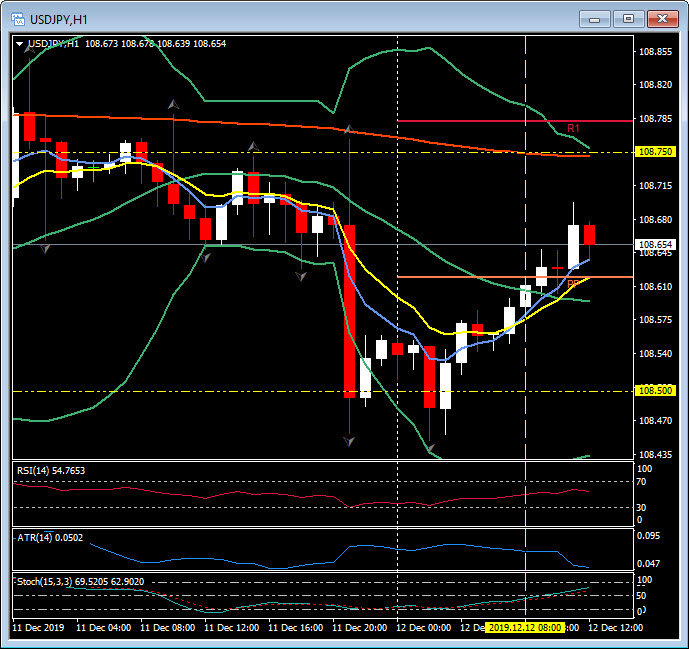

USDJPY, H1

The Yen has printed fresh lows against the Euro, Australian Dollar and a number of other currencies, though USDJPY edged out a two-day low in the context of a less than 20-pip range. The declines in the Japanese currency come against the backdrop of global equity markets holding buoyant and a collapse in machine orders which came in at -6.0% vs expectations of a slight gain of 0.7% from -2.9% last time. Market optimism is guarded about the US and China coming to an agreement on the partial phase-1 trade deal ahead of the US scheduled tariff hike. Some expect a 90-day delay for the December 15 deadline, but second guessing the President is never simple. Trump and his political and economic advisers are scheduled to meet later today. As ever, the Twittersphere is likely to be the first area to look for the President’s latest thoughts.

The Dollar, meanwhile, which came under across-the-board pressure yesterday after the Fed removed a forecast for a 25 bps hike in 2020, has remained heavy, posting fresh lows in the case against the Pound and Yen while holding near lows versus other currencies.

Cable printed an eight-and-a-half high at 1.3229. EURGBP, meanwhile, remained comfortably above recent 31-month lows, while GBPJPY edged out a two-day high, coming within a few pips of the seven-month high the cross saw on Tuesday. Pound gains have come with the Conservative Party being odds-on favourite to win today’s election, though a much-vaunted poll from YouGov, using the same methodology as a poll that accurately predicted the 2017 election result, has suggested the party’s lead has slipped. The poll also showed the Brexit Party failing to win a single seat, and the no-deal Brexit possibility is now much diminished. Out of the five possible post-election scenarios, the worst for markets would be the Conservative Party winning no more than three seats and losing no more than six seats, which would mean the party would be dependent on Northern Ireland’s DUP to form a minority government. The DUP would condition its support on a re-worked Brexit plan. Any other outcome would lead to the current Brexit plan being implemented, or being subject to a second referendum (if the Tories joined forces with the Liberal Democrats), or a softer Brexit plan being formulated by a Labour government, or Labour-led government, which would then be subject to a confirmatory referendum.

Join me tomorrow morning at 09:00 GMT on our Facebook page to discuss the aftermath of the UK Election and the impact for Sterling, UK Bonds and the UK100.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.