USDJPY, H1

Politics remain front and centre today. 3 significant events in an otherwise light US data day.

The House has announced 2 articles of impeachment against President Trump.

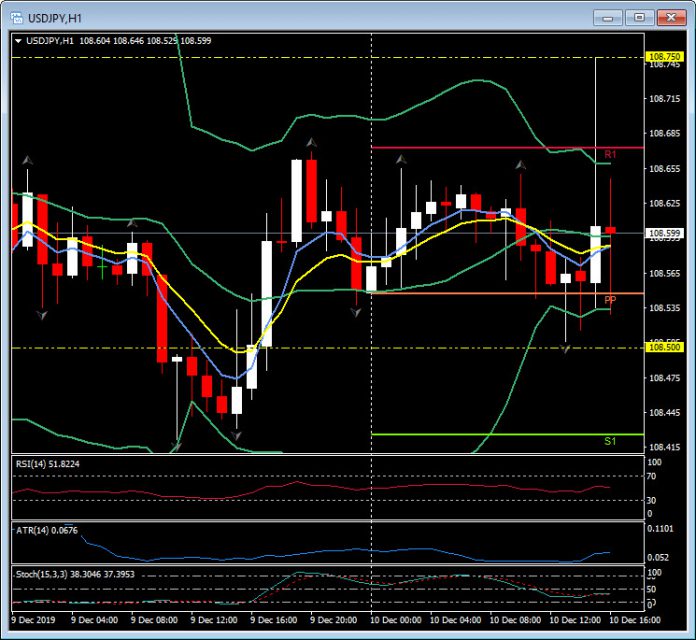

Earlier there were headlines saying the US and China are discussing ways to deescalate the tariff conflict such that there could be a delay to the imposition of more tariffs on December 15. USDJPY spiked to 108.75 before falling away as the impeachment articles were announced.

The USMCA deal is expected to be signed later today (at long last Canada & Mexico ratified it many months ago) as representatives from Canada and Mexico are on their way to Washington.

Wall Street open lower, shedding its knee-jerk gains in pre-market trading on hopes for a delay in December 15 tariffs. White House acting Chief of Staff threw some cold water on the market, reminding that a delay will depend on how the talks go between now and the deadline. But he also said the trajectory toward a deal is pretty good. The market, however, has become less volatile to the constant to and fro on trade hopes. It looks like it will be (as expected) a choppy, headline driven, trading week.

108.50 remains a key (50-day moving average) and psychological support for USDJPY, with resistance, this week, at 108.70. In the higher Daily time frame the pair has been under the 20-day moving average since the beginning of the month in anticipation of the wait and see stance being extended by the FED and the added stimulus promised for the Japanese economy from PM Abe. Daily resistance sits at 109.00 and the November high just north of 109.55.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.