The round of August confidence data has so far been mixed, as the services sector registers the fallout from lockdowns and the resurgence of new Covid-19 infections. Travel restrictions and new social distancing measures hit the services sector and consumer confidence especially in countries relying on tourism. Downside risks to the outlook continue to linger then, even as positive headlines on vaccines and treatment are offering a way out.

German Q2 GDP was revised slightly higher with today’s release – to a still firmly negative -9.7% q/q, from -10.1% q/q reported initially. The breakdown not surprisingly showed a pretty broad based contraction, with only government consumption helping to dampen the blow. Private consumption meanwhile contracted -10.9% q/q and exports slumped -20.3%, versus a -16.0% q/q decline in imports as borders were closed and supply chains disrupted.

Beyond the temporary impact of lockdowns, the most worrying part of the report is the -19.6% q/q dip in equipment investment, which followed a -7.3% q/q decline in the previous quarter and could suggest that companies are not expecting a quick rebound.

The manufacturing sector at least continues to rebound and after a rise in Germany’s preliminary composite PMI German Ifo business confidence today that jumped to 92.6 in August, from 90.5 in July. A better than expected number, that registered a broad based improvement, especially in the current conditions indicator. The breakdown for the diffusion index, which gives the balance of positive and negative answers, showed services sentiment lifting to 7.8 from 2.1, while manufacturing improved to a still negative -5.4, from -12.1 in the previous month. All in all a broad based improvement that should go some way to restore confidence in the recovery especially against the background of positive headlines on Covid-19 vaccines and treatment.

The Eurozone August PMI (August 21) revealed a more mixed picture, however, in the preliminary release. Developments were uneven across countries with France more hit than Germany, although final readings will likely show that Spain and Italy suffered even more from the renewed restrictions for the services sector.

With inflation still at very low levels, central bankers have enough room to manoeuvre. Eurozone HICP inflation may have lifted slightly in July, although with the headline confirmed at 0.4% y/y in the final reading, it remains far below the ECB’s definition of price stability. Part of this is of course due to special factors, with energy prices still far below the levels seen last year and July readings also impacted by the dampening impact of Germany’s temporary cut to the VAT rate. Indeed, core inflation lifted to 1.2% y/y in July from 0.8% y/y in June, although even that is lower than the ECB would like to see.

ECB still debating inflation target

While there may be nothing in the inflation data to suggest a serious risk of deflation, the low headline rate will add to the arguments of those at the council who are pushing for a more symmetric inflation target that would require the ECB to let inflation run above target for a while following a period of below target headline rates. In the current situation that would push the first rate hike even further into the future. A similar debate seems to be happening at the FOMC, which – like the ECB – is also conducting a framework review. There is some speculation that Fed-chairman Powell will give some hint on average inflation targeting at the Jackson Hole conference, which in the past has been the stage for coordinated signals from central banks.

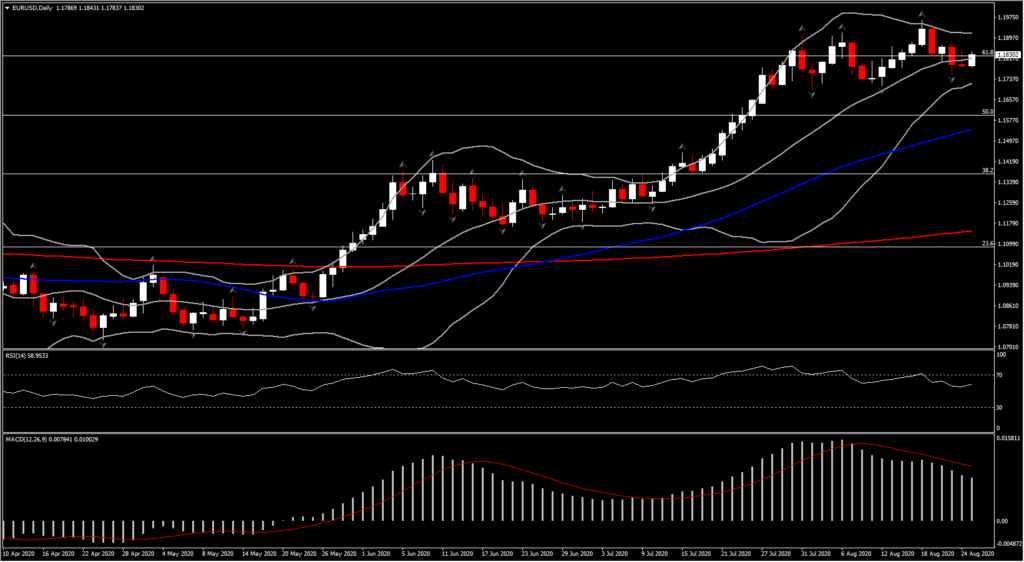

EUR continues to benefit from stimulus agreement

EURUSD has lifted to the mid 1.1800s today, posting an intraday peak at 1.1843, which is 60 pips up on Monday’s New York closing level. The Euro has also rallied against the Yen, which is the day’s biggest loser, and most other currencies. While a bout of general dollar selling has helped to lift EURUSD, there have concurrently been a couple of cues to buy euros, including the better than expected Ifo reading and optimistic comments from German finance minister Scholz.

Still the pair’s 5-month rally out of sub-1.0650 levels of mid March has been losing momentum in recent weeks, even it still produced new 27-month highs. Last week was the first down week the pair has seen out of the last nine weeks. A sustained correction is increasingly likely. The US is clearly through the worst of the pandemic, the economy is rebounding, Wall Street is on an record-breaking winning streak, and Treasury yields have perked up in recent sessions despite an expected dovish lean from Fed Chair Powell at his keynote address this Thursday.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.