The Dollar and Yen are higher on safe haven positioning, and Bitcoin hit its best level in almost three years. US Treasuries have remained underpinned as liquid capital seeks harbour, with the dollar holding up despite a 10bp drop in the 10-year T-note yield since last Thursday, which has seen the U.S. yield differential decline relative to peers, including the Bund. The dollar is also just over 1% up on gold over the last week in a further confirmation that the currency is functioning as a safe haven.

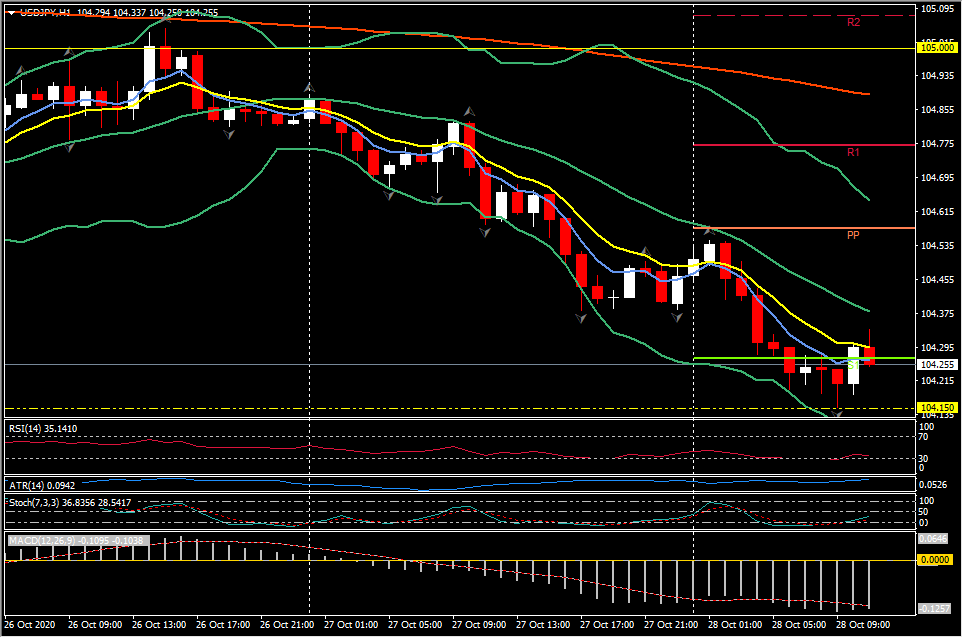

U.S. and European equity markets are continuing to markedly underperform Asian counterparts, with the latter region faring much better with regard to the Covid situation. This has helped the risk-sensitive Australian dollar fare better than it perhaps would have otherwise. AUDUSD posted a 13-day high at 0.7157 before turning lower to near net unchanged levels. As for the U.S. dollar, the USDIndex rose 0.4% in pegging an eight-day high at 93.37, while EURUSD concurrently dropped to a nine-day low near 1.1746. Cable fell by a near same magnitude in printing a two-day low at 1.2968. The pound has been holding steady against the euro. Talks between the EU and UK will continue in London today before relocating to Brussels tomorrow. They are reportedly working to a mid-November deadline. Market participants are cautiously optimistic that at least a narrow free trade deal will be reached, but still await concrete news that the two sides have reached a breakthrough on the key sticking points. Yen outperformance tilted USDJPY lower, with the pairing hitting a five-week low at 104.15 in what is now the third consecutive week of decline. Given the yen’s real interest differential advantage over the dollar, there is mathematical logic for weakness in the nominal dollar versus yen exchange rate. Elsewhere, a near 4% plunge in oil prices lifted USDCAD to a new 9-day high at 1.3239.

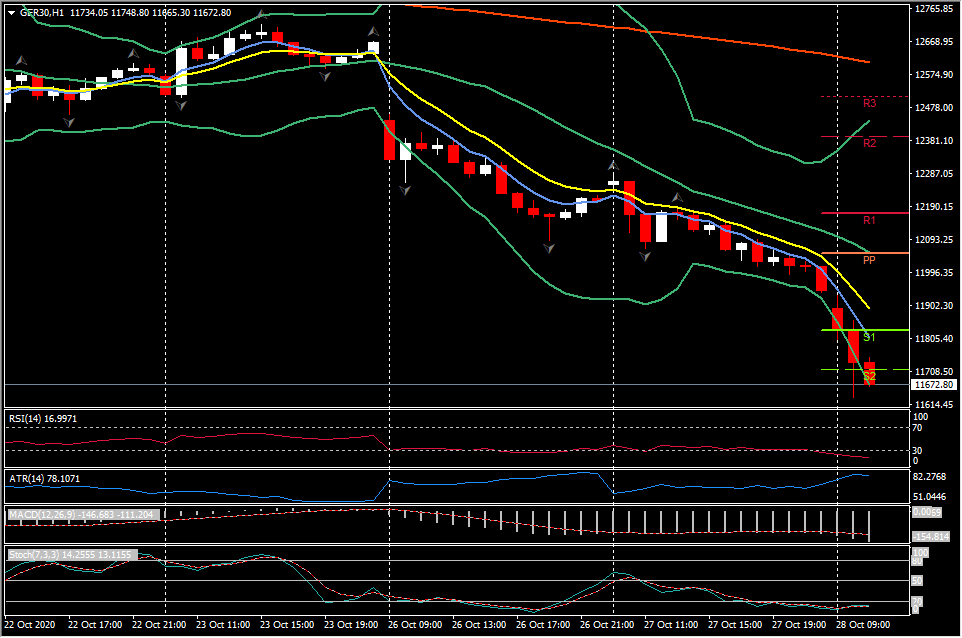

European stock markets are selling off, with the French CAC 40 leading the way and losing 3.5% in early trade amid lockdown speculation. Germany is also holding crisis talks after another spike in new infection numbers and the GER30 has lost -3.2% so far, while the UK100 is down -2.3%. Positive company news are ignored against the background of virus developments, with banks, autos, food and beverage companies among the big winners with the car sector emerging from the crisis and stay-at-home trade boosting drink and food. Eurozone spreads are widening meanwhile as risk aversion spikes, and the Italian 10-year yield is up 4.5 bp, while the German Bund yield has dropped back -1.9 bp to -0.64%.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.