It is no bazooka from Lagarde, however, and at the current juncture it is doubtful that it will be enough to really stabilise markets unless there is positive news on the virus front. On the other hand USD has returned to favour, outperforming even the Yen in the risk-off environment.

The Dollar is registering as the strongest currency on the day, and is even showing respective gains of 0.5% and 0.8% against the Yen and Swiss franc, the usual safe haven currencies of choice, despite the concurrent plummet in global stock markets.

Dollar gains have also come in the face of fed funds futures discounting 80% odds for a massive 100 bps Fed rate cut at its upcoming March 17th-18th FOMC meeting, although offsetting these have been the ECB and BoE actions over the last day, and expected upcoming policy easing from other central banks, including the BoJ next week, among many others. Another reason for the Dollar’s return to perkiness is that the Dollar itself is a safe haven currency, given the underpinning of the biggest and most liquid triple-A sovereign bond market in the world.

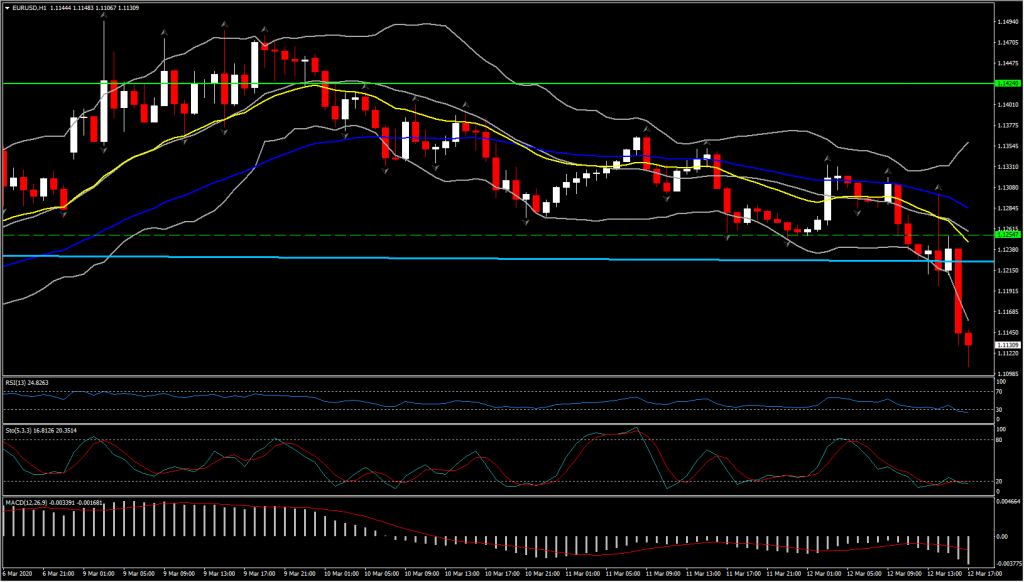

The reason for the Dollar’s recent several-week phase of underperformance stemmed from a dynamic in EURUSD, specifically the unwinding of euro shorts that had been used as funding for carry trades during the good times of record stock market heights. This force, which lifted EURUSD about 5% higher from the 35-month sub-1.0800 lows that were seen on February 20th, has now run dry at a time when the Eurozone’s fundamentals are starting to look ugly. The nationwide lockdown in Italy, a weak link in the Eurozone, is a major concern.

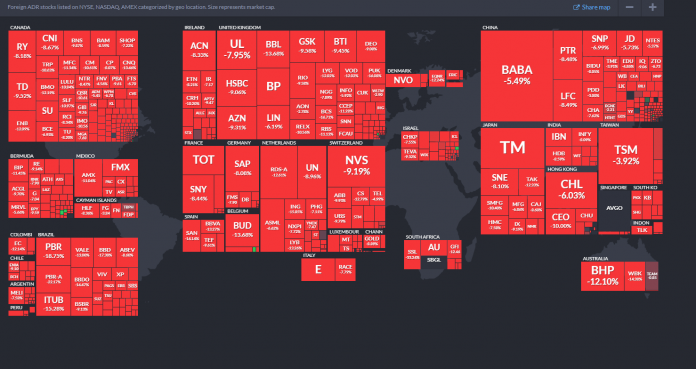

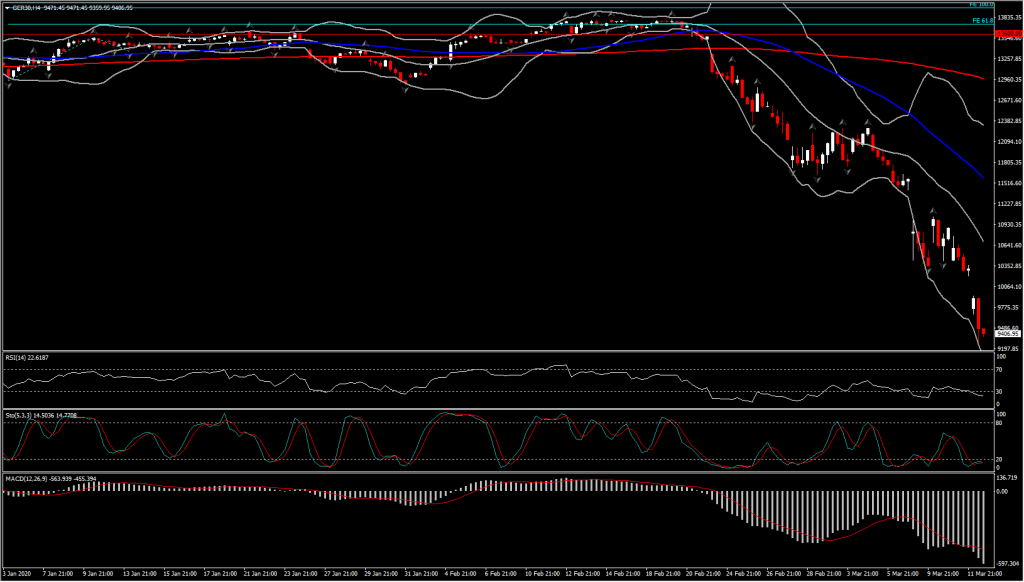

BTP yields have surged in recent sessions with the nation facing debt refinancing amid forecasts that the world’s eighth largest economy is heading for a deep and long-lasting recession. GER30 fell below the 10000 mark after ECB failed to cut rates. The GER30 is down 8.6%, the IBEX 35 down 9.2% after the ECB added stimulus, but failed to deliver the hoped for rate cut. Lagarde said today’s decision was unanimous and officials thought that additional QE was the most effective response to “market sensitivities”.

ECB Briefing:

The Commission will use all the tools at its disposal to support the economy. As the ECB announced its liquidity boosting measures, EU leaders gave the Commission a mandate to further step up the response to the Coronavirus, or Covid-19 outbreak, on all fronts. On the health front the Commission has announced a series of measures and mobilised EUR 140 bln in public and private funding on research for a vaccine. On the economic front there is a new Coronavirus Response Team, which has called on all EU Member States for a coordinated fiscal response. So the measures announced at the national level so far are likely to be complemented by an EU-wide response, which like the ECB’s action will likely focus on providing short term funding and liquidity, with the help of guarantees and government backing. Concrete ideas are to be discussed by the EU next Monday. There will also be a “Corona Response Investment Initiative” directed at health care systems, SMEs, labour markets and other vulnerable parts, which is set to reach EUR 25 bln quickly. EUR 7.5 bln are hoped to be freed by the Council and Parliament in the immediate future to ensure “that the money starts flowing in the coming weeks”.

ECB highlights “flexibility” in new QE program. Lagarde has clarified why the new QE program doesn’t give monthly purchase volumes, but an overall envelope of EUR 120 bln until the end of the year. With the ECB tied to purchases according to the capital key, the longer time frame seems to mean that the central bank is only aiming to reach capital keys by the end of the year. So for now the ECB can focus on stabilising peripheral markets and bringing in spreads, with the hope clearly that by the end of this time frame, things will have calmed down sufficiently to balance the books. Furthermore, corporate bond markets are the main focus in this program and again, Italy seems the country most at risk at the moment.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.