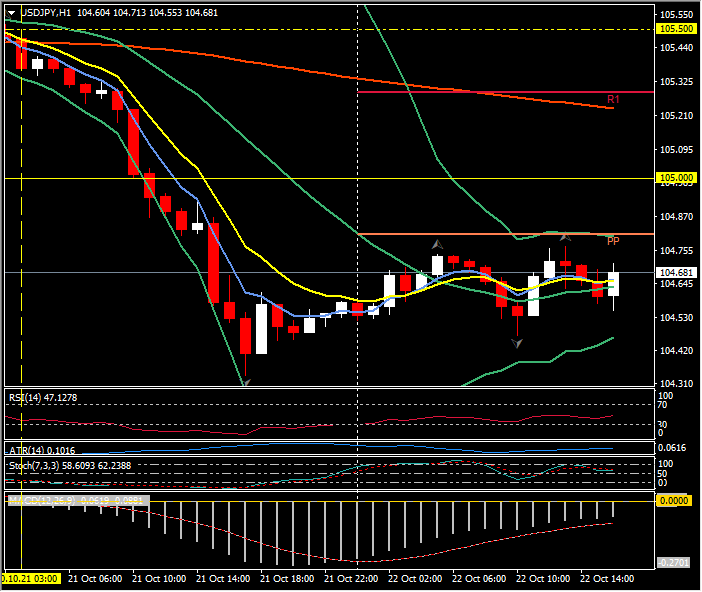

USDJPY, H1

The -55,000 initial claims drop to 787,000 in the BLS survey week trimmed the 75,000 bounce to 842,000 (was 898,000) from a much lower 767,000 (was 845,000) at the start of October to leave a notably tighter than expected path. For a third consecutive week, we saw a big continuing claims decline, this time of -1.024 million to 8.73 million, following a -1.197 million drop to 9.397 million (was 10.018 million). According to the report, California has completed its pause in processing, and the figures over the last three weeks now include actual counts. Today’s mix leaves a much better than expected report overall, though the huge continuing claims declines of the last three weeks partly reflect the loss of eligibility.

* We saw a -55,000 initial claims drop to 787,000 versus a record-high 6.867 million in late-March.

* Continuing claims plunged -1.024 million to 8.373 million from 9.397 million (was 10.018 million).

* The insured jobless rate fell to 5.7% from 6.4% (was 6.8%), versus a 17.1% peak in the second week of May and a 1.2% cycle-low for nearly two years ending in mid-March.

* Initial claims not seasonally adjusted dropped -73,000 to 757,000, after a 99,000 climb to 830,000 (was 886,000).

Initial claims are averaging 806,000 in October, versus prior averages of 865,000 in September, 992,000 in August, and 1.340 million in July. We saw a 4.72 million peak in April and a 211,000 prior cycle-low average in January. We saw a 50-year low for the weekly claims figures of 201,000 in the first week of February.

Initial claims remain elevated due to heightened job churn as the economy transitions to the new national post-COVID consumption basket, with both shortages and unused capacity. Layoffs continue in industries that can’t socially distance, just as many firms are scrambling to rebuild inventory in the face of heightened demand. Initial claims likely won’t track net payroll growth until industry is finished re-configuring to meet post-pandemic demand.

The consensus of 750,000 October nonfarm payroll estimate follows gains of 661,000 in September, 1.489 million in August and 1.761 million in July. The projection is consistent with the path for continuing claims and persistent production growth in the face of plunging inventories and rising sales. We’re seeing high producer sentiment, elevated MBA purchase index readings, strength in vehicle demand and assemblies, and a housing boom.

The Dollar rose slightly following the claims data, where initial and continuing claims dropped more than expected. USDJPY edged a few points higher to 104.70, while EURUSD dipped briefly to 1.1810 from 1.1820. Equity futures remained under water (-0.2% with USA500 trading at 3432), while yields were little changed with the 10-year off 1.5 bps to 0.808% and holds over 0.80%.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.