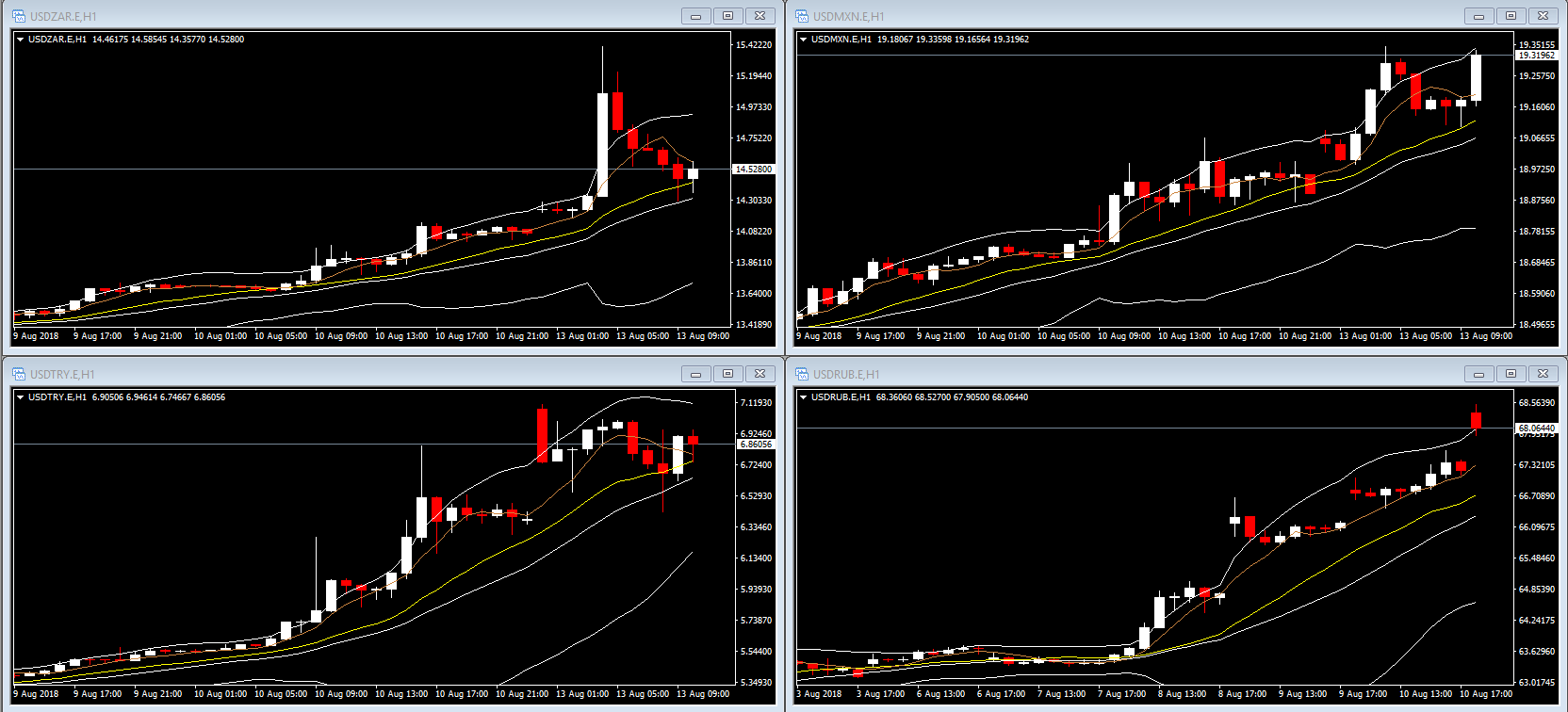

USDTRY, USDZAR, USDMXN, and USDRUB, H1

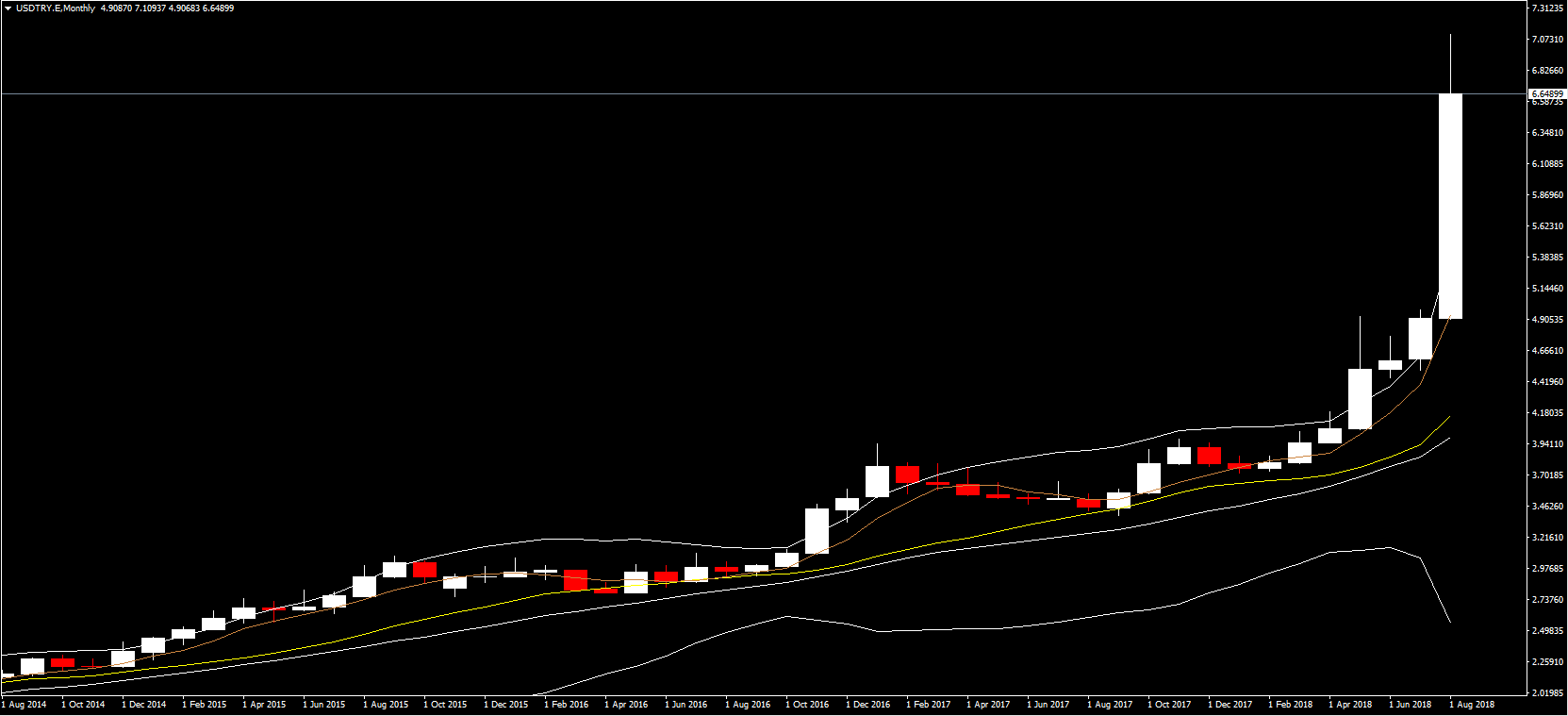

The impressive depreciation of the Turkish Lira during the past week can be mostly attributed to the country’s economic conditions, while the US sanctions can be viewed as the straw that broke the camel’s back. Early today, the Turkish central bank announced a series of measures to hold back on the depreciation, mainly through supporting the country’s banking system via increasing FX liquidity through longer-term lending and deposit limits.

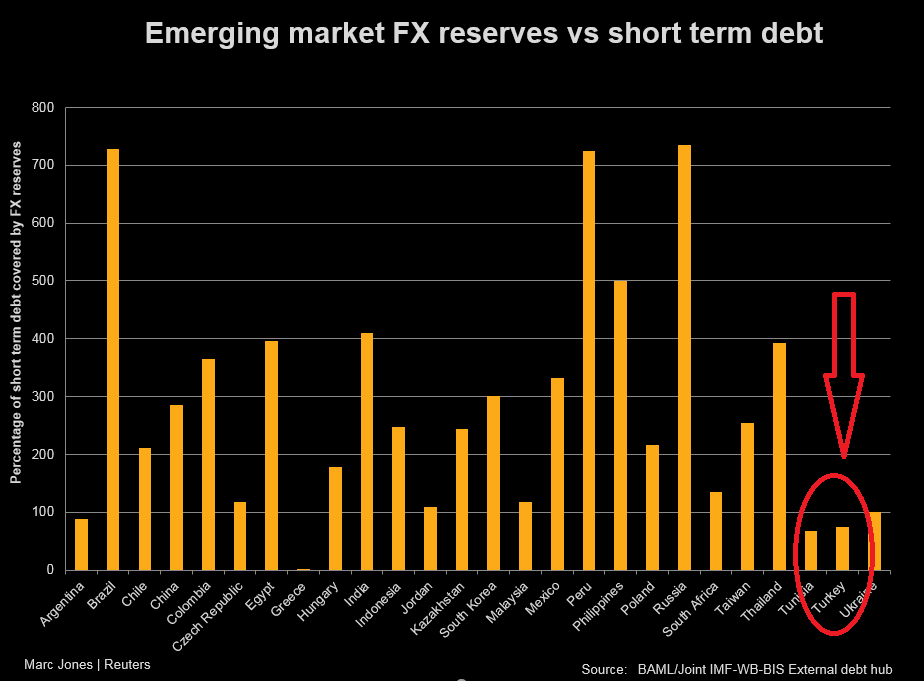

The moves appear to have relatively calmed the markets, with the Lira stabilising and gradually gaining strength against the Dollar. However, whether the measures are sufficient and whether the Turkish central bank has enough power to continue with such a strategy is still unclear. While Turkey boasts some FX reserves, the country is at a worse place than most other emerging economies.

As Marc Jones from Reuters points out, Turkey does not appear to have a large enough pool to withstand much FX pressure. While reserves have not reached all-time lows, this will not be an impossibility in the case pressure continues. Furthermore, comparing the FX reserves to the IMF’s Relative Adequacy Measure (RAM) thresholds of 100%-120%, Turkey’s current standing is at approximately 60%. As if this was not enough, Turkey displays declining rollover ratios for bank lending, with analysts reporting that even a 100% rollover would not be enough to cover financing needs at a time of weak capital inflows, Bloomberg notes. Heavily reliant on external financing, the sharp drop in inward foreign investment and the drop in Lira exchange rate is very likely to deteriorate economic prospects and increase inflation, which already stood at 15.4% in June.

Summing up, Turkey’s problems appear to be endemic because the country is:

- Very dependent on external financing, which is declining

- Unwilling to raise interest rates

- Prone to political pressure regarding central bank actions

Contagion effects appear to continue, with the USDRUB pair seeing the most action, rising to 68.19 at the start of the trading day, outside the 2 standard deviation of the Bollinger Bands. USDMXN and USDTRY follow the same course, losing some steam at the beginning of the session, but rising again as the day continues. In contrast, the ZAR appears to register a more stable trend, gaining on the USD. The contagion effects are expected to continue, at least until the market is convinced that any future measures assumed by the Turkish central bank are enough to stabilise the currency.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/14 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.