The COVID-19 virus has cropped up in sub-Saharan Africa for the first time, with Nigeria reporting an Italian citizen working in the country, who returned from Italy to Lagos on February 25th, having tested positive. This is just the third case reported on the entire African continent (the others being in Algeria and Egypt), though it is still a development that is high on the worry list of the World Health Organization given the continent’s “fragile health systems” (as the organization describes it). The WHO has so far resisted labelling the coronavirus outbreak as a pandemic, arguing that it remains in the window of opportunity for containment. However, the WHO chief said yesterday that it was now at a “decisive point globally” while warning that it could “get out of control.”

The death rate of those infected with COVID-19, from the figures so far, is 2.3%, which compares to a death rate of just 0.05% in the US for seasonal flu (though this rate can be much higher in a bad year). The main concern for scientists is the unknowns about the COVID-19 virus; about, for instance, whether the advent of improving northern hemisphere weather in spring will have a similar remedying effect as it does on seasonal flu. Even though around 98% of those infected will make a full recovery, and scientists think that the virus should weaken as time goes on, the novelty of the virus, along with its voracious ability to spread through human populations in an era of high global travel, along with social-psychological pressures to contain it, will translate as economic risk for markets. Until there are signs that the spread of the coronavirus is in retreat, risk-off is likely to persist in global markets.

Commodities Market:

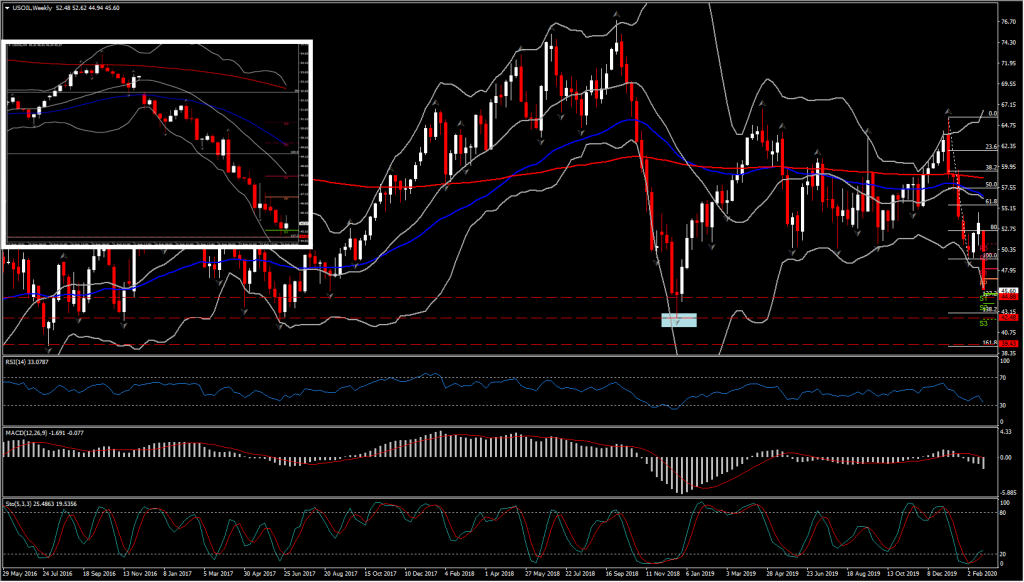

Oil prices plunged again, down some 16% on the week, and by over 31% from the Jan peak. This is their lowest level in more than a year while prices were also set for the largest weekly fall in over four years.

USOIL futures are down another 3.7%, making a low at $44.97, which is the lowest level seen since December 2018. On the week, prices have hemorrhaged 16%, while WTI benchmark crude is now down by 31.5% from the highs seen in early January. The continuing spread of the COVID-19 virus is portending more global economic disruption, and consequently less demand for oil.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.