Negotiations in Washington over the size and composition of another stimulus package will remain a focus this week.

It has been on-again, off-again between the GOP and Democrats in regard to a new stimulus bill, and anything seems possible given the strong incentive to posture ahead of the November 3 elections. In Europe and the UK, surging new virus cases and the plethora of new restrictions threaten the recovery and have the ECB and BoE contemplating additional accommodation. Meanwhile, the Brexit endgame nears and this week’s EU Summit should find both sides posturing, while slowly inching toward a deal.

Despite all the machinations in Washington, and increasing worries over spikes in virus cases and renewed shutdowns in Europe, global stocks finished higher on the week. In fact, even with all the wrangling over the stimulus package, Wall Street had its best performance in over three months as investors kept the faith that something will eventually come to pass in terms of more spending.

The markets were whipsawed early in the week as President Trump put the kibosh on talks, only to have optimism for a standalone deal shattered by Speaker Pelosi who reversed her apparent support for airline and small business relief. But investors remained positive over stimulus and were rewarded on Friday by reports the White House had offered a $1.8 tln package (according to people familiar with the deal). In comments on his radio show, Rush Limbaugh said “I would like to see a bigger stimulus package than frankly either the Democrats of Republicans are offering…I’d like to see money going to people.”

European stock markets have mostly moved higher amid the prospect of further central bank easing, with dovish comments from ECB’s Lane and Schnabel underpinning speculation that Lagarde will sign off another extension and strengthening of the PEPP program. With US markets partially closed today and Canada also on holiday, moves have overall been cautious and while the GER30 is up 0.3% at the moment, the UK100 is little changed on the day.

Wall Street ended the week in the green with the USA100 4.56% firmer, the USA500 up 3.84%, and the USA30 3.27% higher. Core European bourses finished with gains of 1.94% to 2.85%. So far today, the US futures are mixed, with the USA100 outperforming and up 1.0%, while the USA30 is marginally lower. China bourses outperformed after the offshore yuan fell following an announcement from Chinese policy markets that the FX risk reserve requirement will be slashed to zero from currently 20% in a move seen as designed to restrain the strength of the offshore yuan. Hang Seng and CSI 300 rallied 2.2% and 3.0% respectively, also boosted by speculation that President Xi Jinping will use the expected visit to Shenzhen this week to signal a further opening of parts of the economy to foreign investment.

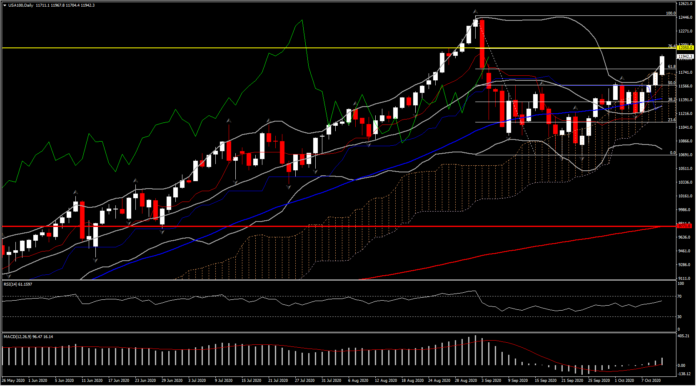

USA100

The bulls are extending their gains for a 4th day in a row, confirming their control of the market as the USA100 has now reversed more than 70% of August’s downleg from the 12,467 high. An uptrend formation has been seen the past 2 weeks, however the fact that the price action is currently outside the daily Bollinger Bands area implies an Overbought condition, something that suggests the need for a short term correction. However the overall picture for the asset remains positive with momentum indicators positively configured. The RSI crossed 60, pointing northwards, and the MACD turned positive, however signal line remains neutral. By considering the Ichimoku cloud, Tenkan Sen bullishly crossed above Kijun Sen, suggesting positive bias in the nearterm. However for the medium term picture to turn positive, Tenkan Sen needs to be above the Kijun Sen while the Tenkan Sen, Kijun Sen, and price should all be above the cloud. This would suggest positive momentum along with an uptrend.

Next resistance, before the all time high of 12,467, is the high from the last week of August at 12,050 which coincides with 76.4% Fib. level. A move below 11,400 (50-DMA) would abort the bullish outlook.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.