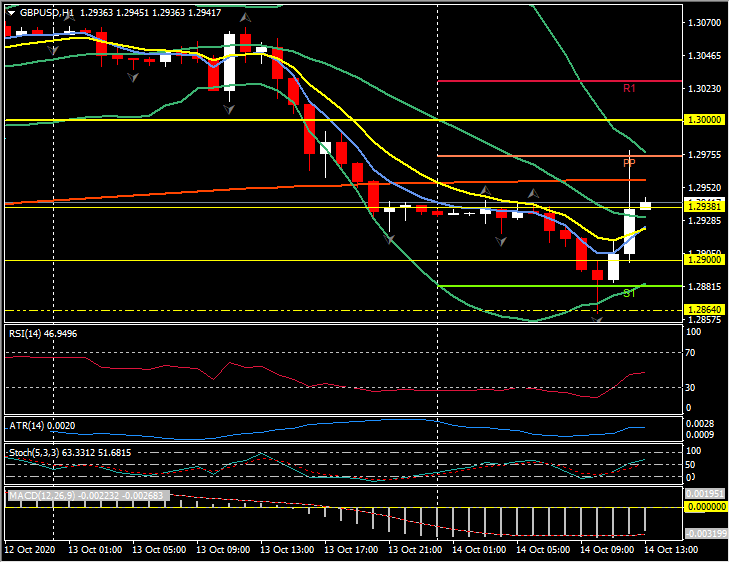

GBPUSD,H1

The Pound was under pressure earlier and was showing about a 0.5% decline on the day against the Dollar and Yen, and about a 0.4% decline versus the Euro, until the UK government announced that tomorrow’s self-imposed deadline has been relaxed. Cable bounced from 1.2900 to 1.2975, EURGBP moved to 0.9045 from 0.9100 and GBPJPY spiked to 136.75, from 135.64 lows.

However, it is still the eve of the EU summit. Boris Johnson said that the “shape” of a deal must be visible by tomorrow, which is a deadline set in fudging language. Johnson and the European Commission head von de Leyen will be talking this afternoon via video conference, presumably to establish whether the “shape” of a deal is in view. The rhetoric from both the UK and EU has reached fever pitch, with both sides strongly emphasizing that there will not be a deal at any price. Johnson blinked first. The apparent extreme hawkishness of Spain and France on fishing rights is notable, while Johnson is under pressure from the powerful ERG faction of his party not to concede on level playing field rules. Sources cited by both Reuters and Bloomberg claim that EU leaders will be issuing a communique later declaring that there hasn’t been sufficient progress for a deal. The stakes are enormous, especially for the UK, both economically and politically, and in consideration of this we continue to expect there will be a deal, albeit a very limited one.

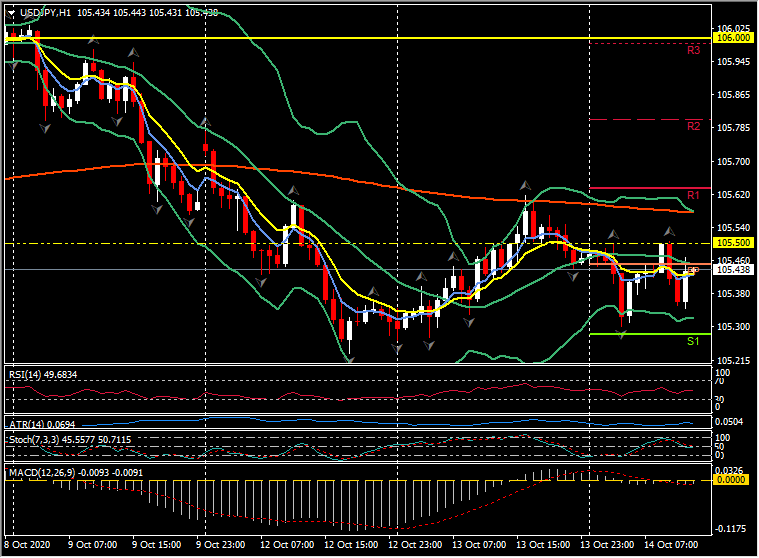

Elsewhere, the Dollar and Yen are holding firm. EURUSD has ebbed into one-week low territory in the lower 1.1700s. USDJPY has become rooted around 105.50, while yen crosses are softer. Chinese demand for JGBs is at a three-year high, reportedly. A JPMorgan research note ponders that part of the reason may be to weaken the Yuan, and notes that JGB yields are in fact favourable compared to German and Swiss paper. New Covid cases continue to billow in Europe. The Netherlands is going into a near-full lockdown, and the UK Telegraph cited a senior government source saying that there is at least an 80% probability of a full “circuit breaker” national lockdown.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.