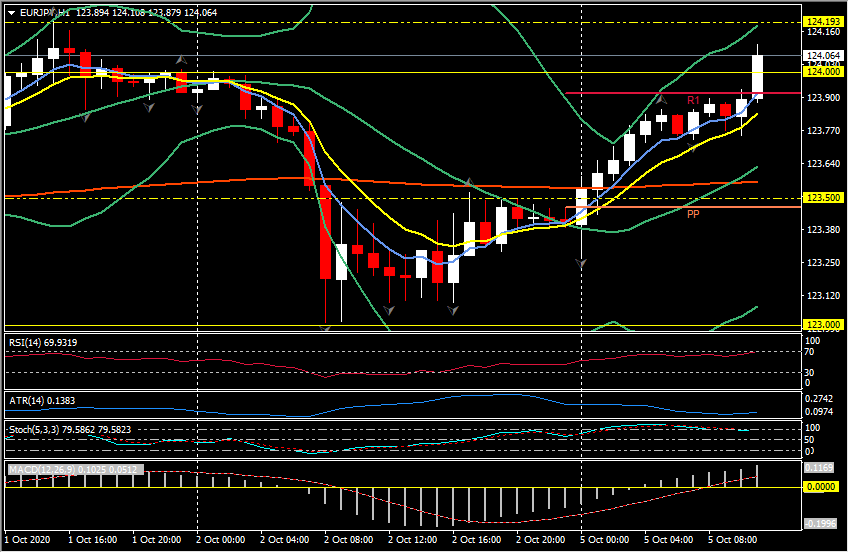

EURJPY, H1

Eurozone Services and Composite PMIs revised higher in the final reading for September. The former came in at 48.0, slightly stronger than the 47.6 reported initially, but still reflecting mild contraction in a sector that – even more than manufacturing – is feeling the tightening of virus restrictions amid the resurgence of new cases. Indeed, the numbers pretty much reflect virus developments.

The German number was revised up to 50.6 from 49.1 as new infection numbers continue to rise, but less than elsewhere in Europe and with restrictions actually relatively modest as the focus remains more on testing and contact tracing, which allows lockdowns to remain small. Six ticks over 50.0 may not seem much, but as Europe’s key economy and with services being the key sector, it is encouraging news, but is lower than both August and Septembers readings. The Italian services PMI improved slightly, even if the reading remains in negative territory, as the country remained off the quarantine list. Spain and France, which have seen a particularly heavy spike in new cases, suffered, however. Manufacturing sentiment meanwhile is improving across the board and the combination left the composite positive at 50.4 for the Eurozone as a whole, up from 50.1 in the preliminary reading. Nothing that suggests a buoyant recovery, but equally nothing to spark fears that the nascent recovery has been halted. Still, the two-speed recovery will also pose a problem for the ECB going forward.

The EUR ticked higher on the positive news, with EURUSD pushing to R1 at 1.1735, EURGBP moving down below 0.9060 and EURJPY breaching 124.00 to recover all of Friday’s losses and test towards Thursday’s high at 124.19.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.