Outside a jump in the Aussie most currencies have been stable so far today, holding relatively narrow ranges against a backdrop of steadying stock markets.

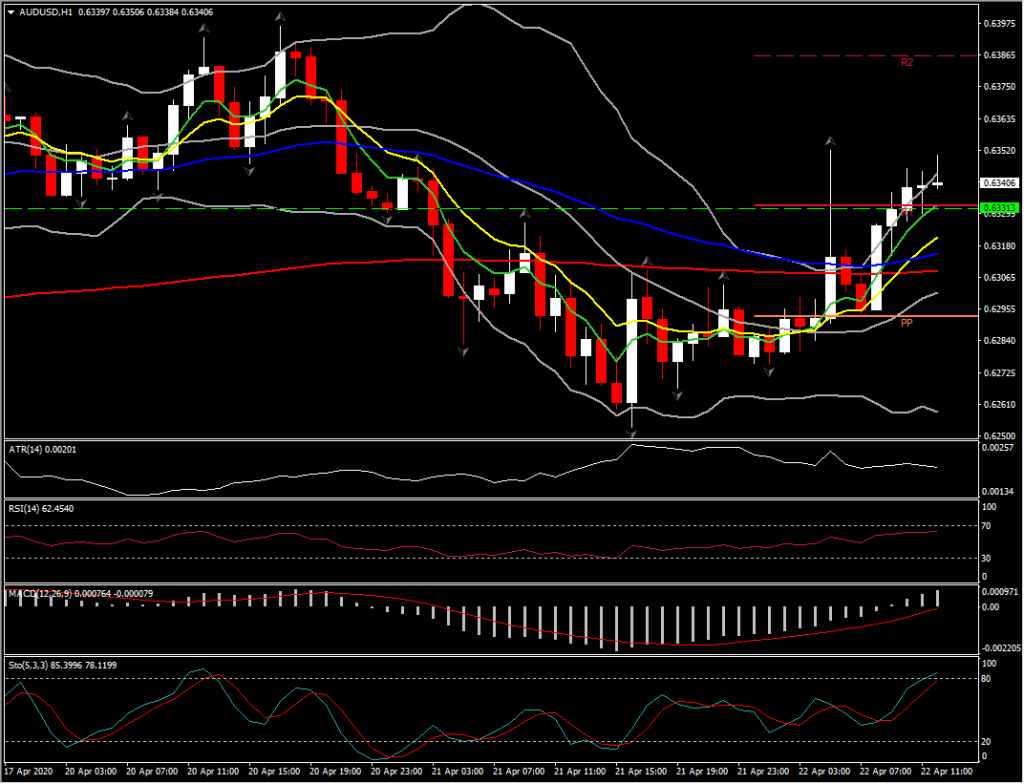

AUDUSD rallied nearly 1% in making a high at 0.6353, after Australian March retail sales surged by a record 8.2% m/m, though is being downplayed as an aberration, having been driven by panicky stockpiling due to the coronavirus outbreak. The pop in the Aussie came well ahead of the data release, with market narratives pointing to profit-taking and short-squeeze motives. Both AUDUSD and AUDJPY have remained shy of their respective highs. AUDUSD most precisely has posted 2 weak hourly candles close to the upper Bollinger pattern suggesting that it might be about time for a correction. Momentum indicators comply with the overbought short term picture , as RSI is at 62 but flattened, MACD Lines extended positively but signal line remains at zero. If the asset turned below R1 at 0.6330, a pullback and retest of the next Support level at 0.6300 could be seen.

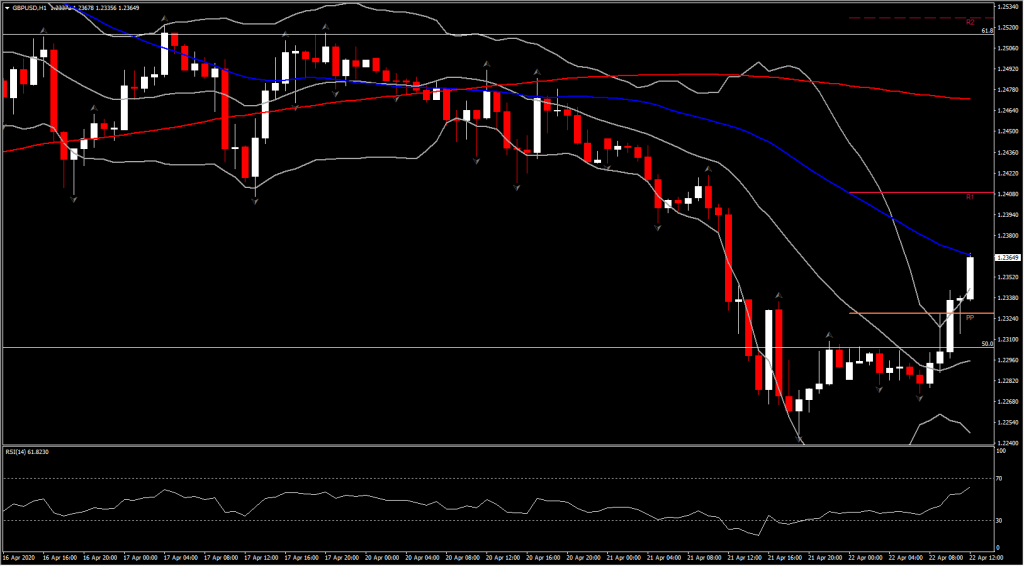

Sterling has found its feet after tumbling over the last 2 days amid a phase of acute risk aversion in global markets. A combo of no-deal Brexit risk and the difficulties the UK has in financing its current account deficit during times of heightened risk aversion had been weighing on the Pound, though the UK currency remains comfortably above the major-trend lows it saw in March. Brexit, while overshadowed by the pandemic, remains a concern, or rather the enduring risk that the UK leaves the EU’s single market at year-end without a new trade deal with the EU. Negotiations between the UK and EU have commenced this week via video conferencing. The UK government has continued to repeat that there will not be any extension of the post-Brexit transition, which expires at the end of the year, with the UK’s chief negotiator David Frost stating that “we will not ask” to extend the transition, arguing that extending would “simply prolong negotiations, create even more uncertainty, leave liable to pay more to the EU, and keep us bound to evolving EU laws at a time when we need to control our own affairs.” The UK has until July 1st to formerly decide on whether to extend the transition period or not.

GBPUSD managed to find a footing in Asia session at 1.2250 area, while in the EU has posted a rebound, with gains up to 1.2363. Intraday however the 3 consecutive sessions outside BB imply to an overbought condition for the asset. However momentum indicators suggest that there is still further steam to the upside, with RSI at 60 and rising and MACD above signal line suggesting that bearish bias is decreasing. Next Resistance is at 1.2415, while Support is at PP a 1.2325.

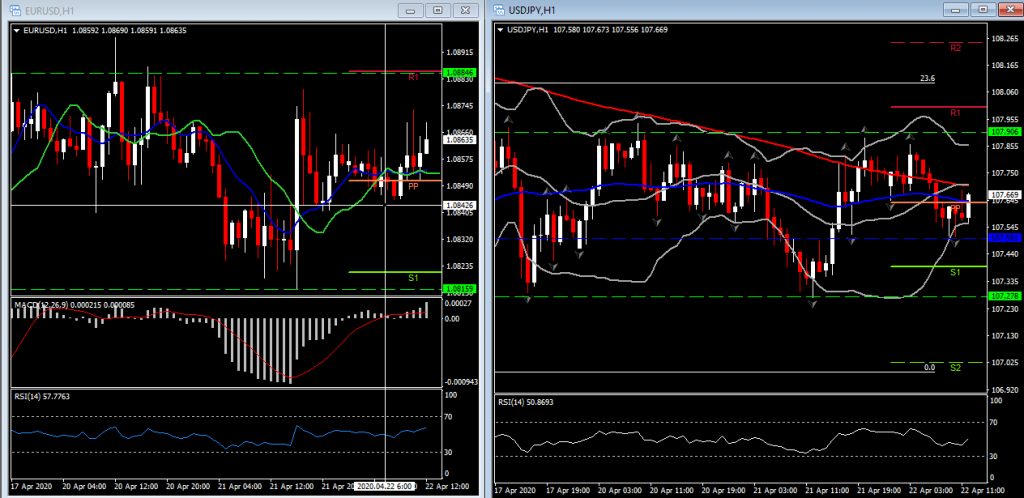

EURUSD has been plying a narrow range in the mid 1.0800s for the past 3 days hence only a break outside the range could provide a medium term direction for the asset. The pair continues to trade a little to the south of the halfway mark of the volatile range that was seen during the height of the market panic in March. Last month’s rapid deployment of monetary stimulus measures by the Fed have impacted the Dollar in recent weeks, having satiated what had been a surge in demand for the world’s reserve currency. This has put a floor under EURUSD, which has held up for a month now. In the Eurozone, meanwhile, the focus has once again turned on BTPs (Italian bonds) and the widening of Eurozone spreads (although narrower today amid abatement in risk aversion), which has prompted some to expect further action from the ECB. The central bank already has more flexibility in its bond buying schedule with the move away from monthly purchase volumes, and with a longer term horizon for its QE program, and we suspect that central bankers are to a certain extent letting spreads move out this week to increase the pressure on European governments to come up with an agreement on stimulus spending at tomorrow’s teleconference of heads of states. EURUSD could remain in a choppy trading pattern, lacking clear directional bias for now.

USDJPY is also in a ranging market in 107.00s area for 6 consecutive days, however in the near term is manage to rebound from its day’s floor at 107.50 and to move above PP and 50-hour SMA. The 107.90 remains a strong Resistance for the pair.

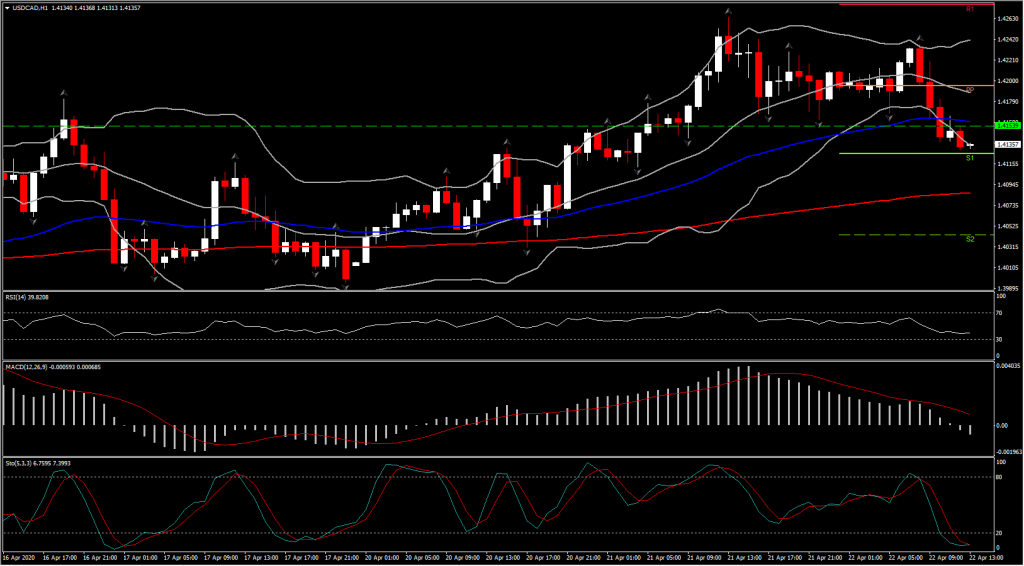

Last but not least, Canadian dollar has managed to find a toehold after recent oil-correlating declines. The USDCAD dipped to a 1.4163 low which is the S1 from PP analysis, though yesterday’s low at 1.4111 has remained unchallenged so far. As for oil prices, the June WTI contract was showing a 7% decline as of the early London session, though, at $10.75, remained above yesterday’s low at $6.55. The give-away pricing reflects the fact there is increasingly no where to store crude.

In time this will force significant production cuts from oil producing nations, with at least some crude importing nations likely to assist in the process by halting imports. The rout in crude prices this week has rattled investors, starkly portending where the global economy is headed in the lockdown era. The Canadian Dollar is anticipated to remain directionally biased to the downside, though at some point oil prices are sure to stabilize and rise, which in turn should give the Loonie a prop. Intraday meanwhile, could a breakout of 1.4111 could suggest further declines, as momentum indicators have negatively configured suggesting increasing negative bias intraday.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.