The major Oil companies are reporting earnings on Friday for Q1 earnings. Both ExxonMobil and Chevron will be in the spotlight due to the fact that other than the pandemic, in the quarter ending March 31, we have seen one of biggests decline in the history of Energy market due to the Price war between Saudi and Russia (for more information please visit our Oil outlook). Oil reached 20-year lows ( 67% down) amid the oversupply and at the same time the lack of demand due to the coronavirus-related disruptions. Demand concerns remain a key driver, as despite that there are some countries that started slowly to reopen their markets , the demand remains extremely low due to the strict travel restrictions that are expected to continue for at least another month.

Hence the expectations are very low for the two US Oil giants tomorrow.

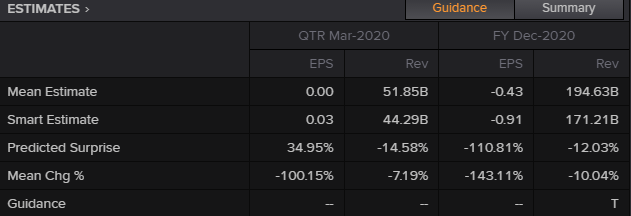

Exxon : Reuters reported “Analysts expect the company to report earnings of $0.00 per share on revenue of $51.85 billion which represents a year-over-year change of –92.7%, which is down 15.4% from the year-ago quarter. Additionally, according to Zacks Investment Research, based on 7 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.04. The reported EPS for the same quarter last year was $0.55.

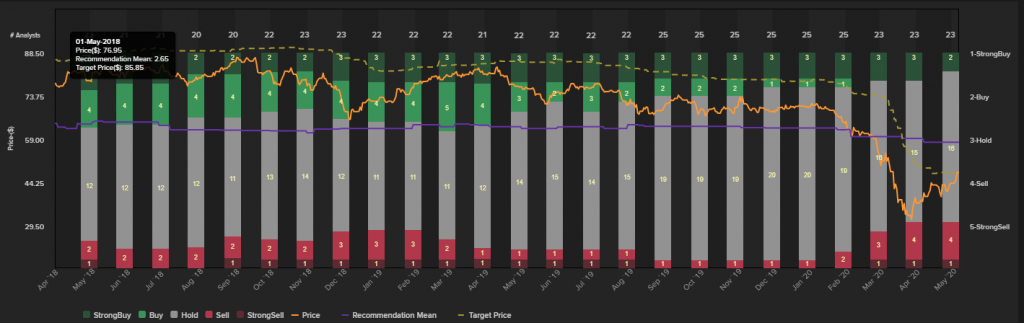

The company has a mixed history of beating and missing EPS estimates over the last 2 years. The company beat estimates in Q2 2019 and Q3 2019 but missed in Q1 and Q4. In each of these instances, the stock reacted as you would expect – it fell when Exxon missed and moved higher when the company beat.

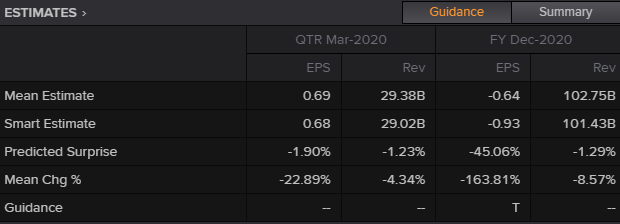

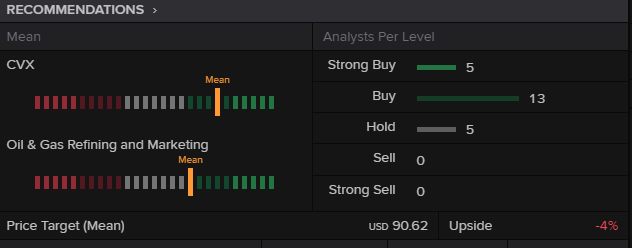

Chevron :Reuters reported “Analysts expect the company to report earnings of $0.69 per share on revenue of $29.38 billion which represents a year-over-year change of -15.1%. In contrast with Exxon, Chevron has manage to surpassed the Zacks in all the latest trailing four reports. Chevron, like its peers ExxonMobil Royal Dutch Shell and BP plc , is set to have faced the wrath of plunging crude and natural gas prices in the to-be-reported quarter. While output gain is likely to have been a positive contributor to results.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.