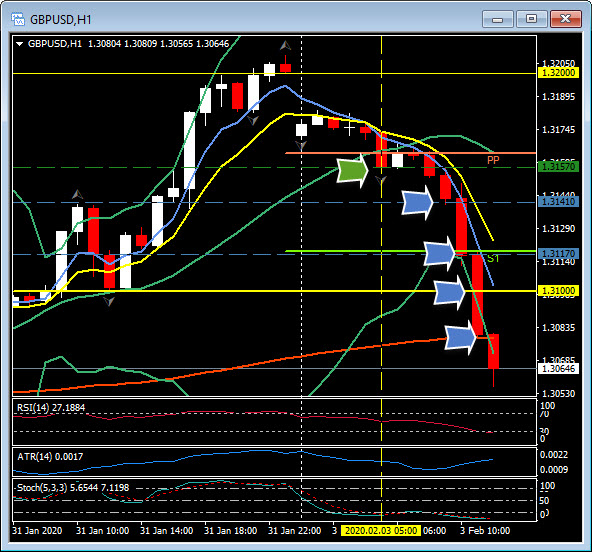

GBPUSD, H1

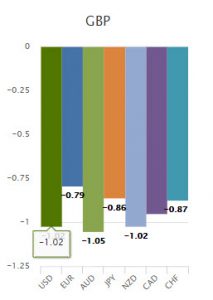

Sterling has come under notable pressure, and is presently showing losses of over 1.0% against the Dollar, Aussie and Kiwi among other currencies. Most of the declines were seen before the release of final UK manufacturing PMI data for January, which showed an unexpected revision higher, to 50.0 from 49.8, while also highlighting ongoing concerns among respondents in the sector about Brexit. The UK currency has now given back all of the gains seen following the BoE’s decision, last Thursday, to refrain from cutting interest rates. Cable has printed a low at 1.3055 in what is already the biggest intraday decline since December 17. The post-BoE high, seen on Friday, was 1.3209, which is a one-month peak.

Today, both the UK (PM Johnson) and the EU (Chief Negotiator Barnier) will outline their initial positions with regard to the UK-EU trade deal and like two rutting stags in the spring there will be a lot of bluster, charge and counter charge. Barnier “We must agree on specific and effective guarantees to ensure a level playing field over the long-term”. Johnson “UK will resist ‘EU rules on social and environmental protections’ in trade talks”.

Later this week PM Johnson will be visiting President Trump, heralding the start of post-Brexit trade negotiations between the two nations. Negotiations with the protectionist president will likely be tough. The outgoing British ambassador to the US, Kim Darroch, in an interview with the Guardian last week, said he doubted that the UK has the resources for parallel negotiations with the US and EU. He also said that Trump will be pitching for greater access for US agricultural products and US pharmaceutical products, which would be politically controversial in the UK. These remarks chime with bearish narratives about the Pound, which are also focusing on the UK government’s self-imposed 11-month time frame for trade negotiations until leaving the transition phase (and thereby access to the EU’s single market and customs union), which many see as being a much too short period to form a comprehensive trade deal.

Later this week PM Johnson will be visiting President Trump, heralding the start of post-Brexit trade negotiations between the two nations. Negotiations with the protectionist president will likely be tough. The outgoing British ambassador to the US, Kim Darroch, in an interview with the Guardian last week, said he doubted that the UK has the resources for parallel negotiations with the US and EU. He also said that Trump will be pitching for greater access for US agricultural products and US pharmaceutical products, which would be politically controversial in the UK. These remarks chime with bearish narratives about the Pound, which are also focusing on the UK government’s self-imposed 11-month time frame for trade negotiations until leaving the transition phase (and thereby access to the EU’s single market and customs union), which many see as being a much too short period to form a comprehensive trade deal.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.