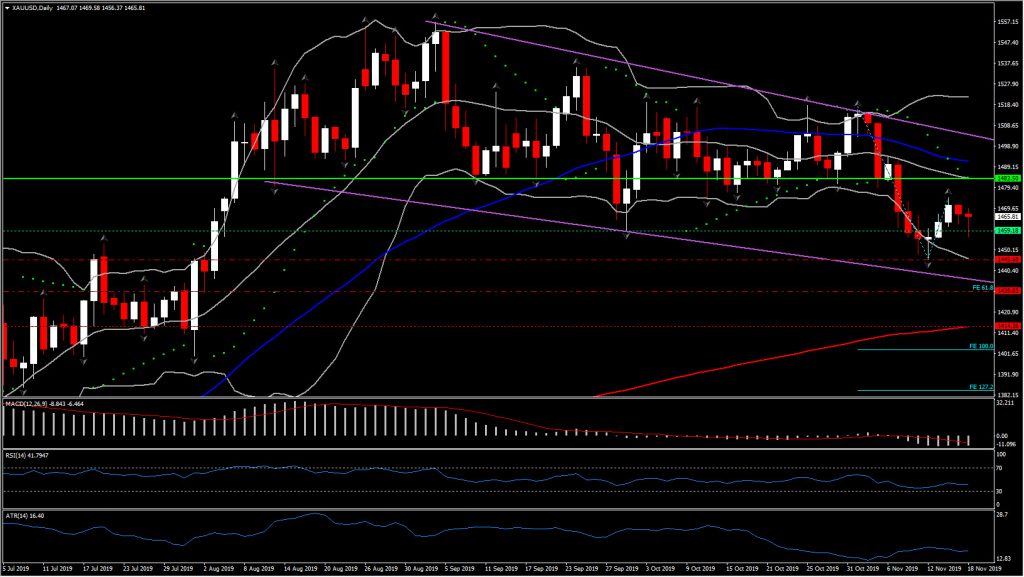

Gold Futures have continued their losing ways, refreshing the 3-month downchannel by reversing last week’s gains below $1,459.00. The rejection of the 20-day SMA could alert market participants to the prospect of a move below the $1,445.00 which will shift the medium term outlook completely into a negative one.

The US Dollar was slightly changed last week and then underperformed against major currencies ahead of the weekend on the back of the mixed retail sales, weaker than expected production, the Empire State index, trade prices, and business inventories. However the USD outlook remains positive as the US economy seems to be in a much better shape than the European or Japanese ones.

Additionally, the data have been ignored, as the USD support came after the White House adviser Kudlow said US-China trade talks are in the final stages. Hence, the optimism over a trade deal, the support from accommodative central banks and the diminished fears over a recession, have boosted Wall Street at the start of what is likely to be a quiet week ahead of the Thanksgiving holiday.

The bullish momentum on Wall Street has seen record high, after record high. By emphasizing on the safe havens tough, with Gold (XAUUSD) being one of them, the risk-on conditions prevailed into the weekend, lifting stocks to further peaks, though weighing slightly on bonds and safe havens as the focus remained on trade hopes.

The Fed’s measure of the Dollar’s broad trade-weighted Dollar is at near 3-year highs. A continuation of Dollar firmness would likely keep XAUUSD overall bias to the downside. Both incoming US data and the Fed minutes on Wednesday are likely to reaffirm the Fed on hold view. This keeps the overall view of the USD bullish with the economy in a “good place” for now.

If this happens, Resistance of Gold set at $1,483.50 (20-day SMA), while a break above it could retest the 50-day SMA, at $1,491.77 and the upper trendline at $1,501.00.

On the flipside scenario though, the next Support level for XAUUSD is at $1,445.00, at November’s low , and at the confluence of the lower daily BB pattern. As mentioned above a move below the latter could open the doors to fresh low, with the next Support coming way lower at $1,430.00 and at the 200-day EMA, at $1,414.00.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.