The Dollar’s weakening bias has resurfaced, pushing the narrow trade-weighted USD index (DXY) to a two-day low at 92.58, extending the correction from yesterday’s one-week high at 93.23. The 27-month low that was seen on Tuesday is at 92.13, and the index will need to close out today in New York below 93.10 to rack this week up as the eighth down week out of the last nine weeks.

The softer USD thesis continues to dominate in markets, as it has since mid May, and was bolstered yesterday by worse-than-forecast weekly initial claims and August Philly Fed manufacturing data, along with an ebb back in Treasury yields as participants recovered from their disappointment about Wednesday’s Fed minutes. While the minutes showed that the FOMC has no immediate plan to take unconventional stimulus measures in monetary policy, there is a realization in market narratives that the Fed is clearly going to retain its uber-accommodative stance for years, whether it’s formalized or not.

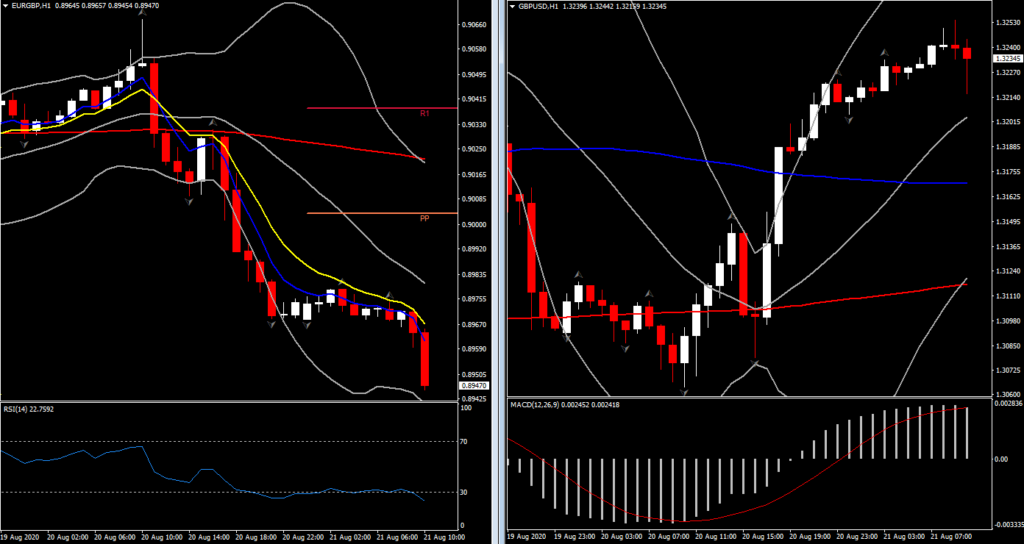

EURUSD edged to a two-day peak at 1.1883, extending the rebound from yesterday’s one-week low at 1.1802. GBPUSD also climbed to a two-day high, at 1.3255, drawing back in on Wednesday’s eight-month peak at 1.3269. The Pound is up on the Euro and other currencies, too. EURGBP fell to a near six-week low at 0.8960, extending a sharp retreat from yesterday’s 0.9070 high.

Above-forecast UK retail sales data today helped, while the risk-on backdrop in global markets is generally being seen as a positive for the Pound, which had underperformed notably during the worst of the market carnage back in March. The UK’s prime minister’s office has this week sent out positive vibes on the prospects for a trade deal being reached with the EU, although, according to some sourced media reports, this may belie continued large differences on the key areas of fishing and EU level-playing-field rules. USDJPY printed a two-day low at 105.56, as did USDCAD, at 1.3157.

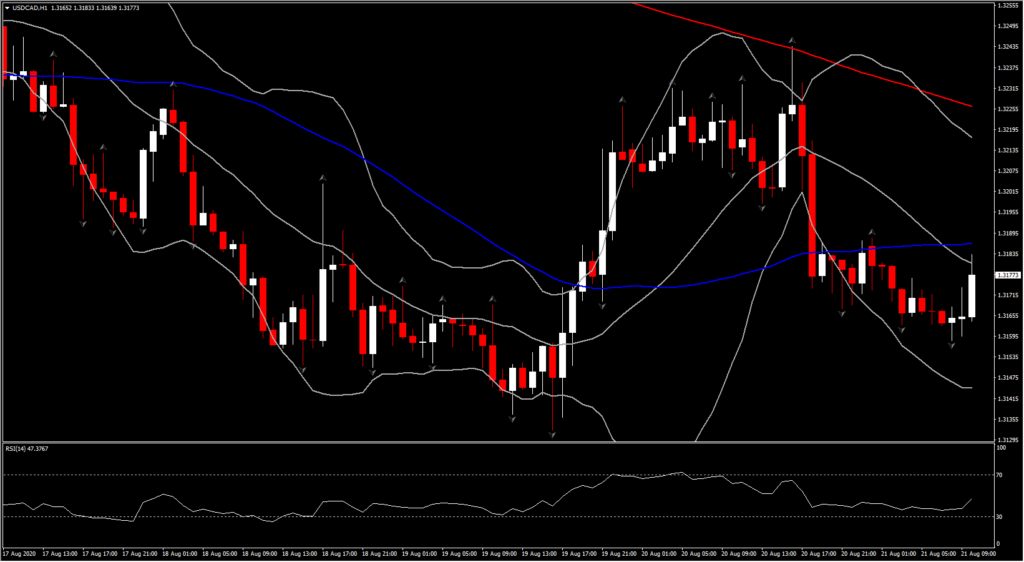

USDCAD fell to a two-day low at 1.3157, drawing back in on the seven-month low seen on Wednesday at 1.3134. A broader retreat in the US Dollar and a near $1.50 rebound in oil prices yesterday have combined to weigh on the pairing. Oil prices remain in a consolidation near recent five-month highs.

The OPEC+ group this week affirmed that there was near full compliance on crude supply quotas among members, helping maintain a broad underpinning of crude prices, along with an overall risk-on theme in global markets. USDCAD has been trending lower, albeit with waning momentum, since mid March. The global economic recovery from lockdowns, which were at their zenith in April, has been instrumental in driving this downtrend, while the US currency waned as a safe haven unit before negative real US yields subsequently become a dominant factor in driving the greenback’s downtrend.

Upside risks for USDCAD include the OPEC+ group’s course to easing output quotas, which could weigh on oil prices depending how it matches with the evolution in demand, alongside the coronavirus pandemic and geopolitical tensions, should they derail the recovery in global asset markets.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.