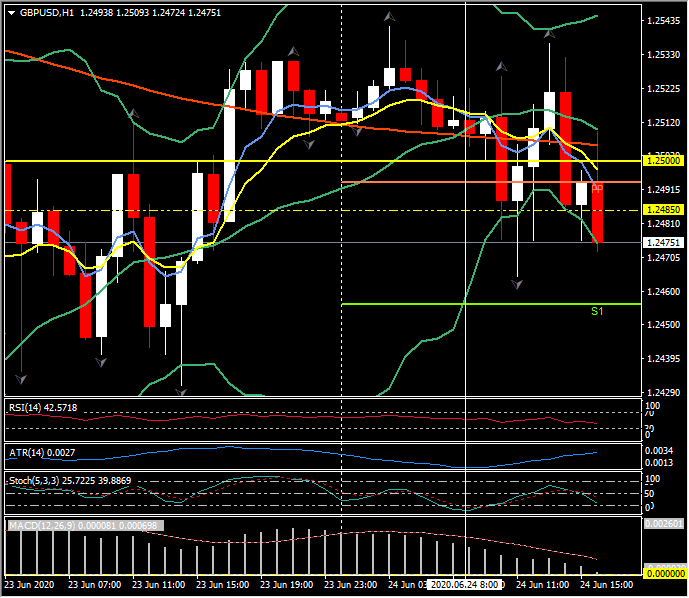

GBPUSD & EURGBP, H1

Sterling came under pressure from the London open, pressing lower against both the Dollar and Euro, among other currencies. Cable turned below 1.2500 after earlier posting a six-day high at 1.2542, and currently trades at 1.2485 while EURGBP printed an intraday high at 0.9057, drawing back in on yesterday’s three-month peak at 0.9082 and now trades at 0.9030.

A combo of the upcoming EU recovery fund and the market perception that the BoE is unwinding monetary stimulus prematurely, has been giving EUR-GBP an underpinning of late. The brief rally that the Pound stage following yesterday’s much better than expected preliminary UK June PMI data was met by a wave of selling. The data, for one thing, compared to other well-above-forecast PMI readings in Europe. The BoE’s raising of its QE program by GBP 100 bln last week, and statement that purchases would be complete by year-end, works out (adding the existing purchase schedule plus with the new 100 bln schedule) at a GBP 6.6 bln tapering in gilt purchases per week. Although this represents a tightening in monetary policy, markets are viewing it as Sterling negative given the perceived risk to growth in the pandemic era. Also, BoE Governor Bailey indicated in a Bloomberg Opinion article on Monday that the QE total would be reduced before hiking interest rates, which marks a reversal of course from his predecessor, Carney. Overall, markets are taking this as the BoE giving forward guidance on unwinding stimulus, and viewing this in such febrile times, and with the Fed and ECB maintaining “will do whatever it takes” guidance, as being a negative for the currency, especially with the Brexit endgame remaining uncertain.

1.2500 remains a key psychological level for Cable both in the short and longer term, whilst 0.9000 has similar but less significant overtones for EURGBP traders and investors.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.