GBPUSD, H1

The final May UK manufacturing PMI was revised fractionally higher, to 40.7 from the preliminary estimate of 40.6. This marks an improvement from the record low that was seen in April, at 32.6. Output, new orders and employment contracted by among the fastest rates in the 28-year survey’s history, although less sharply than the records set in April. The few pockets of growth were linked to healthcare and PPE (personal protective equipment), though there were reports from some respondents that new business was picking up as social and economic reopening commenced. Employment in the sector was lost at the second sharpest rate on record, after the record drop that was seen in the month prior. The outlook improved for a third consecutive month, with most companies in manufacturing expecting there to be a rise in output at the 12-month horizon. Input price inflation remained benign. The final versions of the May services and composite PMI surveys will be released tomorrow. Going forward, much will depend on how successful the reopenings are without sparking a further lockdown.

Today (June 1) marks a key day in the UK, with primary schools in England and Wales opening for the first time in 10 weeks, groups of up to six people from different households being allowed to meet outdoors and the vulnerable, who’ve been shielding since lockdown began, can now also go out in a limited way. However, there are concerns that all of these steps are being taken too quickly. This week also sees the restart of the trade negotiations between the UK and EU, with only one more round left until the UK must decide if it wants to extend its post-Brexit access to the EU’s customs union and single market beyond the end of 2020. There remains a possibility that the UK will leave the EU’s single market at year-end, without a deal agreed. Things will be decided by the EU leaders’ summit in mid June, ahead of the July-1st deadline. There are increasing vibes that the UK will either reach an agreement with the EU, or ask for an extension, despite threats to leave without a deal (which is clearly a negotiation tactic). So far, the official UK government line remains that the December 31st deadline is not being extended.

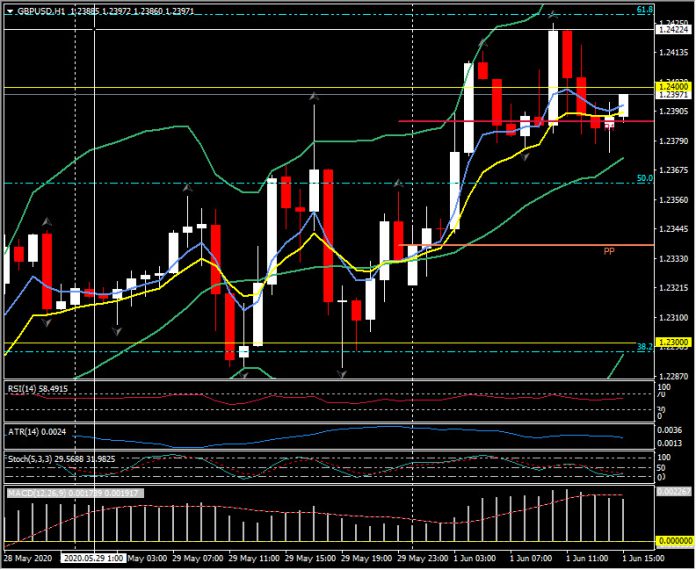

Cable rallied to 1.2425 earlier and has since given up the 1.2400 handle. May 5 was the last day the pair closed north of this level, as it continued its decline from the April high at 1.2600 to the May low below 1.2100; 1.2445 is the 61.8 Fibonacci retracement level of that decline. EURGBP is down from Friday’s 0.9050, a 9-week high, and trades sub-0.9000 at 0.8970 with S1 and the 200-hour moving average at 0.8950. GBPJPY holds 133.50 with R1 at 133.75 and the daily pivot point under 133.00 at 132.80.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.