In Australia, the RBA’s policy meeting tomorrow is expected to result in no change to the 0.75% rate setting. This comes in contrast with the recent lapse in the economic data, which has seen Australian unemployment rate unexpectedly ticking higher, to 5.3% from 5.2%, while the underemployed measure also rose; wages slipped to 2.2% and retail sales stuck at 2.5%.

In general the Australian economy is in a sluggish growth as it is continuously affected by China, which accounts for over a third of the total demand for Australian commodity exports. Hence recent Chinese data are bad news for the export-oriented Australian economy. China’s industrial production slowed sharply in October, with investment growth falling to a record low while Chinese retail sales also underwhelmed.

Therefore despite the expectations of a pause in rate cuts this month, a dovish statement should keep rate cut hopes very much alive. Recall that the minutes to the November meeting showed that the RBA was of a mind to cut rates, as policymakers “agreed a case could be made” for another cut in the 0.75% cash rate given unwelcome weakness in wages, growth and inflation.

Currently the RBA Rate Indicator shows 89% of market expectations of no change in the Official Cash Rate at tomorrow’s meeting. The market has seen 60% probability for a rate cut to be applied in February 2020, as the overall outlook for jobs and property market remaining low especially after the biggest surge in Australian dwelling values in 16 years.

Australian Dollar

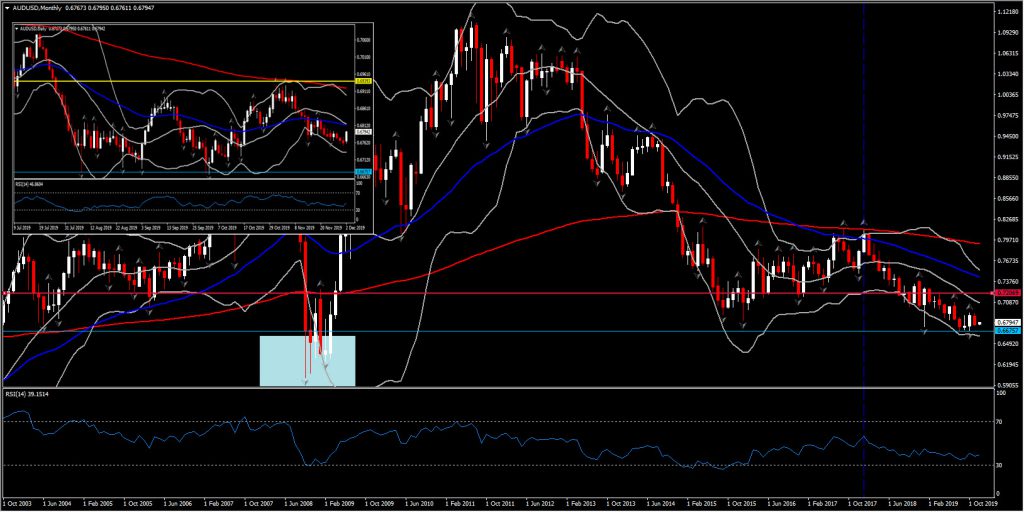

The Australian Dollar has been trending lower since early 2018, which has been driven by the consequences of US trade warring. The expectations for a flat RBA tomorrow could appreciate Aussie in the near term, however the threat of recession in major global economies, and of more slowing in the Chinese economy, along with the RBA’s course to further easing in 2020, should keep the Australian Dollar on a broadly downward trajectory.

A break of the multi-year low at 0.6670 for AUDUSD still seems like a long term scenario, however if this becomes a reality due to a dovish statement tomorrow, then this could open the doors towards fresh lows, stretching the 2-year downtrend.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.