The Yen has continued to tumble, and is showing a near 2% decline against the Dollar from yesterday’s opening levels.USDJPY printed a 10-month high at 112.10, just 28 pips away from its 10-month high, and EURJPY posted a 2-week high, at 121.00.

There have been reports over the last day of major fund managers cutting yen longs, including against short regional Asian currency hedge positions, though most Asian currencies came under fairly heavy pressure today amid concerns about the coronavirus outbreak spreading regionally at an increased rate. There has also been talk of Japanese funds buying US Treasuries. While China reported a large drop in new coronavirus cases, just as the PBoC delivered an expected rate cut, South Korea and Japan reported increases in new cases.

This news led to a mixed performance among Asian equity markets, with China outperforming while other benchmark indices sputtered. Trying to call the point of peak contagion, and thereby the peak of economic disruption, is tough, though the consensus seems to be that it will happen in March or April, aided by the arrival of warmer weather in the northern hemisphere (although scientists aren’t exactly sure if warm weather will have the same quelling effect as it does on flu and cold viruses).

Japan’s Q4 GDP data, released on Monday, disappointed, showing a 1.6% q/q contraction versus the median forecast for -0.9%. Q3 data were also revised down, and the figures came amid expectations for a dismal current quarter performance given the impact of measures to contain the virus outbreak.

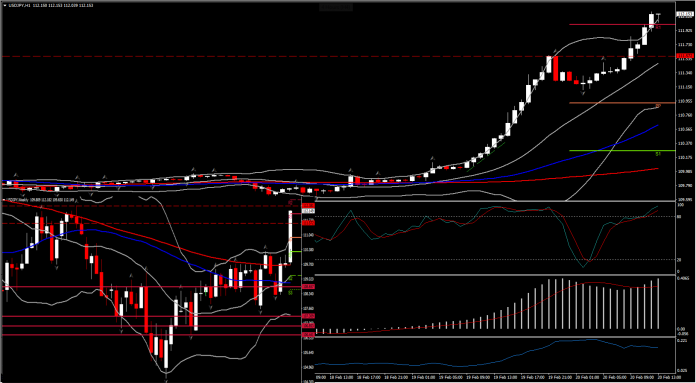

There is a risk that USDJPY might sharply reverse gains should risk appetite in global markets deteriorate and sustain. Intraday meanwhile, momentum indicators continue their positive configuration, suggesting that despite the fact that the asset reached overbought territory there is still room to the upside. Stochastics slopes into overbought area and MACD extends above signal line suggesting strengthening of positive bias, whilst ATR posted a 16 pips move. Some correction could be seen ahead of US session, with immediate Support at 112.00 and 111.58 (yesterday’s peak), however the overall outlook remains positive. Resistance sits at 2019 peak , i.e. 112.38 and at 112.66 (R2 of the day).

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.