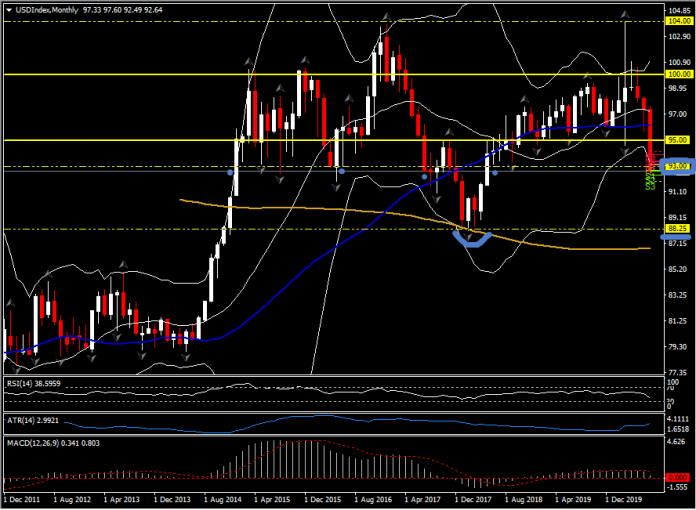

USDIndex, Monthly

The Dollar continued lower in what is now the biggest monthly decline the US currency has seen in a decade. The narrow trade-weighted USDIndex printed a fresh 26-month low at 92.49, the culmination of a 5% decline from the finishing level in June and marking just over a 10% drop from the highs seen in early March. US Treasury yields have printed fresh lows, with the 30-year bond in record low territory, extending declines seen since yesterday’s release of US Q2 GDP data, which came in at a dismal -32.9% y/y, although this met the consensus expectation. President Trump’s tweeted suggestion that the presidential election in November should be postponed has also been in the mix, adding a political element to arguments that the pandemic has precipitated a further erosion in the dollar’s reserve currency status. The EU’s recently greenlighted recovery fund is also seen as a first step in shared fiscal responsibility in the Eurozone, which by all accounts has triggered a re-weighting of euros in currency portfolios at the expense of the Dollar. Gold prices have lifted to back within a couple of dollars of the record nominal high seen earlier in the week at $1,974.90. EURUSD, amid its sixth consecutive week of accelerating gains, has pegged a fresh 26-month high at 1.1908. Cable pinned a new five-month peak, at 1.3143. USDJPY posted a five-month low at 104.19. AUDUSD saw a 17-month high at 0.7228. USDCAD has been an exception to the US Dollar weakening theme, with the pairing consolidating in the lower 1.3400s after making a nine-day high at 1.3461 yesterday. The Canadian Dollar has been affected by the drop in oil prices over the last day. Front-month USOil futures hit a three-week low on Thursday at $38.72, and while since recouping to levels over $40.0, remain down by over 2.5% from week-ago levels.

The big tech companies SMASHED it. APPL. $11 bln profit on $60 bln rev, 4 for 1 stock split coming, AMZN $5bln profit as income doubled & sales up 40%. Alphabet ad revenue down but still beat estimates & FB rev. up 11%, as activity increased 13%. Other companies reported mixed results. Today – Eurozone CPI & GDP (Q/Q) (Prelim), US PCE, Chicago PMI & UoM Sentiment & Exp., CAD GDP (m/m). Earnings are due from: Exxon, Chevron, Phillips 66, Caterpillar, Merck and Colgate.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.