The Dollar firmed up into the London open and beyond, paring declines seen earlier in pre-Europe trading in Asia. The move drove gold and oil prices lower, too, indicating there has been some depth in dollar buying, although the magnitude of movement hasn’t been great.

US equity index futures have managed modest gains after the S&P 500 closed with a 1.9% loss yesterday, though investor sentiment in global markets remains decidedly restive. Most Asian stock markets declined, and Australia’s ASX 200 equity index closed with a 1.7% loss in its worst single day performance in a month. Soaring positive Covid tests and the associated trend toward increasingly restrictive countermeasures, along with the risk of next week’s US election results being contested, and the delay in US stimulus relief, are keeping markets on edge. Overall strong Q3 economic data are being overlooked as markets look to what is appearing to be a grim winter ahead in the northern hemisphere, with risks of a double dip recession being factored in, especially in Europe. Amid this, the Dollar has been holding up, despite a narrowing in nominal US yields relative to peers in recent days, including Bunds and JGBs, revealing that the US currency is functioning as a safe haven currency again.

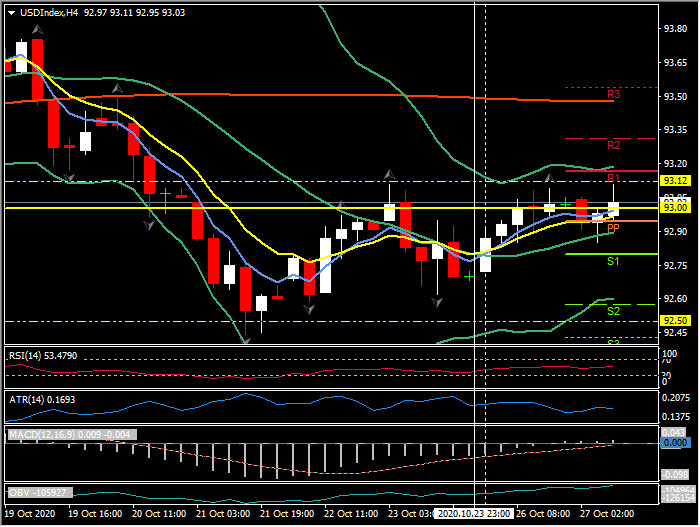

The USDIndex index lifted back above 93.00, though remains down on yesterday’s and Friday’s highs at 93.11-13. EURUSD tipped back to levels around 1.1800 after posting a high at 1.1836. USDJPY remained settled in the upper 104.00s in what could be termed a consolidation of the steep decline seen last Wednesday but has tested below S1 below to 104.60. The pair remains about 0.7% down from week-ago levels. Sterling continued to trade without direction, overall, holding over 1.3000 around 1.3020. EU and UK trade talks continue in London through to tomorrow before relocating to Brussels. They are reportedly working to a mid-November deadline.

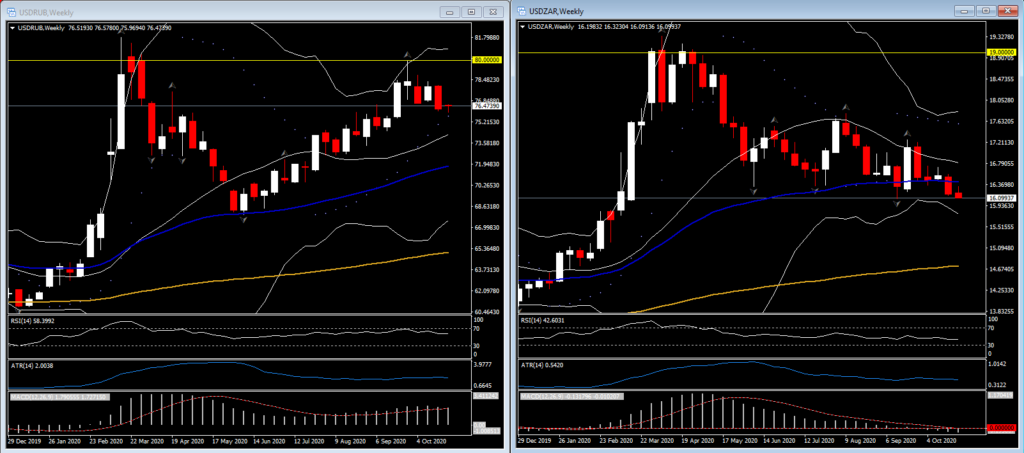

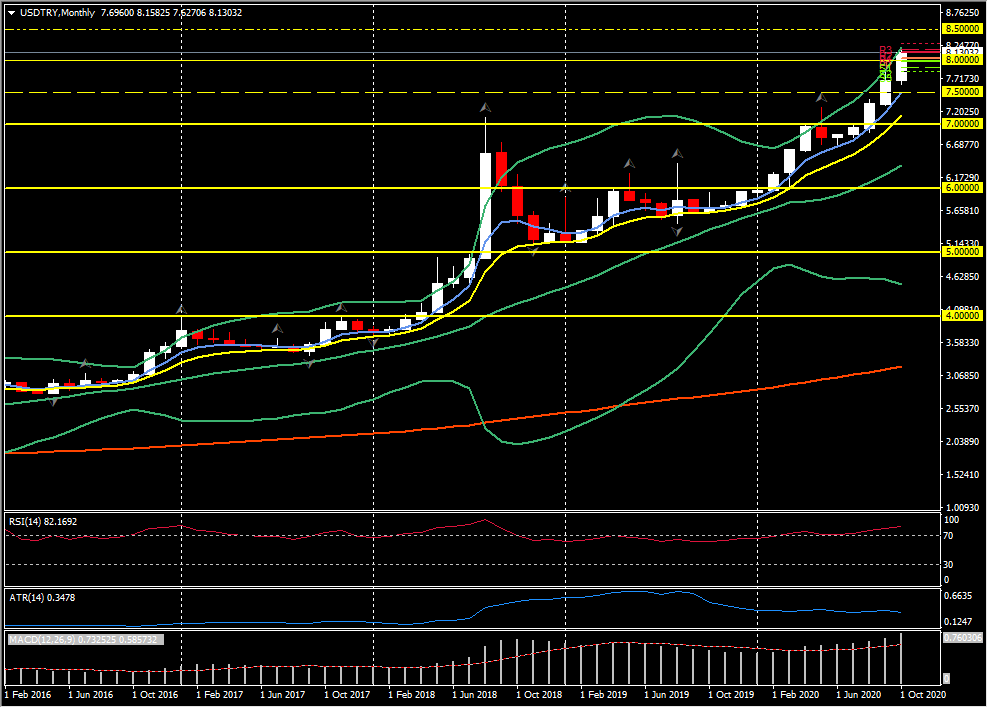

Taking a step back, the currencies that are showing the biggest gains on the year-to-date are the ones that most would expect to have risen against the backdrop of the global pandemic crisis, being currencies of current account surplus economies, specifically ones that don’t have a high commodity export component. Thereby the Euro, Swiss Franc and Yen are the biggest gainers, while the dollar bloc and the likes of the South African Rand and Russian Ruble, among others, are showing the biggest year-to-date declines, save the politically savaged Turkish Lira. Turkey seems to be in dispute with all its neighbours and some further afield. The Central Bank holding rates last week has not helped its predicament – USDTRY printed a new all time high earlier at 8.1580.

USDCAD lifted out of a correction low at 1.3169, with oil prices, although up yesterday’s lows, coming under moderate pressure during the early London session. WTI benchmark crude prices are down 6.5% from week-ago levels, and prospects for a sustained rebound look to be limited given the supply glut and weakening demand as Covid-containing measures intensify across Europe and some parts of North America. This backdrop should keep USDCAD underpinned. The pair has been trending lower since March, though we have been noting trend derailing risks. A run to levels around 1.3500 and above seems possible, as the BOC decision tomorrow and the US Election next week remain the key immediate fundamentals .

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.