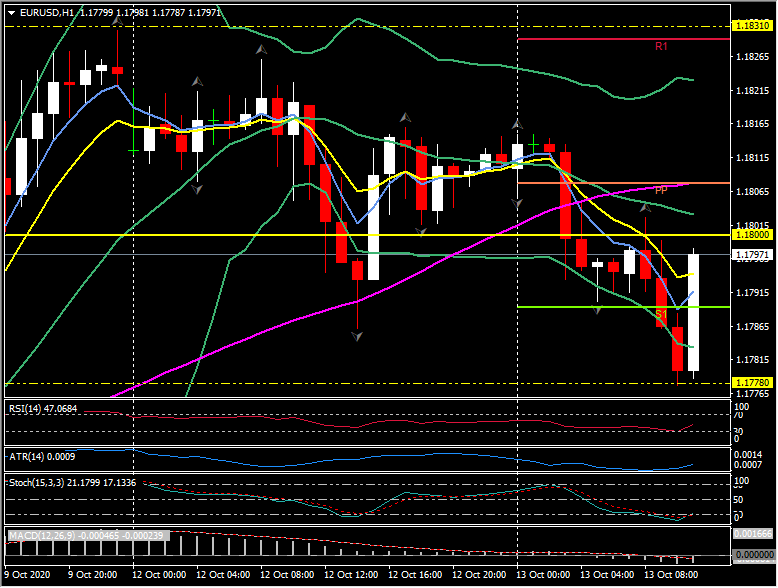

The Dollar is higher as risk-off positioning takes a grip in early European markets following news that Johnson & Johnson has hit the pause button on its Covid vaccine trial due to an “unexplained illness” in one of the participants. There are a plethora of other candidate vaccines at advanced trial stages, but the news nonetheless sparked a rush for cover. The S&P 500 E-mini is down 0.6%, while US T-note and Bund yields have dipped. The USD Index lifted above Monday’s high in making a peak at 93.25, while EURUSD concurrently ebbed to a four-day low at 1.1778, before recovering. An ongoing salvo of dovish signalling from ECB policymakers has resulted in outright euro declines, though has likely been contributory in offsetting dollar weakness recently. Aside from the Fed itself, and partly in response to, many other central banks have been conducting similar messaging campaigns.

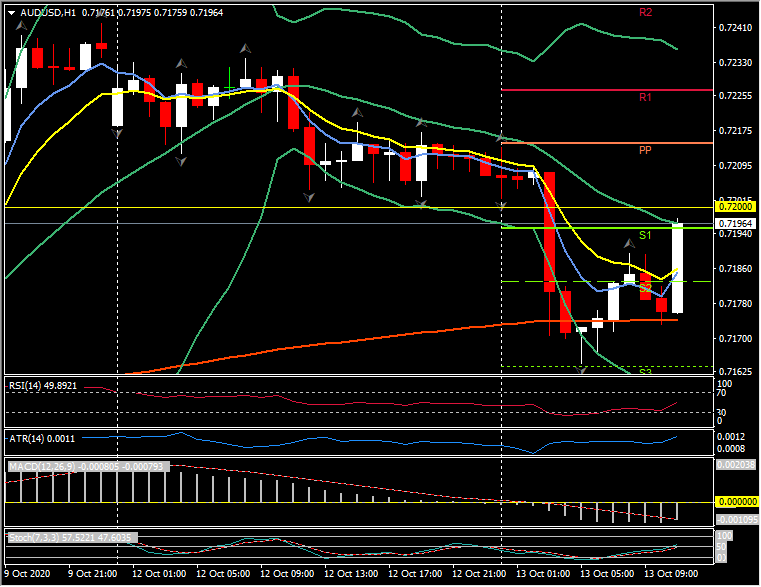

The Australian Dollar has been among the leaders of the underperforming pack, declining against the US Dollar and other peers for a second consecutive day. AUDUSD printed a low at 0.7165, extending the correction from Friday’s 22-day high at 0.7244. The weakness comes despite strong import data out of China, which normally would have been a strong buying cue for the Aussie, which was countervailed by: one, a Bloomberg report, citing sources that China will be banning the import of Australian coal, marking an escalation in trade tensions; and two, weakness in the Yuan after the PBoC removed a bank reserve requirement on yuan forward contracts. The reserve requirement shift will effect more two-way flow in the Yuan by facilitating hedging of both domestic companies and foreign investors. The outlook for the Yuan remains unambiguously bullish, given the markedly favourable growth and interest rate differentials and given the strong balance of payments outlook. Chinese export data for September showed an 8.7% y/y increase in yuan terms, below the median forecast for a 10.5% y/y rise, though imports rose much more than anticipated, by 11.6% y/y (the median had been just a 1.0% y/y rise). The strong import data is a further sign of returning strength of the domestic economy in China. Add this to the fact that air passenger volumes during China’s recent Golden Week holiday were 91% of the volume seen during the same (pre-pandemic) break in the previous year, and the picture is one of returning economic normalcy.

European stock markets are narrowly mixed in opening trades, with the UK100 up 0.04%, GER30 down -0.14% and the Euro Stoxx 50 down -0.03%. US futures are in the red after the negative vaccine headlines, together with hopes of additional stimulus that has been underpinning bonds so far today. The German 10-year yield is down -0.8 bp at -0.55%, the Gilt has lost -1.4 bp and is at 0.255% and Treasuries are outperforming on their return from the extended holiday weekend, which has left the US rate down -2.2 bp at 0.75%.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.