Most USD pairings have remained well within their ranges from yesterday, though the US Dollar and Yen saw mild weakness against most other currencies, outside the cases against the New Zealand and Canadian Dollars.

Wall Street clocked fresh record highs for the USA500 and USA100 yesterday. PE ratios are stretched, but trend following, index tracking and the float of massive global stimulus are driving shares higher, creating a reality gap with fundamental value. Some good news came from the US and China on the Phase 1 trade deal, too, with China’s commerce ministry reporting “constructive dialogue” after the US Treasury stated that “both sides see progress.” Spirits have also been lifted by developments of COVID-19 treatments and vaccinations.

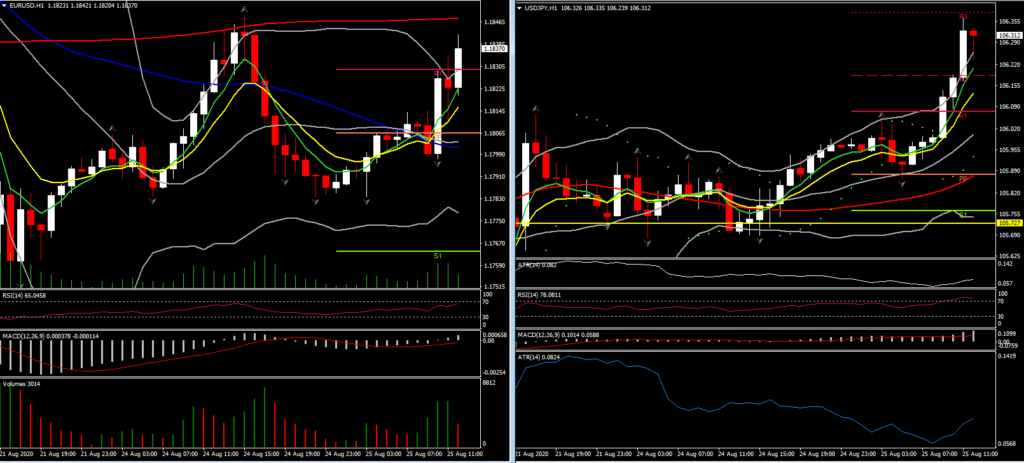

Against this backdrop, EURUSD has been plying overall a narrow range near 1.1800, but it is moderately up on Monday’s New York closing level, despite German Q2 GDP revised slightly higher and German Ifo index better than expected as current conditions improve. USDJPY whittled out a 4-day high at 106.35, reflective of mild Yen underperformance amid the risk-on environment. Cable lifted slightly, reaching a 1.3116 intraday high before settling back below 1.3100, remaining comfortably within the range seen yesterday. Ditto for AUDUSD, with pair modestly up on the day, while NZDUSD bucked the trend in ebbing to a 5-day low at 0.6515. Lockdown measures and a new record lows in NZ 10-year bond yield have been weighing on the Kiwi dollar.

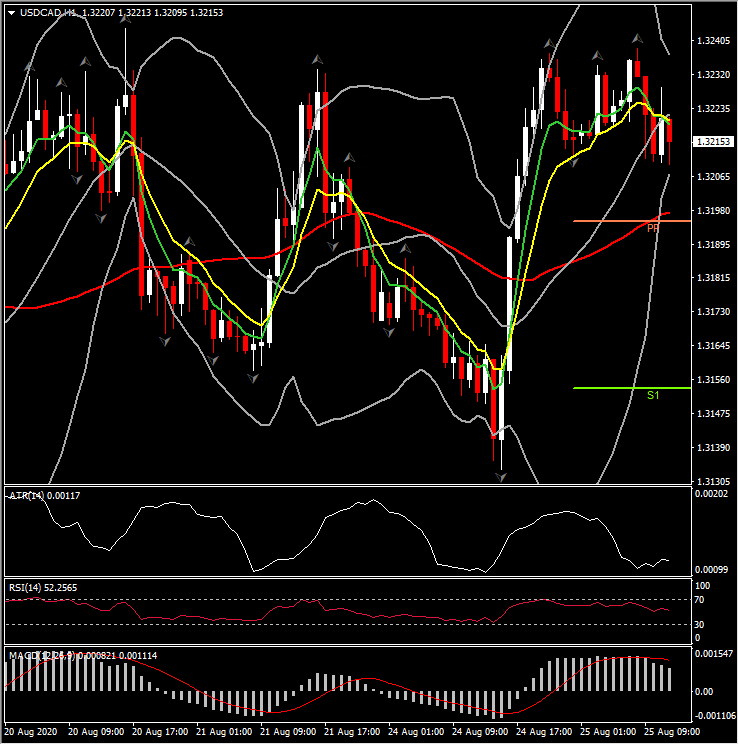

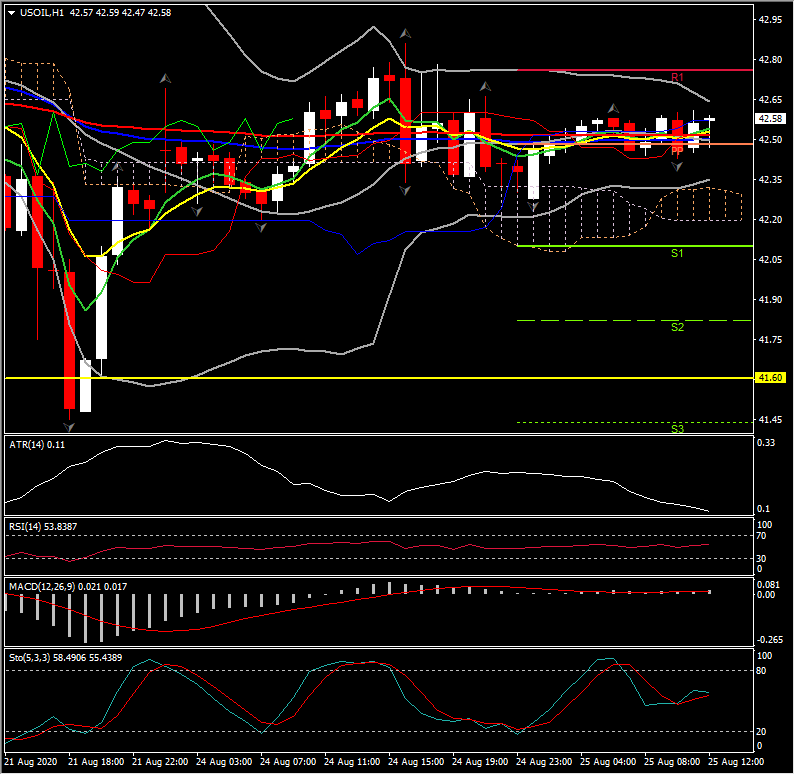

The Canadian dollar has also been on an softening streak, with USDCAD posting a 5-day peak at 1.3240. USOIL prices have settled, having not sustained gains seen yesterday, despite concerns of disruption to oil production facilities and distribution in the Gulf of Mexico as hurricanes bear down. Crude market narratives have highlighted analyst concerns about flagging demand due to ongoing lockdown measures around the world.

In the bigger view, USDCAD has been trending lower, albeit with waning momentum, since mid March. The global economic recovery from lockdowns, which were at their zenith in April, has been instrumental in driving this downtrend, while the US currency waned as a safe haven unit before negative real US yields subsequently become a dominant factor in fuelling the greenback’s downtrend. Upside risks for USDCAD include the OPEC+ group’s course to easing output quotas, which could weigh on oil prices depending how it matches with the evolution in demand, alongside the coronavirus pandemic and geopolitical tensions, should they derail the recovery in global asset markets. With the US economy recouping and Treasury yields perking up, the US dollar may also be set for a rebound after a prolonged phase of weakening.

In the bigger view, USDCAD has been trending lower, albeit with waning momentum, since mid March. The global economic recovery from lockdowns, which were at their zenith in April, has been instrumental in driving this downtrend, while the US currency waned as a safe haven unit before negative real US yields subsequently become a dominant factor in fuelling the greenback’s downtrend. Upside risks for USDCAD include the OPEC+ group’s course to easing output quotas, which could weigh on oil prices depending how it matches with the evolution in demand, alongside the coronavirus pandemic and geopolitical tensions, should they derail the recovery in global asset markets. With the US economy recouping and Treasury yields perking up, the US dollar may also be set for a rebound after a prolonged phase of weakening.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.