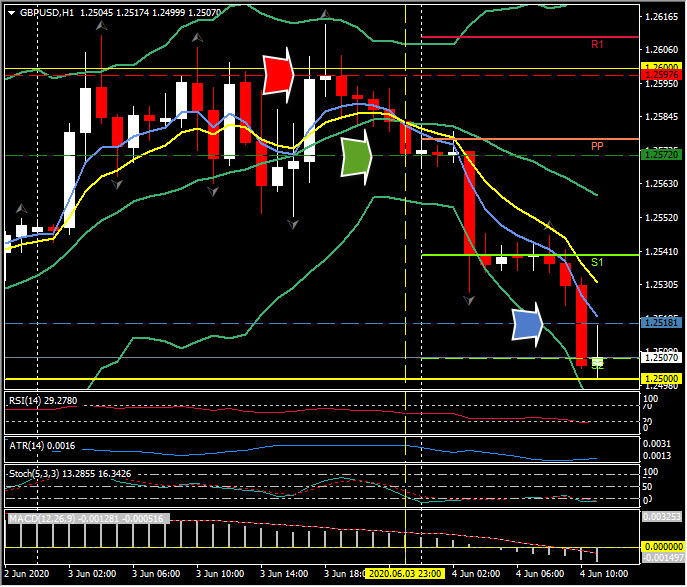

GBPUSD, H1

Cable posted a two-day low at 1.2504, which is down by over a big figure from the one-month high that was seen yesterday at 1.2616. In UK news, and amid the latest round of trade talks with the EU, Rolls-Royce announced 3,000 job cuts due to the bleak outlook in its aviation engine-making business.

Regarding the UK-EU trade situation, the BoE has reportedly warned UK banks to be ready for a no-deal Brexit. As per the Sky News Twitter (yesterday): “City sources say the Bank of England governor Andrew Bailey has told banks to step up plans for the UK to leave the EU without a trade deal.” This comes at a significant juncture, with the final round of UK-EU trade negotiations having commenced yesterday before the July-1st deadline the two sides have set themselves to decide whether the UK can extend its post-Brexit access to the EU’s customs union and single market beyond the end of this year. The UK government has been playing hardball, saying that it is quite prepared to walk away without a deal, even though this would imperil the majority of UK trade to much-less-favourable WTO terms from January 1st 2021, which is the scenario the BoE is warning about.

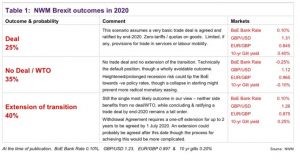

Last week, officials from both sides said that a deal was looking unlikely, though sources cited by the London Times at the weekend said that the UK was willing to compromise, though on the proviso that the EU backs off from its “maximalist” demands on regulatory alignment and fishing access. Our hunch is that the UK will either reach an agreement with the EU, or ask for an extension. The former is perhaps more likely politically than the latter. If we’re right, this would be bullish for the Pound, which has factored in the risk of the UK leaving without a deal (the crystallisation of a hard Brexit) in 2021. We would foresee Cable trading back above 1.3000 in this scenario. The thoughts of NatWest markets are nicely summarized here too along with details of the latest Reuters poll. “Sterling to take a pasting if UK seeks no extension for EU trade talks”.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.