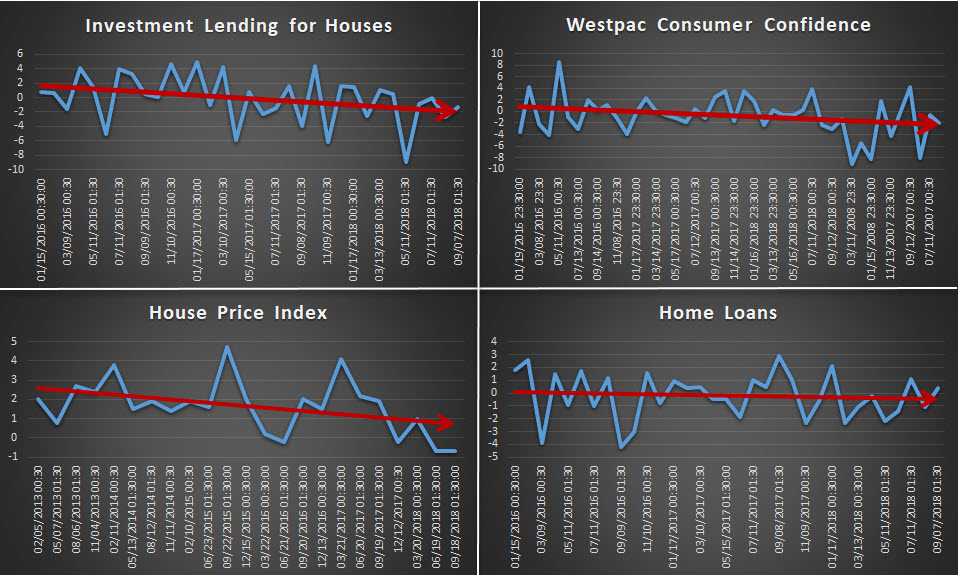

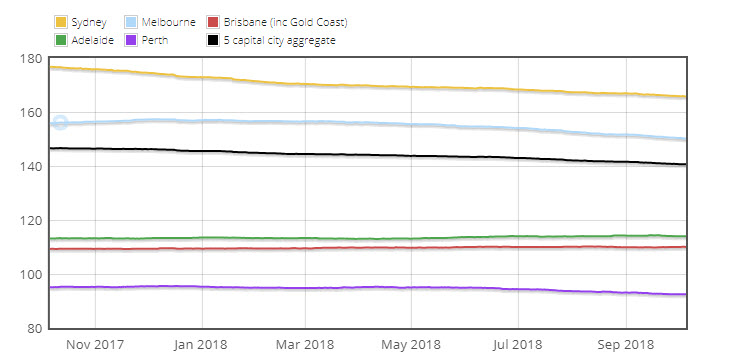

Last time I talked about Australia, I warned that the emergence of troubles for the country was just a waiting game. I still hold that view, with recent data announcements moving in support of it as well. House prices have been on a continuous downwards trend, as the second quarter data suggest, while monthly data (see figure below) are also pointing to that direction, with the 5-city average (black line) registering a 5% decrease on a y/y basis. This can be mainly attributed to the declining investment lending for houses, which was a large driver of the increase in house prices, and also the category in which most interest-only loans were granted. Naturally, the drop in house prices cannot be good for investors, given that they will be unable to refinance their loans and they will be forced to reduce house prices, which would again make it more difficult to re-finance, which would force further drops in house prices and so on.

Source: CoreLogic

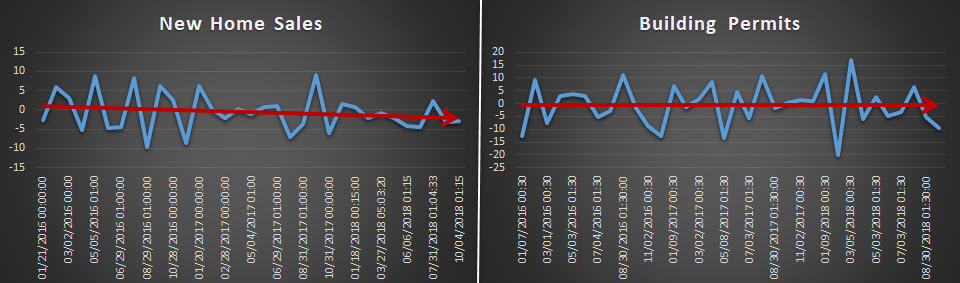

The behaviour of the housing market is also evident in new home sales which have been declining in recent periods. The reason is relatively straightforward: declining house prices make buyers believe that they can get prices cheaper so they postpone their purchase. In contrast, sellers want to buy but cannot drop the price by much because they either believe that prices will continue to rise as in previous periods, or because they cannot lower it due to the increased cost of borrowing. Add to this the decline in lending for house purchases which reduces the buyers’ purchasing ability and further reasons come up. Building permits do not show that much of a reaction due to the fact that a permit costs only a fraction of the cost of building a house, but, they have also been on a downwards trend. The Construction Index is also suggesting that something odd is happening in the country, as it dipped below 50 for the first time in the past 18 months.

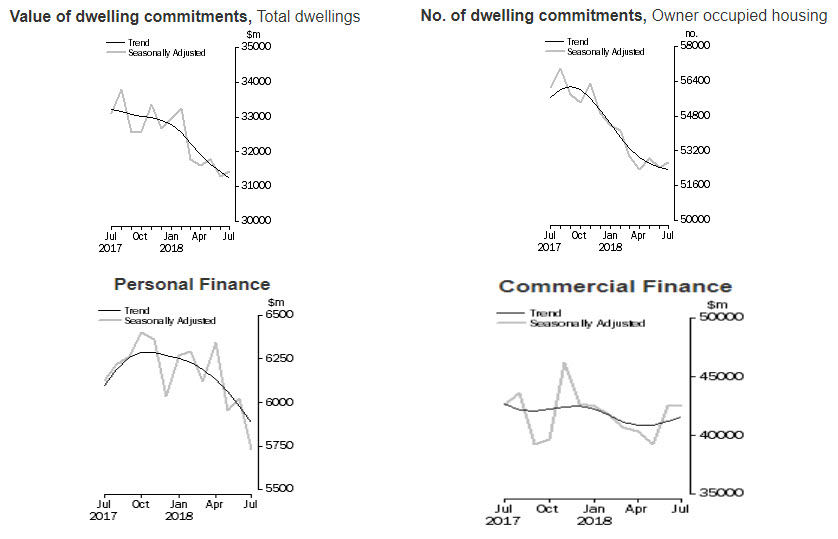

Another figure by Morningstar points to the same situation and that is the real Housing Price Index from 1880. Over the past 100 years, and until 2000, the housing price doubled from 100 to 200, an increase which approximately amounts to 0.7% annually. However, things changed over the next decade as prices moved from 200 to more than 400 by 2012, at an annual average of approximately 6%. Now, with lending and dwellings being on a constant decline according to data from the Australian Bureau of Statistics the boom could likely result in a bust. How big can the bust be? Just note that approximately 52% of all owner-occupied dwellings are mortgaged.

Mortgage rates are also expected to rise, adding more pressure to investors and owners, given that the US policy rate rose by 0.25% last week and is also expected to be hiked by a similar extent in December. More rate hikes are also expected in 2019, as the Fed Chairman has suggested. If RBA also proceeds with raising the interest rate then things could get much more complicated for both lenders and borrowers.

The literal billion-dollar-question is when a slowdown can be expected and how fast this can unfold. The answer here is that while we should expect a deterioration in the data over the remainder of 2018, there shouldn’t be a severe disruption in the country during the year, despite the continuous downwards trend of the AUD. However, 2019 could be an important year for Australia given that we should have a much more informed opinion on how the real estate market and the banking sector will react to a more abrupt deterioration of the macroeconomic developments. Rate hikes will also put pressure on borrowers as they should find it increasingly difficult to either refinance or repay their loans, with the average US rate in 2019 expected to be double the level of 2018. As suggested earlier, this is a waiting game, even though the FX market has been quick to catch the smell of what’s cooking if we observe the path of the AUD recently.

The literal billion-dollar-question is when a slowdown can be expected and how fast this can unfold. The answer here is that while we should expect a deterioration in the data over the remainder of 2018, there shouldn’t be a severe disruption in the country during the year, despite the continuous downwards trend of the AUD. However, 2019 could be an important year for Australia given that we should have a much more informed opinion on how the real estate market and the banking sector will react to a more abrupt deterioration of the macroeconomic developments. Rate hikes will also put pressure on borrowers as they should find it increasingly difficult to either refinance or repay their loans, with the average US rate in 2019 expected to be double the level of 2018. As suggested earlier, this is a waiting game, even though the FX market has been quick to catch the smell of what’s cooking if we observe the path of the AUD recently.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/03 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.