The SNB left its policy setting unchanged, with he Deposit Rate and Libor target still at -0.75%. The central bank repeated that the Franc is “highly valued” and said the bank is ready to “intervene more strongly in the foreign exchange market”.

The statement said that “in its baseline scenario for the global economy, the SNB anticipates that it will be possible to keep the pandemic under control without a renewed serious impairment of economic activity”, although “it is likely that global production capacity will be underutilized for some time to come and inflation will remain modest in most countries”. There is still a “high degree of uncertainty”, and while the recovery in Switzerland is likely to continue it is expected to be “partial for the time being”, with low rates of capacity utilization and rising unemployment.

The updated forecast predicts a contraction of -5% for this year, which is somewhat less pessimistic than in June, although the SNB again highlighted the high degree of uncertainty that is surrounding this outlook. At the same time the SNB noted ongoing increases in mortgage lending and residential property prices, which means imbalances that could lead to financial instability and continue to persist. This is pretty much a mirror of the assessment at the ECB, with cautious optimism, but the central bank is also acknowledging downside risks and high uncertainty. Against that background, the SNB is maintaining an easing bias, but for now continues to concentrate on intensified forex intervention to prevent imported deflation and support the export-oriented economy.

Elsewhere in Europe, the German Ifo index improved to 93.4 in September, in line with our forecast but less than consensus expectations, as manufacturing sentiment continues to improve, while the services sector is registering the renewed tightening of virus-restrictions. MEanwhile, the sector breakdown in the diffusion index, which gives the balance of positive and negative answers meanwhile, showed that services sentiment fell back to 6.9 from 7.7, which still suggests that optimists outnumber pessimists, but nevertheless indicates that the hospitality sector as well as tourism and travel operators are registering the return of regional lockdowns and tighter social distancing restrictions. Manufacturing confidence by contrast, remained negative, although at -0.2 clearly less so than in the previous month, when the reading stood at -5.6.

All in all a reading that backs the baseline assumption of a cautious recovery, but also highlights downside risks as Covid-19 rears its head again. And the situation will likely be even worse in other countries that rely more on tourism and services in general.

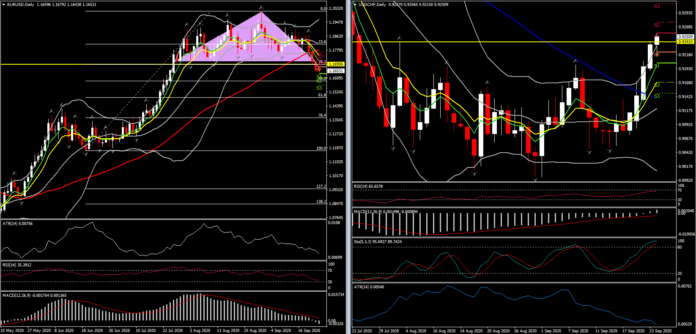

Forex markets meanwhile, sustained the US Dollar and Yen strength theme, while the Swiss Franc lifted against most currencies ahead of the announcement, but stalled at the 0.9250 area after the announcement. However overall USDCHF remains in the upwards trajectory seen for the last 6 days. The biggest losers were the dollar bloc and other commodity-correlating currencies, along with many developing world currencies, in what is a classic risk-off positioning pattern. The USDIndex posted a fresh 8-week high at 94.55, which corresponded with EURUSD making an 8-week low at 1.1645, breaking the 38.2% Fib level since the June rally and significantly posting a breakout of the Ranging market seen August-September.

Global stock markets and commodity prices tumbled again, with yesterday’s rebound proving to be short lived. Incoming September data, including out of the US and Europe yesterday, has been highlighting vulnerabilities in the service sectors in many countries, especially in Europe, as a consequence of Covid restrictions and lockdown measures. Two Fed members, Clarida and Mester, described the US economy as being in a “deep hole,” while the lack of another fiscal support program from a preoccupied Congress, along with anxieties about the upcoming US elections, have also been stirring the concerns of investors.

One development of note is that Belgium has loosened Covid restrictions, markedly bucking the trend in Europe. The government there will no longer rely on new cases to make policy, either, but rather the rate of hospitalisations. Clearly the reason is the marked lack of correspondence between ballooning new cases and an actual public health event in Belgium, which has been seeing daily Covid deaths range between zero and no more than seven since beginning of September. More countries could follow Belgium’s lead, assuming that Covid illness/mortality numbers remain low.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.