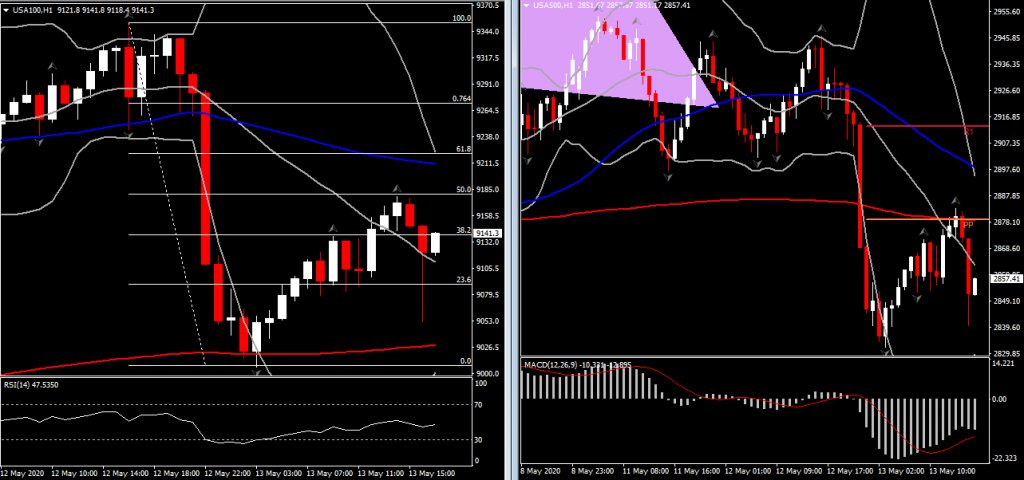

Wall Street had turned sharply lower after Chair Powell’s rather dour outlook on the recovery, while also downplaying (though not fully ruling out) a shift to negative rates. The USA500 is down over -2%, with the USA30 and USA100headed for a -1% decline. Risk aversion picked up on the tumble in stocks, while the fact that Powell didn’t fully shut the door on negative rates have also supported the bid in Treasuries. The early rally in deferred Fed funds futures has been trimmed, with negative rates not suggested until March.

Powell stressed the Committee is not looking at negative rates, the FOMC’s view on that hasn’t changed. He noted all on the Committee held that view, which doesn’t happen very often. The tools the Fed is using currently work, while the evidence of the effectiveness of negative rates is mixed. Negative rates reduce the intermediation process and hurt bank profitability.

Meanwhile, according to the chairman, the unemployment should peak over the next month or so. But, while it may decline sharply, it will likely remain above the pre-virus levels seen early this year. He noted there is a growing sense that the recovery may take a few more months than we’d like. He worries there could be lasting damage to the economy, and fears that the time it will take to get the recovery to gather momentum could turn liquidity problems into solvency problems. The U.S. will have to return to a sustainable fiscal policy, but now is not the time to prioritize.1

In the FX market, all the attention was on Powell, with the USD ignoring the much cooler PPI outcome that came out 30mintes after Fed’s Chair Powell speech. The US April PPI report followed yesterday’s CPI lead, with a -1.3% record decline for the headline and a -0.3% drop for the core that both undershot estimates. The April declines rounded from respective drops of -1.266% and -0.337%. April weakness mostly reflected a -3.3% drop for goods prices led by a whopping -19.0% decline for energy, alongside a -0.5% drop for food prices. We saw a -0.2% decline for service sector prices with divergent component swings that were similar to those seen in March.

Big PPI and CPI declines in both March and April reflect the combination of lockdowns, the OPEC price war, and a global drop in aggregate demand overall, with extra price weakness for “unessential” products and services that are particularly exposed to the lockdowns. Headline and core price weakness since March shows that the demand shock from closed retail establishments is winning in a big way over supply shocks from production shutdowns. This pattern will likely extend into May.

The PPI data along with Powell speech kept USDIndex in a ranging market, with USDJPY unchanged at 106.90-107.00 area, and EURUSD around 1.0850-1.0860 area. However the equity futures after those events resume their yesterday’s losses.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.