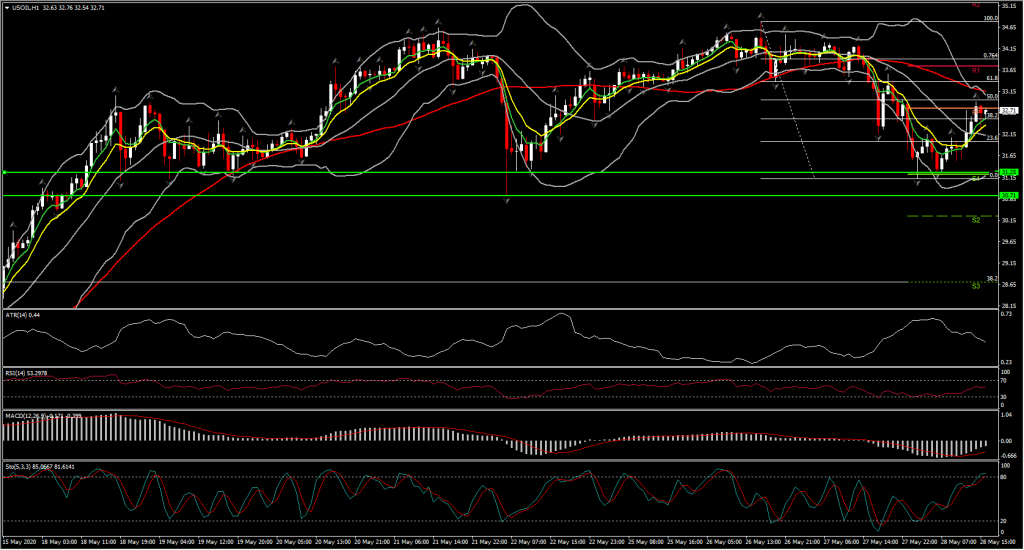

The WTI crude futures have tipped lower by over 3% in the Asia session today, posting a 6-day low at $31.55, extending the correction from the 11-week high that was seen on Tuesday at $34.81. The easing the past 2 days came from a Bloomberg report citing unnamed sources, that Russia intends to begin easing agreed production cuts starting in June. Interestingly, Reuters reported unnamed sources on Tuesday, that Russia seeks to extend the current output limits through July. It remains to be seen who is right. The July contract has since moved above its lows, and remains inside its one-week trading band.

However, correction looks to be back as USOIL rebounded today to $32.70, reversing nearly 50% of the week’s losses. This comes as the overall outlook for Oil is still bullish as oversupply is deducted and demand rises slowly.

OPEC+ adherence to planned production cuts is reportedly high, though Russia is desiring to increase output in July. US output continues to fall amid the forced closure of hundreds of shale wells, with current pricing making such operations unviable. On the demand side, China and India are said to be increasing imports, while fuel use in general has been on the rise as economies emerge from lockdown.

In the bigger picture, as long as the nascent recovery isn’t scuttled by a second wave of COVID-19 infections, oil price risk going forward would appear to be to the upside. However from a geopolitical perspective the threats from the US regarding sanctions in Iran and Venezuela could add pressure to the oil outlook.

Venezuela is suffering a shortage of refined fuel, despite having the world’s largest oil reserves. Venezuela sits atop the world’s largest oil reserves, but it must import gasoline because production has crashed in the last two decades, with lot of people blaming corruption and mismanagement by the socialist administration amid an economic crisis that has led to huge migration by Venezuelans seeking to escape poverty, shortages of basic goods. People have had to endure and shortages of basic necessities such as food and medicines, which forced 4.8 million to flee the country last year. Inflation hit 800,000% last year.

Hence Tehran sent 5 oil tankers to Venezuela this month, with 2 having already been delivered, which carry about 1.5m barrels of fuel. According to Iran’s President Hassan Rouhani, there is a big risk that the country would retaliate if the other oil tankers are do not arrive or are blocked by the US.

Other than political corruption, the Venezuelan economy has been hurt also by US sanctions, which have mainly targeted Venezuela’s oil industry. Oil production in the country has fallen to nearly a quarter of levels seen in 2008. Venezuela’s plight has worsened with a drastic drop in global crude oil prices amid the coronavirus crisis. The price of Venezuelan crude has fallen to less than $10 a barrel, its lowest level in more than two decades, and well below last year’s average price of $56.70.

According to the BBC, the Trump administration recently launched two rounds of sanctions against Rosneft affiliates for trading Venezuelan crude in international markets. In late March, Rosneft announced its surprise departure from Venezuela. Since then, petrol has had to be strictly rationed, with people queuing up through the night to fill up no more than 30 litres.

Doctors and nurses are among those forced to queue, at a time when the country’s health system is collapsing and there are concerns over the spread of Covid-19.

Hence the recent rescue move from Iran represented a deepening of economic relations between Venezuela and Iran, two pariah states run by authoritarian leaders subject to punishing sanctions by the United States government. Representatives of both nations cast the transaction as a sign of strength.

In exchange for the fuel, Iran received gold flown by the airline Mahan Air in late April, in a deal that bypasses US sanctions on both countries. At least nine tons of gold, worth about $500 million, flew off to Iran last month, according to Bloomberg News. That leaves the crisis-plagued nation with a scant $6.2 billion in hard-currency assets, the lowest amount in three decades.

Venezuelan President Nicolás Maduro thanked Iran for its support, describing the two countries as “two revolutionary peoples who will never kneel down before North American imperialism”. “Venezuela and Iran both want peace,” he said in a televised state address. “We have the right to trade freely.” Venezuelan Foreign Minister Jorge Arreaza said that “Iran and Venezuela have always supported each other in times of difficulty”.

Indeed the Iran–Venezuela relations have strengthened substantially in recent years, as the two countries are contemporary strategic allies.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.