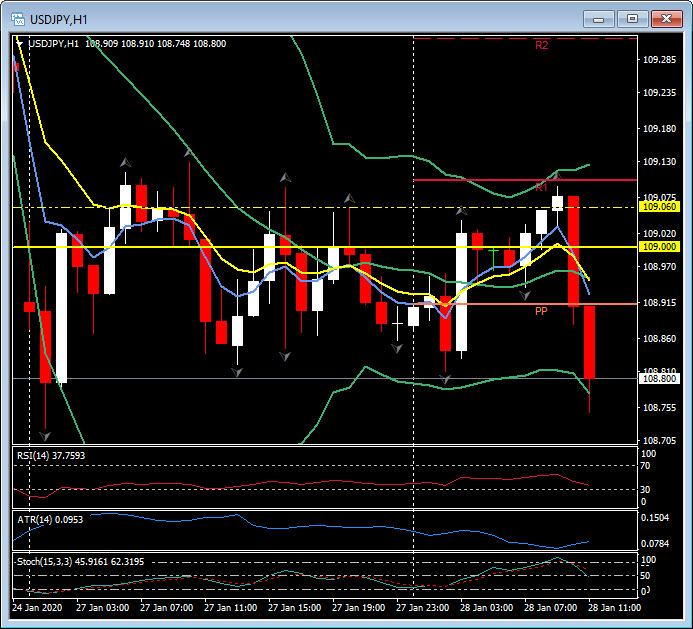

USDJPY, H1

The Yen and Swiss Franc softened, paring some of the safe-haven premiums built up in recent sessions, as the pace of risk-off positioning came off the boil, with Asian stock markets managing to pare intraday losses, although remaining well in the red. S&P 500 futures also managed to rebound by 0.6% after the cash version of the index closed with its biggest daily loss, of 1.6%, in nearly six months yesterday. Chinese markets remained closed, thought the iShares China Large-Cap ETF has racked up a loss of over 10% since January 17. Investor confidence will remain fragile, faced with the epistemological “known unknown” conundrum of how bad and how widespread, and how economically damaging, the prevailing outbreak of the coronavirus stemming out of China will be.

USDJPY recouped above the 109.00 level, extending a moderate recovery from the three-week low seen yesterday at 108.73, only to retest the zone again. EURUSD has once again plied a narrow range, this time around the 1.1020 mark, above the near two-month low that was seen yesterday at 1.1009. The low was the culmination of a moderate downtrend that’s been unfolding over the last couple of weeks, from levels above 1.1150.

USDJPY recouped above the 109.00 level, extending a moderate recovery from the three-week low seen yesterday at 108.73, only to retest the zone again. EURUSD has once again plied a narrow range, this time around the 1.1020 mark, above the near two-month low that was seen yesterday at 1.1009. The low was the culmination of a moderate downtrend that’s been unfolding over the last couple of weeks, from levels above 1.1150.

Sterling remained heavy, with UK rate markets discounting about 57% odds for the BoE to cut the repo rate by 25 bp at its policy review this Thursday. Cable ebbed to a one-week low at 1.3002, and EURGBP posted a six-day high at 0.8465. News was swirling too that the UK government will announce later today that “Huawei will be permitted into the “non- core” parts of the UK 5G network”.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.