The Euro has slipped back into the outperforming lane in showing a 0.3% gain on the dollar, a 0.5% advance versus the Yen and gains against Sterling and the Dollar bloc currencies. EURUSD has printed a one-week high at 1.1820 while EURJPY has ascended into 8-day high terrain breaking the 50-day SMA at 124.75.

Underpinning the Euro is the EU’s first offering of social bonds, designed to finance a jobs program, which received orders of more than EUR 275 bln, according to Bloomberg. The bloc aims to raise EUR 10 bln from the sale of 10-year debt via banks and is also issuing EUR 7 bln of 20-year securities. The issue is the first since the EU announced the EUR 750 bln jointly funded pandemic recovery deal, and with an AAA rating the offer clearly is proving popular, which will likely raise demand for further joint issuance, especially from cash strapped governments in Rome and Madrid. Rome’s resistance to any “interference” in its own finances, however, is one of the obstacles to greater co-operation on fiscal policies in the Eurozone.

The recovery fund is seen by many analysts as a milestone, which reduces Eurozone breakup risks. Data also showed a widening of the Eurozone’s current account surplus in August, which offsets the capital account deficit (and which will at the same increase the net surplus of interest receipts). The Eurozone current account surplus is at 1.9% of GDP in the 12 months to August, down from 2.2% in the corresponding period a year ago.

Still a very sizeable surplus, that highlights the need to strengthen domestic demand and investment in the Eurozone, especially as sa data shows that the current account is already rebounding again, with a surplus of EUR 30 bln in August this year – up from EUR 17 bln in July.

The financial account meanwhile shows that eurozone residents continue to focus their portfolio investment outside of the Eurozone, with net acquisitions totalling EUR 549 bln in the 12 months to August, while non-residents acquired EUR 446 bln of euro area portfolio investment securities in the same period. Nothing there that would change the immediate outlook, but highlighting that the imbalances still remain and that a rebalancing could help to boost the internal economy in the Eurozone.

In FX markets, Euro has established an upside bias against Yen and Dollar, and although further gains seem likely, there are risks. New Covid cases in Europe are surging, and have accelerated in some countries, which is leading to increasingly draconian restrictions, which in turn will have consequences on economic activity and maintain the pressure on the ECB for more expansive monetary accommodation. And while there are at the same time would-be Dollar bears, the proclivity for capital being safe harboured in US Treasuries means this is hinged on the global growth outlook establishing a sustainable improving trend, and that in turn may hinge on the world getting through the Covid crisis.

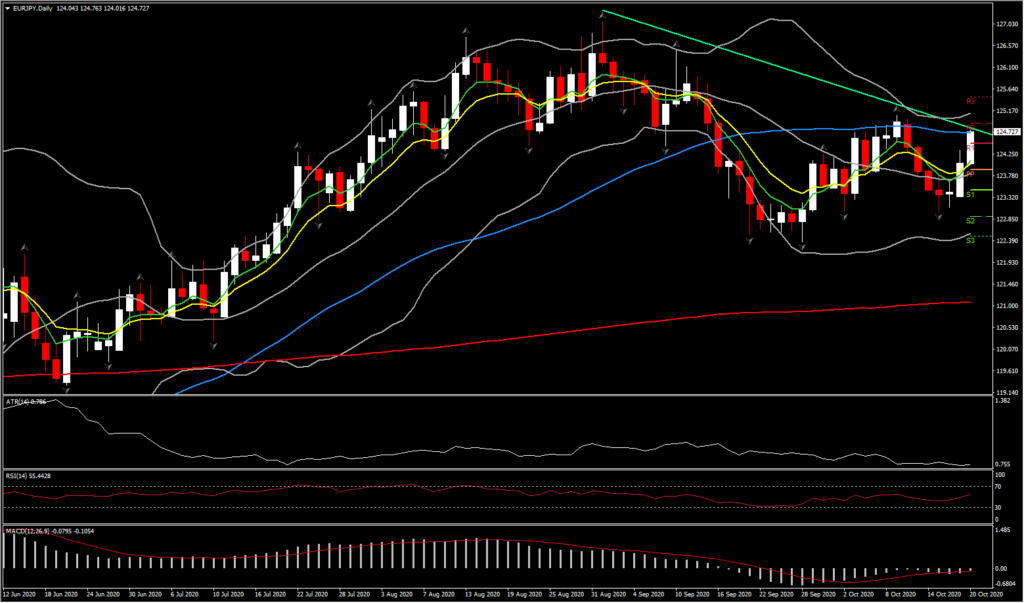

However neither EURUSD nor EURJPY have established a medium term trend yet in the past few weeks. EURJPY rebounded from double bottom seen in October with 2 consecutive decisive moves this week which broke the key confluence of the 50-DMA and 50% Fib. level since year’s high, and turned closer to the upper daily BB pattern. Despite the short term strongly bullish outlook, the overall picture remains neutral with MACD and RSI consolidating at neutral zone. Hence a turn of both indicators along with a close within the week above the 124.70-125.00 area could turn the attention to year’s peak.

Markets are likely to remain skittish, overall, into the US election which is, now just two weeks away, given the perceived risk of it being contested, which in this scenario could lead to a messy political scene for a time and delay fiscal stimulus further (which looks unlikely to happen this side of the election).The Brexit endgame is also sharply in focus. The prevailing view is that the EU and UK, despite the headline dramatics from political leaders, are heading for a free trade deal, albeit a limited one.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.