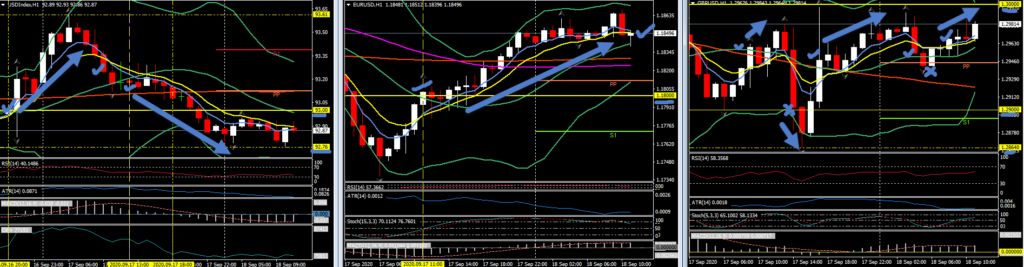

The Dollar has scraped out a two-day low at 92.76 in the narrow trade-weighted USDIndex, with EURUSD concurrently pegging a two-day high at 1.1868, gaining quite sharply from yesterday’s five-week low at 1.1736. A steadying in stock markets today has seen the Dollar ebb back after finding safe haven demand during the worst of this week’s sharp sell-off across global equity markets.

The Pound has come under modest pressure against most other currencies. Cable posted an intraday low at 1.2941. The WHO is warning of a serious second wave of SARS-CoV-2 in Europe¹ (Germany recorded 2,179 cases yesterday) on the back of a surge in new cases (despite data showing a continued very low rate of death alongside a relatively low incidence of Covid being listed on death certificates). In the UK, coronavirus cases and, with it, corona-panic are surging. Localised lockdowns are now affecting 10 million people in the UK, and the government’s scientific advisory group are, according to an FT report, advising the government to implement a two-week national lockdown. The embattled Health Secretary (Matt Hancock) this morning called it a “last line of defence” but “will do whatever is necessary”. This is a negative backdrop for the Pound, adding to the uncertainty surrounding the Brexit endgame, and with the minutes from the BoE MPC meeting yesterday affirming that the central bank is at full steam on contingency planning for negative interest rates (although stressing that it is not ready to do so yet).

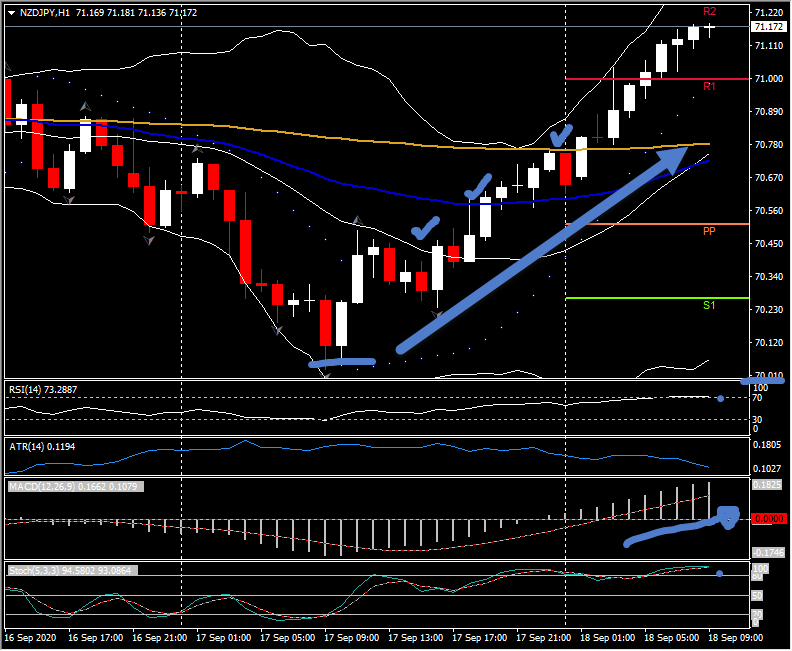

Elsewhere, USDJPY has settled in the mid 104.00s, testing the seven-week low seen yesterday at 104.52. Yen crosses have also rebounded out of lows. Both EURJPY and AUDJPY lifted above their respective Thursday highs. Japan’s core CPI came in at -0.4%y/y, matching expectations, but the NZDJPY was the biggest mover, moving over +0.6% as the Kiwi holds its bid.

¹https://www.ft.com/content/a2901ce8-5eb7-4633-b89c-cbdf5b386938

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.