Teva Pharmaceutical Industries

Teva Pharmaceutical Industries Ltd. is an Israeli American multinational pharmaceutical company with dual headquarters in Petah Tikva, Israel, and Parsippany, New Jersey. It was incorporated in Israel on February 13, 1944, and is the successor to a number of Israeli corporations, the oldest of which was established in 1901. The company was created with the mission of being a global leader in generics, specialty medicines, and biopharmaceuticals. They are now the largest generic drug manufacturer in the world and one of the 15 largest pharmaceutical companies worldwide.

Teva began trading on TASE (Tel Aviv Stock Exchange) as the Teva Middle East Pharmaceutical Chemical Works Company Ltd. in 1951. Today, Teva (TEVA) is listed on the NASDAQ stock exchange.

The company Q3 Earnings report for 2019, will be released on Thursday, November 7, before the US markets open. According to Zacks Reports, in the last reported quarter, the company delivered a positive earnings surprise of 3.45%. Teva’s earnings surpassed expectations in three of the last four reported quarters, with the average positive surprise being 6.30%.

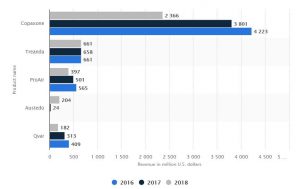

In the past three years, TEVA has derived most of its revenue from products including: Copaxone, Treanda, ProAir, Austedo and Qvar. See the chart below from “statista.com”.

Usually, TEVA’s earnings report is based on three different regions, North America, Europe, and the international market. Before going to check the market forecast, we will review the past reports for these regions, based on company reports on their own website.

Comparing the revenue and gross profit of the second quarter, ended June 30 of 2019 and 2018, in different markets: (US $ in millions)

North America:

• Revenue: 2,071 – A decrease of $192 million, or 8%, compared to the second quarter of 2018 at 2,263.

• Gross profit: 1,067 – A decrease of 9%, compared to $1,179 million in the second quarter of 2018.

Europe Market Segment

• Revenue: 1,183 – A decrease of 11% or $145 million, compared to the second quarter of 2018 at 1,328.

• Gross profit: 674 – A decrease of 7% compared to $727 million in the second quarter of 2018.

International Markets Segment

• Revenue: 741 – A decrease of $48 million, or 6%, compared to the second quarter of 2018 at 789.

• Gross profit: 312 – A decrease of 5% compared to $328 million in the second quarter of 2018.

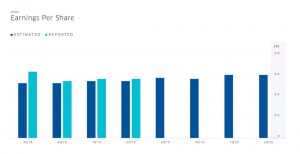

The data above show that the North American market is the most important market for TEVA products. Additionally, in the Earnings Per Share (EPS) reports of past quarters report, as mentioned above, Teva’s earnings surpassed expectations in three of the last four reported quarters, with the average positive surprise being 6.30%, more details we can see in the below chart by separated quarters, provided by Nasdaq.

Q3 Forecast:

As Zacks reports, “in the third quarter, sales are expected to have been hurt once again by rapid erosion in sales of Copaxone, lower sales of other branded drugs, Bendeka/Treanda and ProAir, pricing erosion in the US generics business and negative currency impact due to the strengthening of the Dollar. Meanwhile, sales of the other new product Austedo are likely to have increased in the third quarter.” With this general estimate, Zacks’s ranking for this company in the stock market is #2, as buy recommendation. In the chart below with more details we can see Seeking Alpha’s estimate for the third quarter of 2019, as well.

Technical Overview:

Since January 2019, after October 15, for very first-time candles could clearly open and close above 50-day EMA, which can be interrupted as a positive signal, even though the share price has seen a 92% decline in the past 4 years. Technical indicators have been slightly returning to the positive side, in the higher timeframe charts, Weekly, Daily, and H4 charts, while in the H1 and M30 charts remain channel bound with a bearish bias. $7.46 and the all-time low of $6.05 are next support levels, while 50-week EMA at $11.72, after key resistance level at $9.25 and $12.55 are the key resistance areas.

Click here to access the Economic Calendar

Ahura Chalki

Regional Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.