The year is quickly coming to a close, and is ending on a very cheery note, especially versus last year.

Worries over a recession have faded and have been replaced by signs of stabilization and expectations of improving economic growth in many regions. Monetary policy remains accommodative, and some fiscal stimulus may be taken up too. Downside risks have been dissipating. The long awaited Phase One deal between the US-China looks ready to be inked.

However, despite all this positive bias as we are getting close to the end of the year, we have seen Gold and antipodean currencies benefitting on the anticipation of the US-China trade deal and the latest data showing a steadying in global growth, which is quite weird.

Gold is in a strong rally so far today with a change around 0.5% since open, while its year earnings are around 15% from $1,280 lows up to today’s $1,485 levels. So far performance could be explained partially by the slightly weaker US Dollar, while in the overall outlook, Gold’s outperformance and any potential swing higher could be based on any further Fed easing bias in the year ahead.

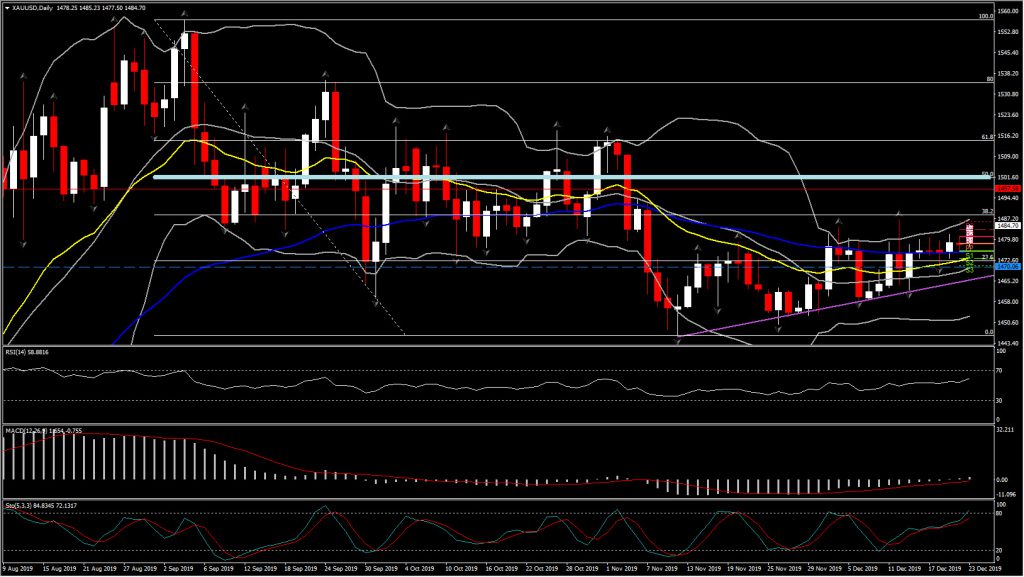

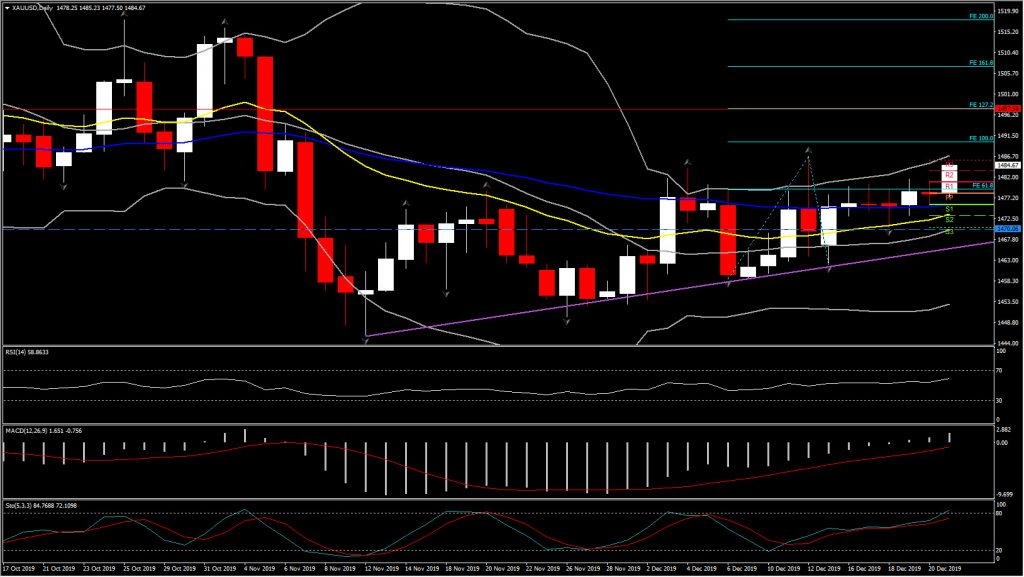

Meanwhile, as of its current performance, Gold Futures refresh the November’s upchannel by jumping today $7 higher and retesting for a second time the 38.2% Fib. retracement ($1,488) level since August’s drift. Despite smooth 2-month upwards movement, the asset needs to post a decisive swing above $1,500 (round level and midpoint of August- November decline) along with signs of traction from momentum indicators as well, in order to confirm the overall turn of its outlook from negative to positive.

As intraday picture looks that is readying for a correction of the already overbought asset, in the daily timeframe, indicators are close to neutral followed a 2-month development in the negative territory. RSI is at 59 giving signs of slow strengthening of positive momentum, while MACD lines are at neutral zone. Hence, the key Resistance in the long term is a close above $1,500, which could open the doors towards $1,534-$1,550 area, while in the near term a close above the 38.2% Fib level at $1,488, could find its next Resistance $1,497.50. Support levels are set: $1,478 (PP) and $1,475.60 (50-day EMA and S1).

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.