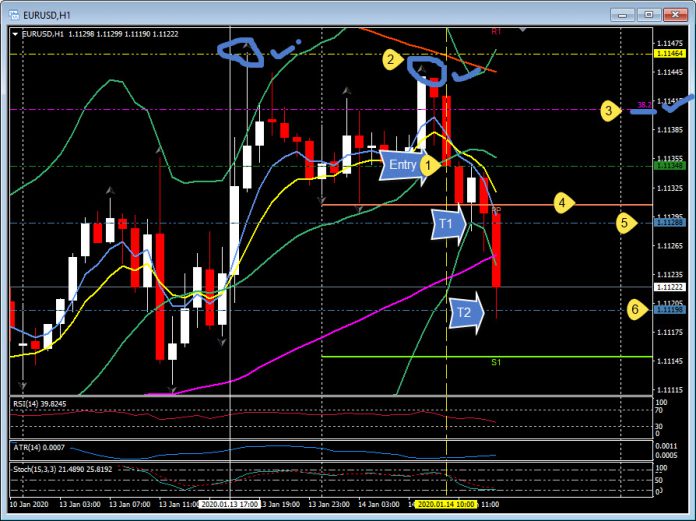

EURUSD, H1

EURUSD remained in a narrow range below the six-day high seen yesterday at 1.1147. The Crossing EMA strategy produced an initial short position at 11:00 GMT (1) following a rejection of yesterday’s high, the 200 MA (2) and the 38.2 Fibonacci level (3). A breach of the daily Pivot Point (4) has seen the price move down to both T1 (5) and T2 (6) (net gain 15 pips) and also test the S1 level and yesterday’s low at 1.1111.

The Dollar itself has lost some buoyancy in the wake of last Friday’s below-forecast US jobs report for December. US nonfarm payrolls missed with a rise of 145k, while wages and hours worked were soft. Markets are factoring in about a 55% chance for the Fed to cut by 25 bps or more by year end, up from the about 50% odds being given ahead of the jobs report. The ECB, meanwhile, is embedded in a wait-and-see policy stance. EURUSD has been trending lower since early 2018, dropping from levels near 1.2500 and posting a 32-month low at 1.0879 in early October, the current nadir of the trend. Momentum has faded, with the Fed having backed out of its tightening cycle after hiking rates three times last year.

The Dollar itself has lost some buoyancy in the wake of last Friday’s below-forecast US jobs report for December. US nonfarm payrolls missed with a rise of 145k, while wages and hours worked were soft. Markets are factoring in about a 55% chance for the Fed to cut by 25 bps or more by year end, up from the about 50% odds being given ahead of the jobs report. The ECB, meanwhile, is embedded in a wait-and-see policy stance. EURUSD has been trending lower since early 2018, dropping from levels near 1.2500 and posting a 32-month low at 1.0879 in early October, the current nadir of the trend. Momentum has faded, with the Fed having backed out of its tightening cycle after hiking rates three times last year.

Meanwhile, conversely, EURJPY posted a five-month high today, and EURGBP a seven-week high.

Meanwhile, conversely, EURJPY posted a five-month high today, and EURGBP a seven-week high.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.