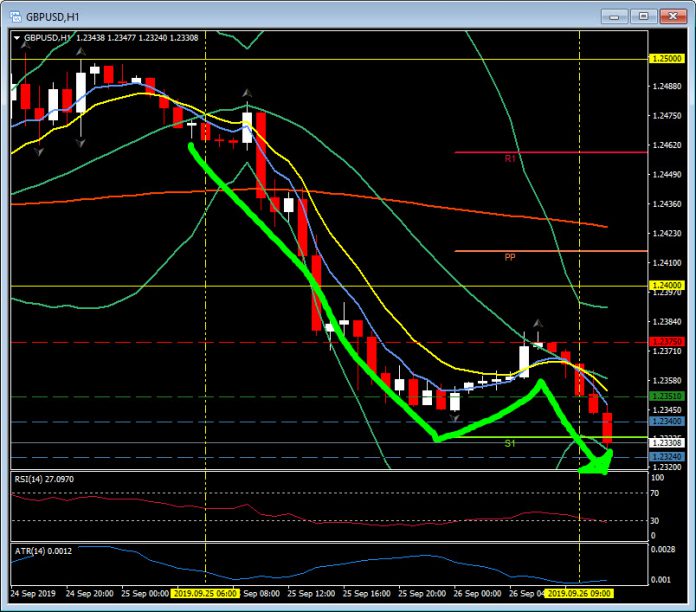

GBPUSD, H1

The Dollar has given some of the gains seen yesterday, tracking the US 10-year Treasury yield, which has deflated by a few basis points after rising notably yesterday. The narrow trade-weighted USDIndex (DXY) has ebbed back to around 98.95, off from yesterday’s two-week peak at 99.05. EURUSD concurrently lifted to around 1.0960-64 from its lows around 1.0937-40, and USDJPY deflated to around 107.60 from 107.88.

Yesterday was all about a risk-back-on vibe, flipping Tuesday’s declines following President Trump’s speech at the UN in New York.

(i) The smoking gun of the evidence in the telephone transcript presented by the White House in response to the whistleblower allegations about President Trump’s dealings with Ukraine weren’t so smoky after all (although not fumeless, and the Democrats impeachment inquiry will continue).

(ii) The mood music coming from US-China and US-Japan trade negotiations became more upbeat. This left markets focusing on fundamentals, particularly the prevailing bullish Wall Street narrative — USA500 trading below long-term average in price/earnings terms and dividend yields being higher than the 10-year T-note yield. Tuesday’s close onto the support at the 20-day moving average provided a spring board yesterday for an 18 point recovery to 2985. The world’s most significant equities market is now back to within 50 points of its all-time highs.

Overnight in Asia and in early European trades, the mood has been less bullishly robust. The fallout from trade warring has thus far been been greater on the Chinese economy and some other Asia economies than it has been on the US economy. Overall, the dollar looks likely to retain an underlying upward bias against most currencies, something that does not go down well in the White House.

The other big mover yesterday (Cable down over 1%) ripples on today. PM Johnson returned to a particularly vitriolic and acrimonious Parliament as the Brexit deadlock looks no nearer to a conclusion. When, how or even if the UK leaves the EU still remains unresolved, and as ever, uncertainty breeds fear and fear spikes confidence, sentiment and the long-suffering pound. Cable remains rooted under 1.2400, triggering another move lower on the crossing EMA strategy at 10:00.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.