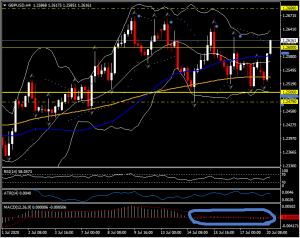

GBPUSD, H4

Cable has recouped to over 1.2600 after ebbing to a 1.2517 low in Asia. The pair is lacking direction overall with the pair near to midway levels of the range that’s been persisting since April. EURGBP pegged a three-week high at 0.9140, underpinned by broader firmness in the Euro as EU leaders draw closer to green-lighting the EU recovery fund, but has since cooled to the upper 0.9080’s. There remains downside risk for the Pound, given the risk that trade discussions between the UK and EU could continue without breakthrough. Officials have continued to report that they remain deadlocked over key issues. While there have been reports of “landing zones” on difficult issues coming into view, there have also been reports that the UK government is planning free ports and competitive tax cuts, which would rule out any chance of a broad trade deal being made with the EU. Negotiations are scheduled to continue through to the end of the month before resuming on August 17th. October is being touted as the deadline, ahead of the UK’s scheduled year-end departure from the single market.

Aside from the trade negotiations, the focus over the coming week will be on the preliminary July PMI survey data (due Friday), which is likely to show a further plateauing in the rebound from the lockdown lows. June retail sales data is also up. Data have been showing that the UK recovery has been lagging peers. The relatively large size of the leisure and hospitality sectors, which have been hardest hit by the pandemic, accounts for this.

Technical View

There is intraday (H4) bias as the GBPUSD enters the neutral zone and tends to trade in a sideways range between the lows of 1.2479 and 1.2688. Further advances should pass 1.2688 which is a strong resistance which has formed a barrier along the weekly high. Passing this level will make the Pound strengthen to try out 1.2812. On the downside, a decline to get past minor support 1.2479 is needed to confirm continued decline past the EMA, with targets at 1.2358 and 1.2250 or lower to 1.2072.

Prices are still sitting above the EMA 200 and RSI at the middle level (58), and the thin movement of the MACD showed a long consolidation last week.

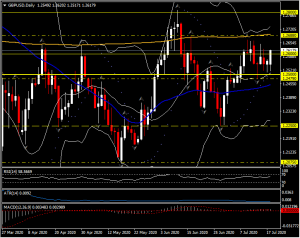

In the Daily picture, the rebound from 1.1409 still looks strong, there is no sign yet for a trend reversal. Last week’s prices were still held below the high average price of 1.2647. The bullish bias is beginning to hold at this level. The resistance level is seen at 1.2812 . A break of this level will test the next resistance level at 1.3200 and further to 1.3512. On the negative side, a break of the minor support 1.2479, the price will test the ascending trendline and 1.2247.

The trend down from 2.1161 (2007 high) will still continue sooner or later. However, a decisive break at 1.3512 would be required to confirm the medium-term bottoming and changes the bullish outlook to 1.4376 first resistance.

Click here to access the HotForex Economic Calendar

Stuart Cowell & Ady Phangestu

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.