Eurozone GDP rebounded 12.7% q/q in the third quarter, more than initially expected, but not a total surprise after German, French, Italian and Spanish numbers all surprised on the upside and after ECB head Lagarde already flagged the probability of a stronger number yesterday. Activity may have rebounded over the summer, but overall activity was still down -4.3% compared to the level a year ago. At the same time, virus developments and renewed lockdowns are casting a dark shadow over the outlook with the risk of a double dip recession pressuring governments and the ECB into adding further stimulus.

European stock markets have pared early losses, but remain mostly in negative territory, as risk appetite was hit yesterday by fresh concerns over the outlook for the tech sector after reports from the likes of Amazon.com Inc and Apple Inc weighed on markets. iPhone sales and Twitter user growth missed estimates, and while US futures are also up from overnight lows, the USA100 future is still down -1.2%. Disappointing company reports out of Europe added to the cautious backdrop and GER30 and UK100 are currently up 0.4% after paring some of their earlier losses, with the prospect of additional ECB easing helping. The Spanish IBEX stabilised after selling off yesterday and the French CAC 40 is also fractionally higher on the day.

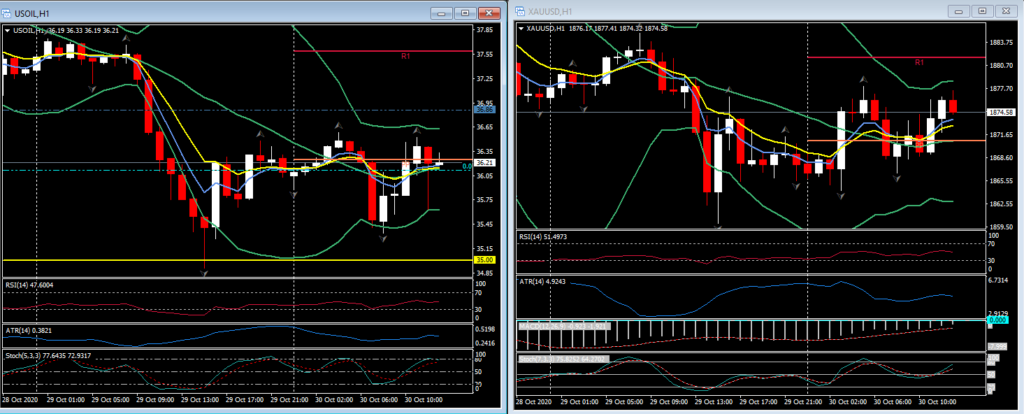

Asian markets meanwhile closed with broad losses. Topix and Nikkei declined -2% and -1.5% respectively, the Hang Seng was also down 2% at the close, the CSI 300 -1.6% and the ASX -0.6%. The front end USOil future meanwhile is currently trading at $36.20 per barrel and Gold futures change hands at $1874 per troy ounce.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.