The markets continue to take a sanguine view of the apparently stalled progress in the EU and UK trade talks. All things Brexit continue to go down to the wire, and expectations for any real progress are low until much nearer the deadline, which is widely accepted as being the EU leaders’ summit in October. The consensus view is that a deal will be struck. There are grounds to doubt there can be anything other than a narrow deal, given the intransigence on the EU’s level-playing-field rules and fishing rights.

A bare-bones deal or a no-deal outcome are a risk.

Prime Minister Boris Johnson’s cabinet is full of Brexit ideologues; of the view that Brexit is an opportunity to craft the UK on the Singaporean model, as an outwardly-oriented, low-tax and pro-trade hub. Signing up to the EU’s level-playing-field rules is not consistent with this view, and there is only so far that the EU is likely to bend. The government, which has over four years on the electoral clock and a large majority in parliament, is in a position to weather the short-term economic damage that leaving the EU’s single market without a comprehensive new trade deal would cause. Note that when UK leaves the single market, it will not just be leaving free trade with the EU but also the 40 free trade deals the EU has across the globe.

Another risk is that the UK government’s pandemic-era furlough scheme will end in late October, which is likely to cause an upward jolt to the unemployment rate, with the aviation, high street retail and hospitality sectors to be hardest hit. The wage support scheme protected about 9.5 mln jobs at the height of the lockdown, though there remains up to 1.5 mln jobs at risk of being chopped in October, unless the government extends its support scheme (as Germany did with its plan last week).

Furthermore, today’s UK economic data releases, showed that employment in the manufacturing sector dropped at one of the steepest rates since the Great Recession 11 years ago.

The final UK August manufacturing PMI was revised a tick lower, to 55.2 in the headline reading versus 55.3 in the preliminary figure. The details showed production in the sector to be rising at its quickest pace since May 2014, while new orders rose by the fastest since November 2017. Export orders rose for the first time in 10 months. However employment was on the downside, while backlogs of work fell at an increased rate, too, which points to space capacity. Business sentiment for the year has ahead remained near the 28-month peak, with hopes being pinned on expectations for a return to economic normalcy.

The risk is that conditions will deteriorate as lockdown-caused work backlogs drop, and when the government wage support program expires in October as stated earlier, which will likely spark job losses (there is a chance that the scheme will be extended).

The final August services PMI survey will be released on Thursday. The government’s ‘Eat Out to Help Out” scheme (with the government, courtesy of the bond market and eventually the taxpayer, meeting up to half the bill for consumers at restaurants and pubs from Monday to Wednesday during August) was partly behind the strength in activity in the service sector. The scheme, as of today, has now expired, which will likely lead to a weaker services PMI headline in the September survey. The service sector will be particularly exposed to a cut in the wage support scheme in October, with the aviation, high street retail and hospitality sectors most at risk.

As markets for now are taking a sanguine view of the trade talks and as there is a slight recovery in both the domestic and global economy from the more extreme phase of lockdowns that were seen earlier in the year, the UK currency remains well supported.

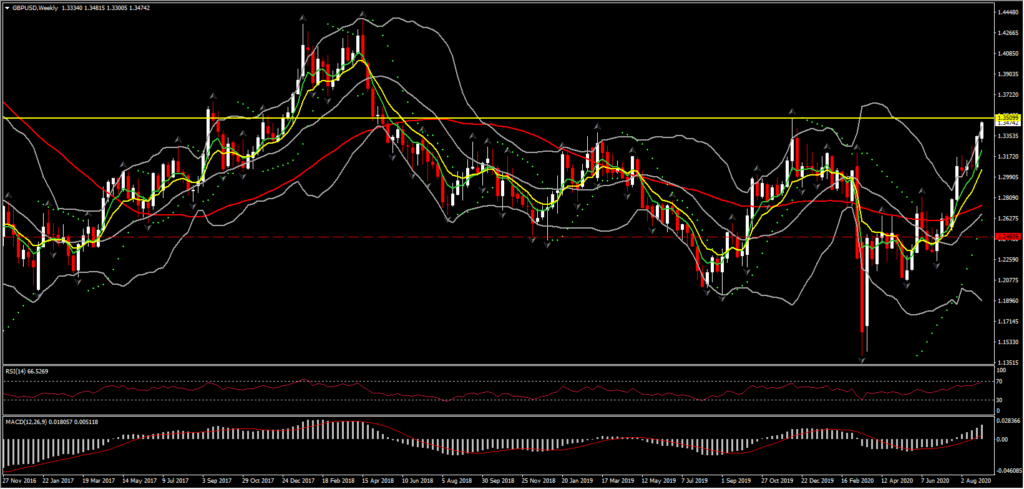

GBPUSD has risen above the 1.3470 level for the first time since April 2018. The pair has continued to be floated by broad US Dollar weakness. GBPJPY has also been lifted by Yen weakness, which saw the cross print 7-month highs yesterday. The Pound has fared less well against the Euro and other currencies. Among the mix of forces affecting the Pound is the coronavirus, which has ceased to be a public health event in terms of causing severe illness and associated hospitalizations and deaths. This being the case, regional UK governments remain somewhat trigger happy with regard to implementing localized lockdown measures in response to rises in new cases, and we can assume that this will only get worse going into the winter, the season of contagious respiratory illness.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.