Some days ago, an article appeared commenting that the end of easy money policies would lead to failures in emerging markets which rely on foreign capital. While foreign capital inflows is a theme of much importance throughout all developing economies, as I suggested on Wednesday about the Chinese economy, it is not often the case that it is connected with small interest rate movements such as the 0.5% envisaged by the Fed for the coming year.

Put simply, paying an extra 50bp interest rate should not be sufficient to withhold foreign investment, given that in the real world nobody makes investments which are expected to earn just a marginal rate of return. To put this simply: interest rates, at this point in time, are much lower than the prevailing interest rates in the 2004-2007 period which prompted the careless lending practices and sowed the seeds which led to the Great Recession.

At this point, it would take a more than 200bp increase in the policy rate for the current mortgage rate to reach 2006 levels, and more than 300bps in the case of the bank prime rate, something that the Federal Reserve is not willing to do, at least over the course of 2019. Still, as an illustration that high interest rates do not always curb capital outflows, Foreign Direct Investment in China rose by more than 250%, during the 2004-2007 period, while policy rates still increased from 1% to 5%.

Investors are really not afraid of investing even when interest rates are high for the simple reason that they do not invest at the margin, i.e. they do not invest in a project which is expected to earn a 5.01% return. As such, while monetary policy does have an impact on reducing consumer spending and withholding some relatively low-yielding investments, it does not have an impact on riskier projects.

Returning to our main point, the world’s biggest problem in the years to come, will be the accumulation of debt and the need for a Japanese-style “lost decade”. As I’ve said before, Central Banks have opted to “fight fire with fire”, i.e. increase the amount of available money in the economy as a response to a banking crisis which decreased the amount of available credit. Even more ironically, in periods of high non-performing loans, the only option to reduce that percentage is to increase overall lending in hopes of substituting some.

This approach, as this article also points out, has the disadvantage that the amount of money obtained via QE has not been used for productive purposes. Banks have only recently started to use money from their reserves, which still this does not guarantee that this extra liquidity will enter the market for productive purposes. In fact, the only thing that QE appears to have caused is a shift from the bond to the stock market, and the small-scale reduction of the Fed’s balance sheet has equally caused no issues.

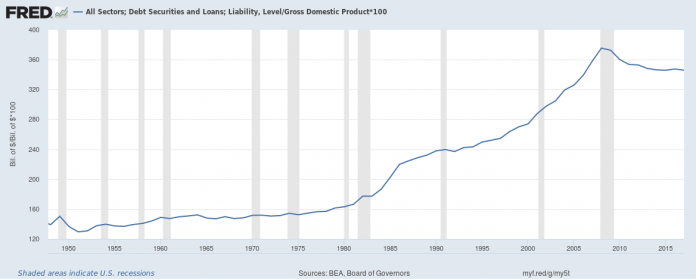

In addition, the heavy borrowing needs of the US government mean that debt is just flown from one place to another, within the same economy. The result is the very unpleasant figure at the top of this post, suggesting that total debt in the US economy is currently still at a very high 345% of GDP, even though it is at lower levels than prior to the crisis, where it stood at 375%. The accumulation of debt by the US government appears to have been strong enough to keep the overall debt levels higher than they would have otherwise been: excluding government debt, the debt burden of the US economy stands at approximately 240%, compared to 300% in 2008.

While the issuance of new loans can be beneficial to the economy, the fact is that the US, and the world in general, needs a slower loans growth rate in order for income to catch up. This would not entail a Japanese-style lost decade, but more of a conservative approach to lending, allowing private sector liabilities to increase by less than income. Here is where interest rates enter the equation, as they can assist in increasing debt payments of existing loan-holders and thus put a hold on growth. Overall, the world needs higher and not lower interest rates in 2019.

The real problem with the US is that it has started feeling the pain from the China sanctions: tariffs mean that Chinese products are more expensive, raising costs for US companies. This is not new, as I argued in our Q4 outlook and in late October, where I suggested that tariffs “are also expected to hurt corporate profits”.

These effects are mainly found in the manufacturing sector, where PMIs have already started coming out worse than expected. Even though manufacturing is just 10% of the overall GDP figure, the negative effects from a production drop would propagate throughout the whole economy. While employment in the overall economy could be growing, it could easily worsen in the future if the trade war continues. In addition, manufacturing is where many of Trump’s voters come from and the part of the population whose interests he wishes to protect. Thus, along with the agreement for China to purchase more agricultural products, Trump could be willing to push through some sort of manufacturing deal, hoping to boost US exports to China. Since the data are moving against him, nobody should be surprised to see an agreement soon enough, as it is to both parties’ best interests, especially as China has many more things to worry about. Naturally, this does not mean that US companies will not be affected by any worsening in China’s macro environment, but, the domestic effect would be much less than the trade war’s.

On the debt front, it’s anyone’s guess how things will evolve: the US government does not appear to be willing to cut back on expenses, and neither does it appear eager to increase taxation. As such, 2019 is likely to face another government shutdown if the current debt ceiling does not increase substantially.

To sum up, the major concerns about the US economy remain the same as they were in October: trade wars and fiscal policy. If the first is resolved then there could be a rationale for more than two rate hikes in 2019, something which will definitely hurt the US fiscal position, despite the Fed selling government bonds to reduce its balance sheet. In the case that trade tensions continue, then the Fed will definitely postpone rate hikes until towards the end of the year, where it may also abandon the idea of hikes altogether if the trade deal is reached in the last two quarters of the year.

At the moment, the state of the US economy is not supportive of any policy action, given the above two growth hurdles. Unless the trade war is resolved, the country’s data releases, which are currently sending an “it’s complicated” message, will continue to deteriorate in the future.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.