Bigger picture, with European growth fading and the U.S. economy still chugging along fairly well, EUR-USD is set to remain in sell-the-rally mode. Monday’s 1.0966 low is now support, with the 20-day moving average at 1.1028 marking resistance.

- USDJPY: fell to better than two-week lows of 107.05 from pre-open highs of 107.79. The fall has come on the back of a bout of risk-off conditions, with sliding stocks initiated by Trump bashing China on trade from the UN, then talk that House Democrats are considering a special committee to impeach Trump. The pairing fell through its 20-day moving average at 107.24, though found some buyers ahead of the 50-day moving average, which currently sits at 107.06

- USDCHF During Tuesday, the Swiss franc continued to gain support from a lack of confidence in the global growth outlook, especially after recent weak global manufacturing data. The Swiss currency & gold made net gains on Tuesday and remain underpinned with the franc weakening only slightly on Wednesday as US political developments added to investor concerns with the dollar around 0.9870.

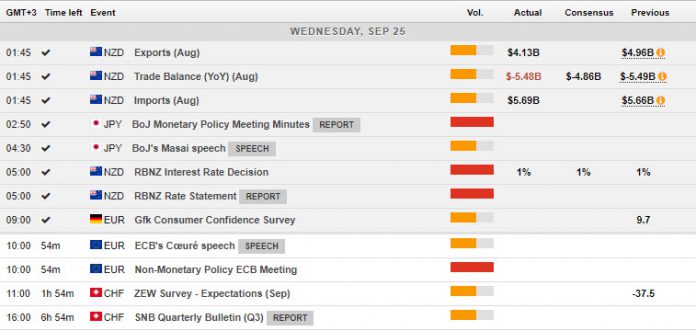

Main Macro Events Today

- Non-Monetary Policy Meeting (EUR, GMT 07:00) – The monthly meeting of the ECB – with a speech from member Coeure to open events.

- SNB – Quarterly Bulletin (CHF, GMT 13:00) and ZEW Survey (08:00 GMT) – With political developments on both sides of the Atlantic moving at a pace the safe haven status of the CHF could receive a bid with positive news flow today.

Support and Resistance levels

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.