Tesla (TSL)

It is a massive week full of earnings reports on Wall Street. And one of the companies that should be watched is Tesla, which has a report queue tonight after the US market closes. The stock price has reported a strong rally since the Q4 of 2019 and up to the 16th of February, with its stock price rising 5 times from $200 levels to nearly $1000. The stock price was quickly deepened to $348 however on the Covid restrictions and more precisely on the lockdown of the new Gigafactory in Shanghai, China, which began operations in late 2019.

However even though it sounds a bit weird, the upcoming report is expected to be very optimistic, with the majority of analysts reporting that TESLA is one of the companies that is better positioned during this global crisis.

Actually, in April, Tesla reported stronger-than-expected Q1 deliveries as the company managed to produce 102,672 vehicles (87,282 Model 3 and Y, and 15,390 Model S and X) and delivered 88,400 vehicles (76,200 Model 3 and Y, and 12,200 Model S and X). Additionally, Model Y production started in January and deliveries began in March, adding to the strong numbers. This announcement in April doubled the stock price of Tesla, which is currently sitting at $764.

The numbers are actually brilliant if we compare them with other automakers such as Fiat, General Motors and Ford which posted steep Q1 delivery declines over the last year, citing coronavirus-related disruptions that forced customers to comply with social distancing guidelines. This is also something that boosted Tesla’s share price in April.

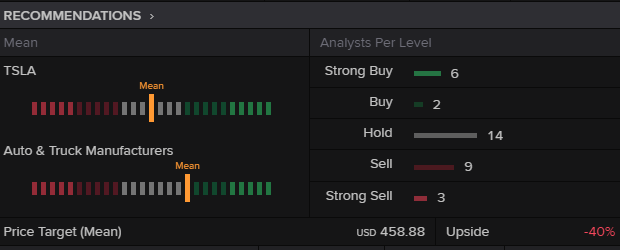

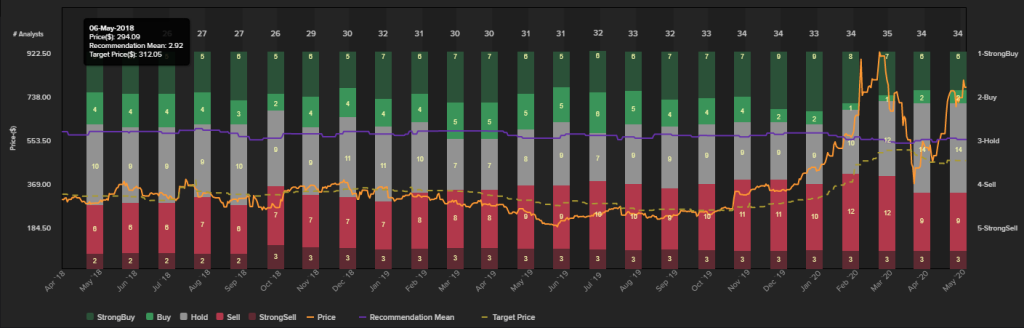

Hence despite the fact that the delivery section has declined by nearly 21% from Q4 2019, the strong production has turned analysts optimistic, with Tesla’s consensus recommendation “Hold”, corresponding to the majority of the consensus recommendation for the Online Services peer group. 23% of the analysts have a Strong Buy or a Buy rating and 45% have a Hold rating ahead of its earnings.

Meanwhile, according to a poll of analyst by Reuters, the consensus recommendation once again is “Hold”, wih the stock’s mean target of around $458.88 as shown below by Thomson Reuters Eikon. (2020).

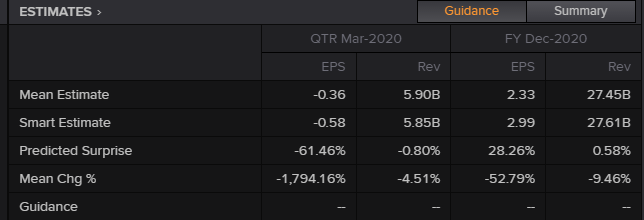

Additionally, as shown by Thomson Reuters Eikon (2020), the electric carmaker giant is expected to have –$36 in earnings per share during the first Quarter of 2020, which represents an incline from the -$1.77 reported EPS for the fiscal Quarter ending March 2019. Revenue is expected to be released at $5.9Bln which is 28.9% up from last year.

Over the last 2 years, Tesla has beaten EPS estimates 50% of the time and has beaten revenue estimates 63% of the time. However, despite the optimistic view over production and delivery, it has low chances of beating estimates this quarter since it has seen negative earnings revisions ahead of its Q1 report.

Last but not least, the company is currently facing a significant risk in China for the next quarter, as China will cut subsidies on new energy vehicles (NEV) such as electric cars by 10% this year, as the finance ministry said on Thursday, following a decision last month to continue providing incentives to buy cleaner cars. The subsidies will apply only to passenger cars costing less than $42,376.

However, Tesla is likely to be strongly hit by this announcement since the Chinese Model 3 is priced at $45,683.8, which is the model that was supposed to be built in the Chinese Gigafactory in Shanghai. The Long Range version coming in June of this year also starts at more than $51k.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.